A Liar To the End: SBF’s Sentencing Hearing Was his Final Self-Indictment

The biggest fraudster of his generation couldn't talk his way out.

Yesterday, FTX founder Sam Bankman-Fried was sentenced to 25 years in U.S. Federal prison. There is no parole in the Federal system, but with good behavior and thanks to the 2018 First Step prison reform act, he could serve as little as 12 years actually behind bars, when he could move to a halfway house or home confinement.

SBF’s potential eligibility for early release, on top of what some have argued was a relatively light sentence, are frustrating. Allen Stanford, by comparison, was sentenced to 110 years for a $7 Billion fraud. Nonetheless, Bankman-Fried may not be a truly free man until he’s 55 years old.

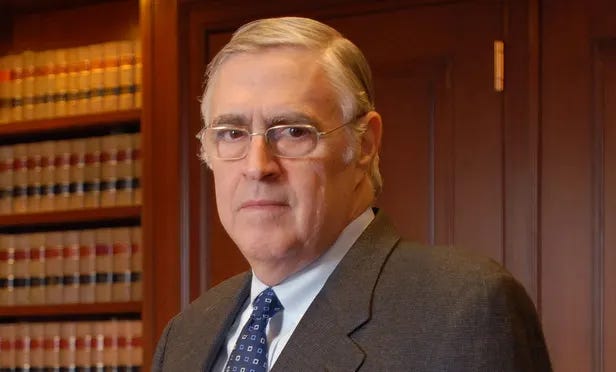

I want to focus on the part of yesterday’s hearing, held at the Southern District of New York courthouse in the courtroom of Judge Lewis Kaplan, that was an unambiguous win. Judge Kaplan, showing incredible insight, firmly debunked all of the disingenuous, weaselly excuses Bankman-Fried and his defenders have vomited out over the last year.

Kaplan laid out in no uncertain terms that Sam Bankman-Fried is a bad person: a power-hungry habitual liar and unrepentant thief. Even better, Kaplan was contemptuous of the worldviews that seem to have underpinned Sam’s behavior – Effective Altruism and utilitarianism.

“A thief who takes his loot to Las Vegas and successfully bets the stolen money isn’t entitled to a reduction of his sentence.” - Judge Lewis Kaplan

Annihilation

The Mukasey-Young defense team, having taken over for Cohen and Everdell, yet again reeled out the flimsy justifications that Bankman-Fried had good intentions and could still do “good in the world” if he got a short sentence – the same arguments Sam was making more than a year ago, and that his mercenary public supporters continued to make even after his conviction.

But Judge Kaplan utterly eviscerated this conceit on every front, highlighting throughout the hearing that Bankman-Fried was a habitual liar, who had taken no responsibility for his documented crimes, and had already made plans to rehabilitate his image.

The hearing began with Kaplan “rejecting entirely” the defense’s claim that depositors had suffered “no loss,” calling that claim “misleading, logically flawed, and speculative.”

On the claim’s misleading nature, Kaplan reiterated his iconic point that “a thief who takes his loot to Las Vegas and successfully bets the stolen money isn’t entitled to a reduction of his sentence.” But further, Kaplan specifically argued that the estate’s planned repayment at dollar value at bankruptcy date does not equate to material repayment in full; that even that plan is still speculative; and that investors and lenders are not even getting a superficial full repayment.

In tallying Sam’s sentencing enhancements, Kaplan added Obstruction of Justice points for witness tampering and, most gratifying, what Kaplan said was repeated perjury committed by Bankman-Fried during his sworn testimony in his own defense. Just as I wrote last year, SBF is going to prison in large part because he’s incapable of shutting the fuck up.

And indeed, when Sam rose to speak in his own defense again at the sentencing hearing, he continued to lie – to the public, and most pathetically, to himself. Rambling and mumbling, dressed in a tan prison jumpsuit and with chains around his ankles, Bankman-Fried was still trying to sell the “I fucked up” narrative he first rehearsed during his November 2022 media tour.

He repeatedly claimed that FTX was never bankrupt, that the money to pay back creditors was all there. He yet again seemed to blame bankruptcy lawyers and other third parties, along with a “liquidity crisis,” for what happened.

The Mukasey defense team’s closing statement echoed other parts of Sam’s willful self-delusion. Mark Mukasey argued that Sam wasn’t like other financial criminals, because he “is not the defendant who looked victims in the eye while he took their money … Sam was not a financial serial killer who set out” to harm victims.

Mukasey also leaned into Barbara Fried’s mystifications about her own son, the idea that Sam is uniquely hard to understand, and that understanding him should somehow alter the significance of his actions.

“He doesn’t make decisions with malice in his heart,” Mukasey said, “he makes decisions with math in his head … Sam himself is kind of a beautiful puzzle.”

I somehow resisted throwing up in my own mouth. It has been infuriating, morally and intellectually, to hear the same garbage regurgitated again and again by Sam and his shameless elite defenders.

So you can imagine just how gratifying it was when Judge Kaplan rejected every bit of the premise, and then some. Mukasey’s attempt to praise Sam’s mathematical mind even seemed to backfire, with Kaplan characterizing SBF’s crimes as themselves driven by a calculation:

“He was viewing the cost of getting caught, discounted against the gain of not getting caught. It started at least as early as Jane Street, and it continued to the very end. It’s in his nature. You don’t have to believe me, everyone says this.”

For the same reasons, Kaplan characterized Bankman-Fried as a continuing danger to the public, and said his sentence was imposed in part to prevent Bankman-Fried from committing more crimes. This was “a man willing to flip a coin on the continued existence of life and civilization on Earth,” he said, citing witness testimony. In short, Kaplan nuked the very premises of Effective Altruism and Barbara Fried’s utilitarianism.

Kaplan further condemned SBF for “never [saying] a word of remorse for [his] terrible crimes … He knew it was criminal. He regrets he made a very bad bet about the likelihood of getting caught.” Further, Kaplan noted that Bankman-Fried was likely to try and resurrect his reputation on release.

“It doesn’t take much to see the outlines of the [PR] campaign; This man will be in a position to do something very bad in the future, and it’s not a trivial risk. Not a trivial risk at all.”

Michael Lewis, perhaps the most prominent and toxic of Bankman-Fried’s craven apologists, attended the sentencing hearing and sat in the overflow observation room. As Sam walked off to his lengthy prison sentence, Lewis frowned, gnawing on his knuckles with a deeply furrowed brow. Perhaps he registered that his own credibility, earned over decades of decreasingly honest work, had also been condemned.

Though I and others will continue unpacking the full details and nuances of what really happened at FTX, this marks the chronological end of Sam Bankman-Fried’s story. His appeals will fail, and by the time he is released – even if it is in a mere 12 years – he will be a sad, tarnished, and forgotten irrelevancy.

Manhunter

This ending is particularly gratifying for me. A year and a half ago, in late November of 2022, I wrote a column for CoinDesk titled “FTX’s Collapse was a Crime, Not an Accident.” FTX had collapsed and declared bankruptcy by November 9, but FTX founder Sam Bankman-Fried had spent the following weeks conducing a no-holds-barred media tour.

Bankman-Fried gave interviews to nearly everyone who would have him – dozens if not hundreds of them. And in those interviews, he presented the narrative that FTX’s collapse was the product of some bad accounting (the “poorly-labeled internal stub account”), excessive leverage at the hedge fund Alameda Trading (noone seemed to ask why that mattered for FTX, a supposedly separate exchange), and bad market conditions (the “run on the bank” narrative.)

By late November, there was rising anxiety among knowledgeable observers that the son of a bitch would get away with it – that he would manage to sell the public a narrative by which he was hapless but well-intentioned. In reality, within days the bankruptcy estate managed by John Ray III had uncovered numerous signs, not just of mismanagement, but of fraud. Those included billions of dollars of personal loans to executives, and most importantly, the liquidation exemption that allowed Alameda Research to borrow essentially infinite amounts of FTX depositor funds.

My column channeled the mounting rage that many were feeling at the time – and improbably, it had a real impact, becoming one of the most widely-read pieces ever published by CoinDesk, and spreading far enough to be shared by political influencers like Ann Coulter (yeah, that one was weird). Bankman-Fried was convicted of fraud in several of the instances I highlighted, and more, on November 2 of 2023, a year to the day since CoinDesk leaked the Alameda balance sheet that ultimately revealed the fraud.

So I don’t think I’m being self-aggrandizing when I take some credit for Bankman-Fried’s sentencing yesterday to 25 years in Federal prison. Much larger portions of the credit, of course, go to Ian Allison, the CoinDesk reporter who unearthed the balance sheet; and to Federal prosecutors who masterfully built the court case.

This isn’t the first time I’ve bent the curve of another person’s life, simply by unearthing inconvenient facts. It’s been an incredible privilege, and it’s an aspect of journalism that I’m continuously surprised gets so little attention. While I’m at least taking a break from the intensity of the work, for much of the last five years I have been something like a bounty hunter, or detective, or assassin, channeling my own rage at injustice into investigative work that hurts bad people – bad people like Sam Bankman-Fried.

Very soon, I’ll be writing about what that’s like. Stay tuned for the victory lap.

Thanks for the great work, David. It’s encouraging that real journalists still exist. The truth will set us free, but for many in power the truth is not good for business.

Excellent article. Thank you for your coverage. I follow Mandy Matney and Liz Farrell, who cover Alex Murdaugh (SC thief, liar, and lawyer who killed his son and wife). They share the same sentiments of changing the course of a bad person's life (and that of his accomplices). The investigative journalism world is still so important, all these years after 60 Minutes started knocking on the bad guys' doors.