👁️ Basic Capital: The Worst Investment Product Of All Time - or Just the Weirdest?

When is complexity itself a scam?

Greetings from Toronto, where I’m stopping briefly to appear in a sneak preview for Use Case Magazine. It’s a very ambitious, print-first project attempting to do thoughtful and long-form journalism about crypto. You can sign up for early access at usecase.xyz

I’ll have a major feature coming out there in September/October focused on the memecoin trenches of 2024/early 2025, and will be publishing a full-length interview supplement to that piece for supporters here soon.

If you happen to be in Toronto and want to meet in the next day or so, feel free to reach out on Twitter.

“There's no reasonable scenario where this product is better than investing the same capital in an S&P 500 index fund.”

Should You Borrow for a 401k?

Today I just want to focus on one story that has Fintwit* simply ablaze. (*a community of investment advisors, asset managers, and theorists who yap, generally very insightfully.)

Basic Capital is a new offering that uses some pretty elaborate structuring to enable 4x leverage on your retirement investing. At very first glance, it seems like a truly awful concept that drains any potential leveraged gains through loan interest and fees. But founder Abdul Al-Assad, an ex-Goldman guy, has been very engaged with critics, and after digging in a bit the value seems at least debatable.

That makes Basic a pretty incredible case study, showing how to think through an offering even in the regulated world of traditional finance, and decide whether it’s a grift. There are also deeper questions here having to do with market structure and the flow of funds in the background.

But maybe the most salient point is the messaging, which leans on the idea that this leverage is something that very wealthy people have special extra access to, and that what Basic offers is some kind of democratization of “one weird trick” that’s only available to the wealthy. As a commentator going by TJ Terwilliger put it rather profoundly, though:

“It’s way easier to believe there’s a secret you’re not in on than it is to believe that you’re not disciplined or patient enough.”

The Basics of Basic

Here’s the starting point: Basic Capital lets you borrow 4x your retirement savings, then lards that up with a heap of fees. High fees are almost always the basis for any legal grift in tradfi. Fees are how Chamath Palihapitiya, probably the most notorious scumbag in today’s investing landscape, made money shilling utter dogshit SPACs. That doesn’t mean Basic is a grift, just that this is what most suit-and-tie grifts look like.

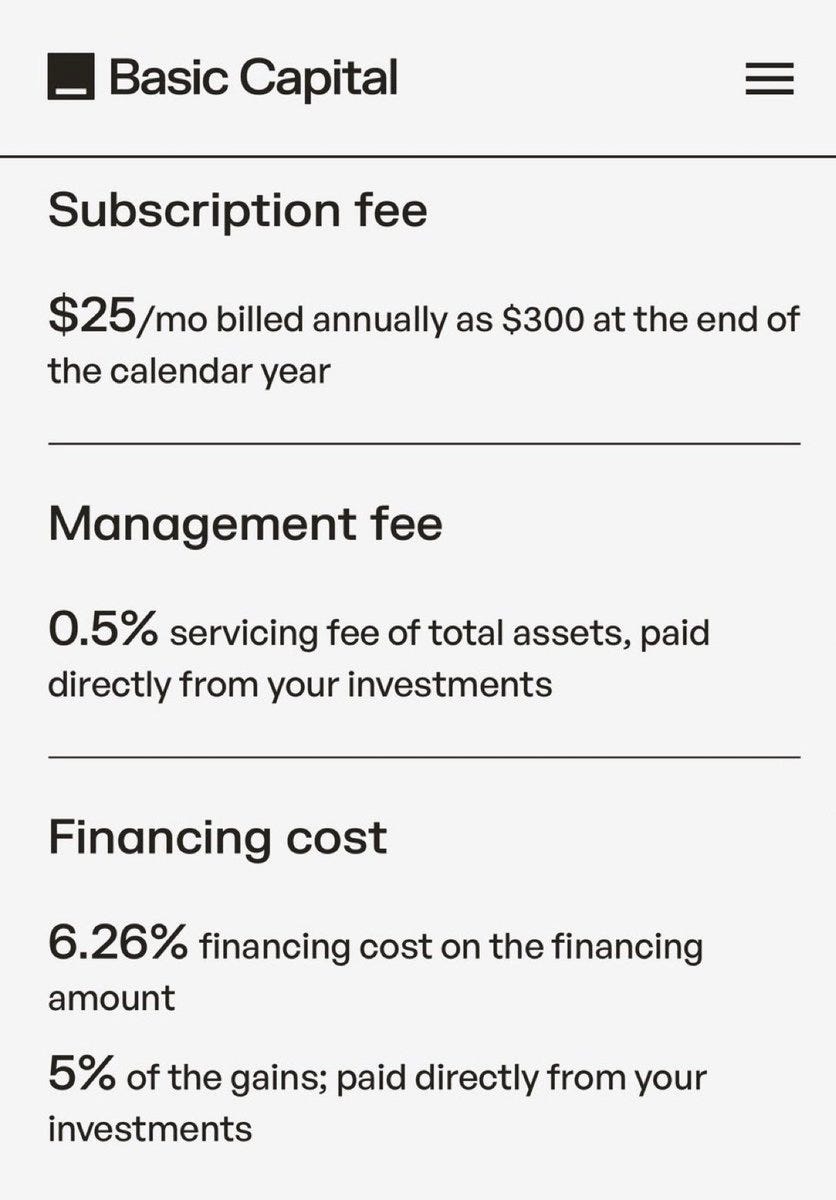

The fees starts with the 6.26% interest, which is already a problem: The S&P has delivered an average of over 10% returns historically, so right from the jump you’re giving up most of your added gains. Then there’s another 0.5% management fee, an annual flat $300 fee, and another 5% of all your upside.

I’ve been writing about finance professionally for more than a decade, and the math on this is still wildly beyond me - and I think ultimately that opacity and complexity are the core issues here. But some attempts have been made by smarter folks to game out scenarios, most notably Kevin Dahlstrom.

Dahlstrom has penciled various scenarios in a Google Sheet, and it looks pretty bad. One notable thing is that 75% of the total pot in these accounts has to go into bonds (explained below), so the variance of equity returns is dampened.

Here are Kevin’s calculations, with the really important part being the first and last lines:

(Please remember to copy the sheet if you want to play with it, don’t bombard Kevin with permission requests.)

That last line is returns against principal, not against the full borrowed amount. So e.g. if you have $100,000, use Basic to lever it up to $500,000, pay their fees for 20 years while stocks average 10%, you’re losing more than 5% annually compounded compared to the same mix without leverage.

There are a lot of caveats and unknowns here, but Dahlstrom concludes that “There's no reasonable scenario where this product is better than investing the same [starting] capital in an S&P 500 index fund.”

Al-Assad, obviously, disagrees. He has replied that his own “back of envelope” math suggests returns of 13% net of fees, vs. ~10% if the same unleveraged principal is plowed straight into the S&P 500. That is definitely huge, but even if you accept Al-Assad’s assumptions, the question becomes what the downside risk is for an extra 3% annually - see below for that.

Furthermore, there are some more specifically complex and risk-additive factors. Most notably, the interest rate floats. Which in some sense means all bets are off, this thing could be anything and borders on just being a pure gamble with your future, regardless of assumptions.

The Caveats and Conditions of Basic

Matt Levine’s take on Basic Capital expands on the very arcane legal structure involved in this setup, quoting Basic’s own explanation: “‘your IRA buys sole interest of an LLC that we set up and manage on your behalf,’ and the limited liability company ‘secures financing for 4 x your … contribution.’ The financing appears to have a five-year renewable term.”

This appears to be in part to protect the investor’s principal: Basic claims “There are no margin calls or mark-to-market triggers. If the market falls below a certain level, you aren’t forced to liquidate. The financing is structured more like a mortgage: It’s a loan to a separate entity (an LLC) that holds the assets. There’s no personal recourse beyond your initial contributions; you cannot owe more than you put in, even if the market crashes.”

This is accomplished in part by the requirement that about 75% of the portfolio be in bonds, which generate yield that (in theory …) covers financing costs even if the market is down and the borrower themselves suddenly can’t. So it doesn’t seem like even your principal can be liquidated - but the fees could still wind up really setting you back in a particularly bad year.

The other thing to mention here is that apparently the bond portion of these portfolios is anticipated to transition to including more private credit. That gets into issues of default and transparency that need more examination - according to Dave Nadig, there’s serious reason to believe there would be weak record-keeping as to what exact private debt you hold in this setup. There have also been serious questions about default rates in private debt, which would potentially make Dahlstrom’s already-bad numbers considerably worse.

The LLC structure here is inherently weird as hell, and on its face seems intended mostly to create a liability firewall that limits downside to initial principal. But others have speculated that the layering of insulation also helps remove fiduciary responsibility from Basic itself. “Fiduciary duty” is the legal requirement to recommend investments that are actually good for the customer, rather than just generating fees for the servicer.

The Bigger Questions of Basic

Beyond the already-arcane setup, there are second-order implications to leveraging a 401k into bonds and private credit. There are also broader concerns around complexity and target market.

As Dahlstrom also points out, scalability is an issue once Basic transitions from bonds to private credit - if there’s a lot of demand, you could just run out of private loans to make. That especially becomes a problem combined with transparency issues, raising the specter that Basic could become some kind of funnel for retail investors into increasingly sketchy private credit, leading default rates to balloon and destroy the already debatable and very conditional alpha.

Levine also raises questions about who exactly is going to provide the funding for the loans to Basic’s customers, but I’m not sure I see this as a key issue. It’s intended as a risk-dampening option for capital that doesn’t want direct bond or equity exposure, so on its face, just a pretty straightforward risk swap. There’s a lot of money out there that’s happy to make 5% or whatever it is Basic ultimately passes through to its lenders.

Then there are market implications. As Leyla Kuni of Accredited Investor Insights puts it, “if there are $5 chasing the same asset that only $1 was chasing previously, what happens to the asset price?” Obviously, the price goes up, which depending on your perspective either fuels bubbles, or ratchets the entire asset market up permanently.

Finally, the use of a floating rate makes Basic reflexive, at least in the abstract: If it succeeds, it notionally puts more demand on capital. Might not be enough to move the needle in a way that dilutes its own success, but worth keeping in mind.

Should There Be a Regulated Upper Limit to Complexity?

This is the most important question in all of this. Basic is just one manifestation of a larger trend towards retail-facing complexity that will not end well for the heedless.

Basic’s marketing pitch is very, very simple, and to many, will be very compelling: “Leverage is how you get rich.” That’s not particularly true - most millionaires are just patient and prudent - but it’s not entirely untrue, either. And with not just crypto platforms but even RobinHood offering increasingly exotic leveraged instruments, people are getting used to it in a way that makes Basic’s pitch more appealing.

The problem is quite simply complexity. Taking big fees is a red flag, but it’s also why the finance industry exists, and there are products that are totally worth paying the fees on, whether for convenience or just in general.

But what if almost nobody can really understand the fees relative to what you get for them? The mix of flat fee, APR, and performance rake on Basic is already totally mind-numbing, and the cap of 25% on equities probably completely undermines average people’s rough idea of what a 401k would be invested in.

I’m willing to grant that the motives behind Basic really were innovation, and maybe even democratization. But in their quest to find out if they could do it, they may have forgotten to ask whether they should do it - not just the specific product, but as part of the entire system and business of finance.

In other words, while individual results are obviously unpredictable, I don’t think the existence of a way to legally lever your 401k is good for capital markets or savers - even those who don’t participate.

Excuse typos, didn't edit:

Is there something preventing IRAs from holding any of the 3x leverage S&P 500 ETFs with less than 1% in fees? Or am I missing something? My guess is:

4x is greater than 3x! (ignore the extra weird fees behind the curtain)

We know leveraged ETFs typically do worse, but we don't with this (because it's crazy weirdness most people would realize is unnecessarily and possibly fraudulently complex)

Speaking of weird, what's the “one weird trick” that the wealthy have access to? Whatever it is, my guess is that it is not this. But would be nice if the trick was spelled out and how it is of course different.

–

“

Levine also raises questions about who exactly is going to provide the funding for the loans to Basic’s customers, but I’m not sure I see this as a key issue.

“

Sometimes I think DeFi is a great way to see what happens in TradFi but is often obscured by bailouts and money in politics. And in DeFi who provides funding for loans is extremely important. For example, let's say they have a mixed collateral scenario. You can deposit BTC, ETH, derivatives of it, mostly legit stablecoins, oh, and /our governance token/. I'd run. That's prime Mango Markets exploit territory. Actually it's subsubsubprime territory.

You have an exotic asset to provide as a deposit. You will need to go somewhere that accepts exotic assets. You want a decent rate, you'll probably need to mix in with some others. Those others are now your risk that the entire platform defaults.

Also speaking of complexity hiding flaws in bad investments, this isn't even close to probably the biggest one in crypto/DeFi. Governance tokens. At the end of the day, you're watching a supposed automaton play chess, but inside the pedestal below the chessboard is a person who ultimately moves the magnetic pieces. Neat looking mechanical puppet, but ultimately a human puppetmaster will do whatever they please with pieces. And they do it all the time!

I'm going to reach out to DefiLlama and see if they can't start recording cases where the developers just said screw the governance vote “because this is an emergency” or maybe didn't give a reason at all. It might shock a lot of people. Honestly the smart money is probably aware of this and that's what is really keeping the number of governance “attacks” down–and the trajectory of their prices.

–

“

But what if almost nobody can really understand the fees relative to what you get for them? The mix of flat fee, APR, and performance rake on Basic is already totally mind-numbing

“

That's what makes DeFi a useful lesson. It can be expensive though. APRs are bull**** (because the higher APRs are almost always based on tokens that plummet in value well before “annual” time passes). APYs equally because of it. Simpler almost always works better. Boring a** lending. If you want a bit of risk/leverage, borrow a different asset, sell it, buy more of your primary asset, deposit it. That's it. Works better than pretty much everything else. But, if you don't try it, it's hard to believe it.

–

“

I’m willing to grant that the motives behind Basic really were innovation, and maybe even democratization.

“

Ain't no one with enough startup capital and a desire to build a TradFi product like Basic got it based on ideals of democratization. I'd love to be proved wrong.