👁️ A Cardano Rots From the Head

Of Chain Splits and Reputation. Also Pompliano's Payday, Berachain's Back Door Deal, and More.

Hello and welcome to your (usually) weekly Dark Markets financial fraud news roundup. I’m David Z. Morris, longtime tech, finance and crypto investigator.

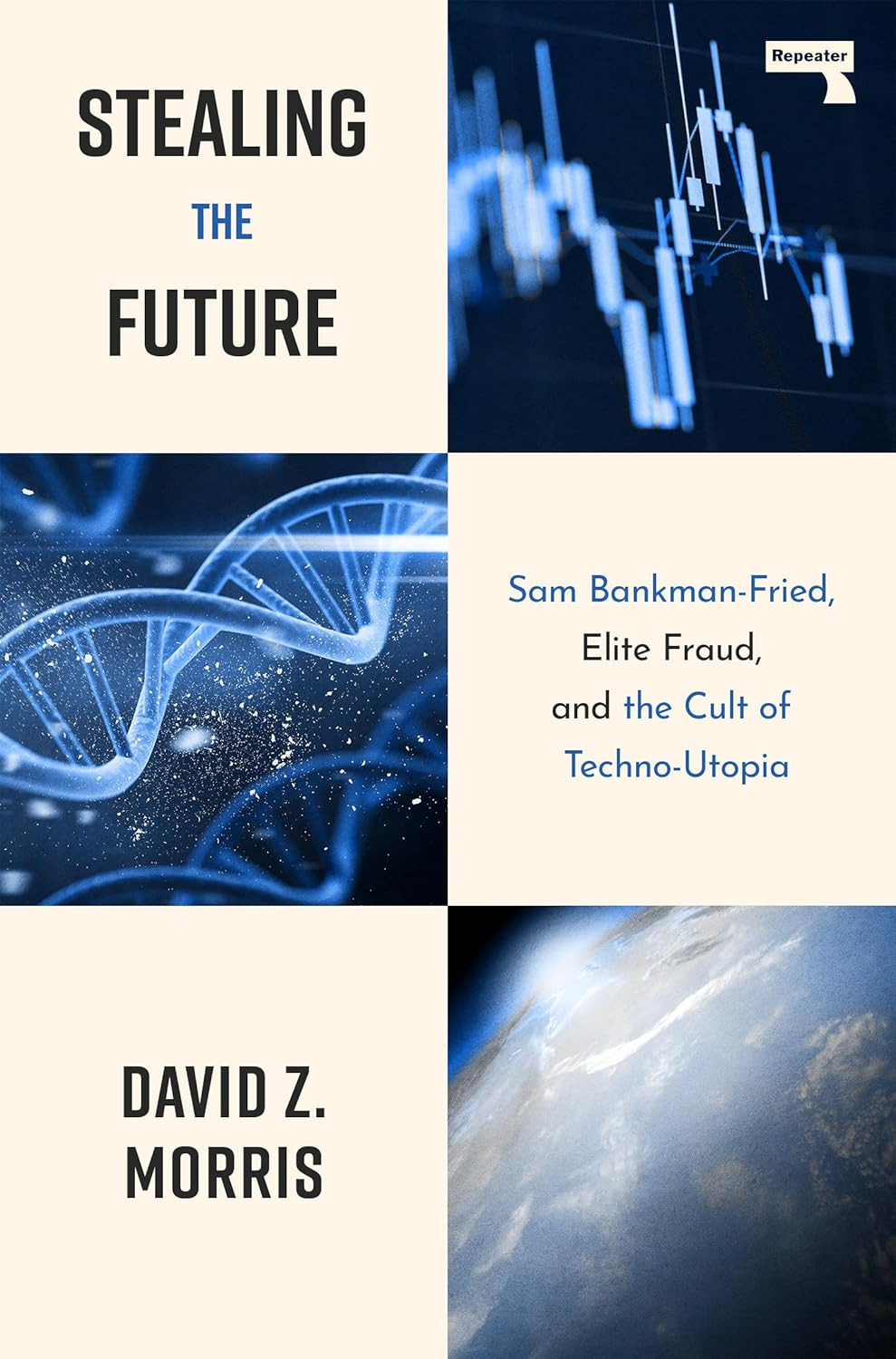

Things have been slightly disrupted here by two weeks of book release stress, including an event in an entirely different hemisphere at Subzero/Devconnect in Buenos Aires, which is just unbelievablly lovely. But Stealing the Future: Sam Bankman-Fried, Elite Fraud, and the Cult of Techno-Utopia is finally, totally out! See below for an important request for early readers.

Both the Subzero and Powerhouse events were recorded and I should be able to share them quite soon. You can also keep an eye on CSpan Book TV, which filmed the Powerhouse event and should air it in the next few weeks.

In Today’s Edition: Cardano’s Perpetually Wounded Egos; Pompliano Got Those Moves Like Chamath; Housing Markets and Hypergambling; Berachain’s Backdoor Man (?); Alice Guo, the Mayor of Pig Butchering

A Major Favor: Please Review “Stealing the Future”

If you’re one of the lucky ones who preordered my new book and already has it, and if you’ve had a chance to at least dip a toe in, please consider leaving an honest review on Amazon in your region.

I ask specifically because two early reviews have been suspiciously uncharitable (I’m certainly biased, but I don’t think it’s even plausibly a one-star book). And while I’m personally motivated to be paranoid, third parties have echoed my suspicion that these negative reviews might be part of the SBF family’s larger disinformation campaign, aimed at supressing the book’s contents.

Please post reviews that reflect your own views of my work. But don’t do it for me: do it to help expose some of the worst people in power right now.

Podcast: SBF, $Libra, and the “Mormon Manson”

Recluse was kind enough to invite me back to The Farm Podcast to discuss the parapolitical dimension of FTX, over two whole episodes.

AI, Cults, and Techno-Feudal Dreams (Part 1)

The first part of our conversation focuses directly on Sam Bankman-Fried and the FTX fraud.

AI, Cults, and Techno-Feudal Dreams (Part 2)

The second part ventures farther afield, including discussing the bizarre connections between $Libra scammer Hayden Davis and Evril LeBaron, a possibly U.S. Intelligence-aligned Mormon fundamentalist extremist often known as “The Mormon Manson.” Much more to come here on that subject.

Anthony Pompliano’s $400m Payday for Shilling Dogshit

I’ve crossed paths with Anthony Pompliano a few times in a few different ways. He invited me to a small dinner maybe seven or eight years ago, so I can assure you that his eyes are just as dead in person as they look on TV when he’s assuring you Bitcoin is about to rally. I also worked for a short while with his now-wife, who used to be a journalist but now runs a cringingly worshipful newsletter about entrepreneurship.

In short, these are people without real moral values, who probably don’t even realize that about themselves. So no surprise that Pompliano’s Bitcoin Treasury company ProCap included clauses that could unduly enrich Pompliano personally at the expense of investors.

While Unchained compared it to Elon Musk’s recent Tesla pay package, that’s not quite accurate. While Musk’s package has performance benchmarks, Pomp’s payouts have limited or no benchmarks.

For instance, in exchange merely for launching the DAT, Pomp’s firm got stock worth close to $100m, a major pre-dilution against the firm’s Bitcoin purchases. All told the potential upside for Pomp totals $400m - but according to Unchained, even if ProShares tanks 50%, Pomp gets $50 million.

And with Bitcoin tanked and the DAT trade crumbling, it seems likely that Pompliano has profited while his own investors suffer intense pain. That makes Pomp’s maneuver less like Musk’s, and much more like Chamath Palihapitiya’s disastrous 2020 SPAC deals, which left Chamath a billionaire and his investors broke.

Housing (Un)Affordability Drives Hypergambling Culture

A new study highlighted by Sheel Mohnot makes a remarkable but very compelling claim: that “as households’ perceived probability of attaining homeownership falls, they systematically shift their behavior: they consume more relative to their wealth, reduce work effort, and take on riskier investments … producing substantially greater wealth dispersion between those who retain hope of homeownership and those who give up.”

This is ‘intersectional’ analysis at its finest. Pursuing long-term objectives in an environment of basic trust produces better outcomes for individuals and society as a whole. But as goals fade into implausibility, and trust in traditional assets and rewards for work gets shaky, people are baited into both short-run consumption and high-risk games that are relatively harmful for them individually, and collectively toxic.

I would guess a similar analysis could be teased out of corollated late-stage-capitalism factors like declining real returns on investment, but the symbolic and emotional stakes of homeownership are harder to argue with.

Read at SSRN: “‘Giving Up’: The Impact of Decreasing Housing Affordability on Consumption, Work Effort, and Investment”

Cardano’s Problem is Reputation, Not Security

The Cardano blockchain network experienced a malicious fork thanks to someone partly following AI-generated instructions to recreate a known exploit. This appears to have been a white-hat penetration test gone horrifically wrong: the AI purportedly gave the perpetrator bad instructions for “how to block all traffic in/out of my Linux server,” so what was meant to be a simulated attack became a real one. The chain split required a major community scramble to fix, and the token tanked 16% in already-brutal conditions.

The aftermath, however, has been far more interesting than the breakdown itself. While many blockchain hacks and compromises are greeted with sympathy by the broader community, Cardano’s apparent semi-downfall was celebrated far and wide, for one simple reason: everyone except for his bagholders utterly loathes Charles Hoskinson, Cardano’s creepy, self-important, delusional liar of a founder.

In fact, nearly a decade after the infamous “Metamask support” interaction, Hoskinson just two days ago penned another immortal bit of ego-tripping delusion that has instantly been adopted as mocking copy-pasta across Crypto Twitter.

“You do understand what I do for a living? I literally make decentralized central banks and rebuilt Wallstreet on a blockchain”

Which is simply a crazy thing to say when your project holds a whopping $200 million in assets.

Cardano community members have worked frantically to counter the narrative that this was a “hack” that resulted in a “chain halt,” which are genuinely incorrect characterizations. And Hoskinson said that the FBI had been notified - which in the case of some blockchain exploits is actually defensible!

But on both points, the Cardano community has gotten no sympathy. Nobody gives a flying fuck about their attempt to distinguish a chain fork from a halt. All that matters is that one of the most loathed non-criminals in crypto is eating shit. I’ll be sharing a big example here soon.

There’s also a lot of genuinely dunk-worthy confusion on the Cardano side, where many supporters seem to have at best a vague sense of what blockchains actually are. It turns out having a megalomaniac as a founder attracts people with limited literacy and critical thinking skills.

The lesson here is a perverse one: while crypto is “trustless” in the sense that anyone can access these chains, the character of your leadership team still matters immensely. Charles has treated people poorly for nearly a decade now, and both he and his investors are facing the consequences.

A Life Sentence for the Mayor of Pig Butchering

In one of the more surreal stories in recent memory, a Chinese national who posed as Philipino has been sentenced to life in prison for her human trafficking, part of her apparent role orchestrating a “pig butchering” scam center that enslaved roughly 800 people.

Alice Guo ran for and won the mayoralty of the small Philipino town of Bamban in 2022. But by 2024, a ‘scam center’ was discovered on land she formerly owned, and it was discovered that she was not in fact Philipino, but Chinese by birth. She subsequently went on the lam and was discovered hiding in Indonesia.

“Pig butchering” or romance scams have proliferated wildly over the last decade, enabled in large part by Tether, the offshore crypto shadow bank/”stablecoin.” (Notably, a pig butchering victim played a controversial, disruptive role in the prosecution of Tornado Cash developer Roman Storm.)

Sadly, Guo isn’t really “the” mayor of pig butchering, but likely one of dozens or even hundreds running similar slave camps across southeast Asia.

Berachain’s Backdoor Refunds

Unchained reports that the most prominent investor in alternate blockchain network Berachain made what amounted to a fake investment, thanks to a refund clause. Brevan Howard “invested” $25 million through a group called Nova, but were guaranteed the right to a refund in a “side letter” leaked to Unchained.

If true, this would amount to substantive fraud. But it seems just as plausible that the contract has been misinterpreted, and that Bera’s hapless response has aggravated a non-event.

First, to take the story at face value: if not disclosed to other investors, the sweetheart refund deal is securities fraud, because it concealed that the “lead” investor didn’t actually have skin in the game. It may also have amounted to corruption of Brevan Howard from within: Unchained reports that Brevan Howard’s Kevin Hu, who led digital investments, had taken a personal stake in Berachain’s seed round, meaning he stood to personally benefit from the firm’s (deceptive) public stake.

All of this matches broader discourses and suspicions around Berachain within crypto circles. While we’ve all really been enjoying the parties, experts have almost uniformly disparaged the project as a “VC chain” motivated by insider self-dealing and pump-and-dump logic.

In response to these implications, pseudonymous Berachain founder Smokey issued a really unfortunate rebuttal. Front-loaded with claims that the story’s “framing is incomplete” and that the sources were “disgruntled ex-team members.” Smokey alludes to Brevan’s “complex commercial agreements,” and disparaging the author of the report.

In short, it sounds like the oily corporate evasiveness of someone who is 100% guilty.

But Here’s the Thing: The story might actually not be fair!

One lawyer, admittedly pro-Berachain but not employed by Berachain (and whose thread I have temporarily lost) explained that the refund clause would only be exerciseable if, more or less, the tokens were never actually issued. We’ll see how this plays out, but a clear explanation from Smokey, rather than defensiveness, would have saved everyone a lot of heartache.

If you need advice with comms problems like this, remember, I do take private clients.

Per the review, best I can do without self-doxxing: https://debank.com/stream/3386767

Why do I post on DeBank? Is their default stream a cesspool of self-promoters and ads? Typically. But it's also the only crypto site I go to often. I keep hoping they'll clean it up someday. And at least it's not owned by a wannabe Nazi.

"

First, to take the story at face value: if not disclosed to other investors, the sweetheart refund deal is securities fraud, because it concealed that the “lead” investor didn’t actually have skin in the game.

"

I'm not sure crypto is a "security." The very name suggests a transparency, longevity, and accountability that does not seem to exist for either the instruments or the framework surrounding crypto. Now, fraud need not apply to securities. And fraud is super easy to understand as lying. So, it seems on my very limited understanding that with securities, being an investor means you had to comply within this hardened framework, it carries with it an implicit statement that you abide by the framework. So, when you don't disclose certain facts, then you commit securities fraud with your lie being you abide by the framework. But if there's no framework, there is nothing to abide by, therefore, lack of disclosure might not be fraud, because there is no lie, only omission, and there's no framework that says omission matters.

If I'm at a poker table, a friendly game with friends, and I told a buddy, hey, I'll give you a signal when I got a great hand, and you'll say it loudly that you think I got a great hand, and then people will think you figured out my tell. Then when it's convenient, I'll throw the same signal, but I won't have a great hand, and you can make the same statement. If you do, I'll spilt my winnings with you for that hand. Well, I didn't say anything did I? My buddy did. So he maybe committed fraud. But did I? Well, if we all had a rule that you can't collude with friends like this, and that colluding to perpetrate a lie is the same as lying, then I did. But until that framework exists, I don't see how I lied, thus I don't see how I committed fraud. (Of course, I would never do this unless everyone thought this kind of thing was fun, and I don't actually find this kind of thing fun, so I probably wouldn't want to be involved, and I don't like anyone lying on my behalf, or because of me in any way, regardless.)

Of course, this cannot mean all fun and no consequences. It should mean if you are not held to the standards then you don't get to enjoy all the benefits that come with running enterprises in the framework: I.e. access to and protection within the U.S. banking system (for the instrument at least, for the individual is complicated). Not a lawyer. Not a securities expert. Just some rando with some thoughts. I also definitely don't want to keep crypto out of securities because I want backroom deals. I just think: a) I do not trust the people in power now who currently want to bring it into the world of securities, b) I do not trust their choices on who they will target with securities law, c) I do not think compliance will be scaled appropriately to the capabilities/sizes of the teams and will likely end up leading to monopolies. I don't want Big Crypto to be added to the list of Big enshiittifiers. Of course, Big Crypto may already exists, but since the biggest enshittifiers ARE in the world of securities, that's likely where the best tools are for enshittification.

I do think it is a great thing to call out people like DZM does in this post. And then don't invite them to your next poker party.