👁️ Daniel Shin joins Bill DiSomma in Terraform's Pig-wallow

South Korea's Tech Golden Boy played along in Chai deception

In Today’s Edition:

The Bitcoin Halving is Not Priced In

Mango Manipulator Avi Eisenberg: Is Code Law?

Another FTX Insider claims Effective Altruism drove SBF’s fraud

Elon Musk’s Ketamine Therapy is Going Just Great

Hints from Google that AI Search Is a Shitty Business

Jump Trading AND Daniel Shin Implicated in Terra fraud

Be Long Bitcoin Ahead of the Halving

It’s time to be mid-curve - the Halving is not priced in.

The Bitcoin “halving,” coming April 20, will cut the block reward for bitcoin miners in half. This will force less-efficient miners off the network, temporarily reducing hashrate. It will also reduce the flow of new coins into the market … which is arguably not in itself enough to materially impact the price of BTC, but it IS enough to get speculators riled up about “scarcity.”

Google Trends shows search interest for “Bitcoin Halving” just picking up steam again in the last week or two, after a surge of interest in late February. That likely includes a lot of new ETF investors learning about this for the first time. Expect a moderate pop in the next couple weeks, then a selloff.

Avi Eisenberg, the Mango Mangler

Is code law?

That might not be a directly relevant question in the criminal trial of Avi Eisenberg, but for crypto types, it hangs over the whole thing. Eisenberg has long claimed that his $110m exploit of the Solana-based DeFi platform Mango was just a “highly profitable trading strategy,” since it merely exploited a financial weakness in the contract logic, rather than a “hack” per se.

Anyway, Eisenberg’s criminal trial begins today at the Southern District of New York, where it is open to the public. I’ll probably drop by for some insight.

Insider Claims Effective Altruism Drove SBF’s Crimes

Another close associate of Sam Bankman-Fried has come forward to say that Effective Altruism lay at the root of his massive crimes. This was the subject of my new deep dive into SBF’s motives. The Wall Street Journal quotes Andrew Croghan, part of the original 2018 Alameda Research crew, who had left the FTX circle by 2020.

Still, Croghan took issue with media depictions of Bankman-Fried as greedy. Whatever illegal acts the FTX chief committed, Croghan said, they were motivated by effective altruism ….“People think he’s your average mustache-twirling villain,” said Croghan, who doesn’t identify as an effective altruist himself. “I don’t think that’s the case…. He could have stolen a lot more money for himself, if that’s what he really wanted to do.”

Croghan, unsurprisingly, seems to think he’s defending SBF, that the supposed moral motivation makes things better … instead of looking within, at the clear outcome of a broken ideology he seems to still cling to.

Hints from Google that AI Search Is a Shitty Business

The FT reports that Google is considering charging for AI-powered search and other AI services. The FT points out that this is the first time Google has even hinted at charging for anything related to its core search product.

This should have AI investors running scared. AI search isn’t inherently profitable, because the compute costs are so high. This means it can’t scale to the kind of immense profits driven by the zero-marginal-cost nature of existing digital information services.

The fact that nobody actually wants this is just icing on the cake - FT also points out that offering AI search for free, for nearly a year now, hasn’t helped Bing gain market share.

Elon Musk Doesn’t Know What’s Going On

Elon Musk is being sued by a young man who was the subject of a “false flag” conspiracy theory that Musk amplified on Twitter. Musk’s lawyers tried to keep transcripts of his testimony from being released to the public, because he comes off as simultaneously a prick, and seriously mentally impaired. This includes mistaking his accuser’s lawyer for the plaintiff.

Daniel Shin Joins Jump Trading in the Terraform Barrel

We’ve already discussed that Chicago-based Jump Trading has been heavily implicated in Do Kwon’s Terraform fraud. Whistleblower James Hunsaker has now more specifically claimed that it was Jump founder Bill DiSomma himself who ordered the deployment of more than $200m to defend the TerraUSD (UST) peg in May of 2021. Both Bill DiSomma and nominal Jump Crypto head Kanav Kariya have plead the Fifth Amendment in the current case. (Alex Osipovich of the WSJ has more on DiSomma here.)

After UST regained its peg in that instance, Jump’s role was never publicly mentioned, with Do and others claiming for the following year that UST was “self healing.” This is one major element of the fraud for which Terra was found liable, and for which Do will eventually face criminal trial.

I attended the civil trial for one day, when the core of the discussion was whether Jump Trading’s “Bookstacker” automated buying program had been used strategically to prop up the UST price during a May 2021 depeg. Unfortunately SEC still hasn’t gotten all the evidence published, but prosecution charts made it pretty clear Jump’s intervention helped prop up the fake “stablecoin.”

I was more surprised, though, to see evidence that Daniel Shin actively collaborated with Do Kwon in his fraud. Shin, a renowned South Korean tech dude thanks to founding something called TicketMonster, was technically a cofounder of Terraform, but he wasn’t actively involved on the blockchain side. Instead, he was building Chai, a payments platform.

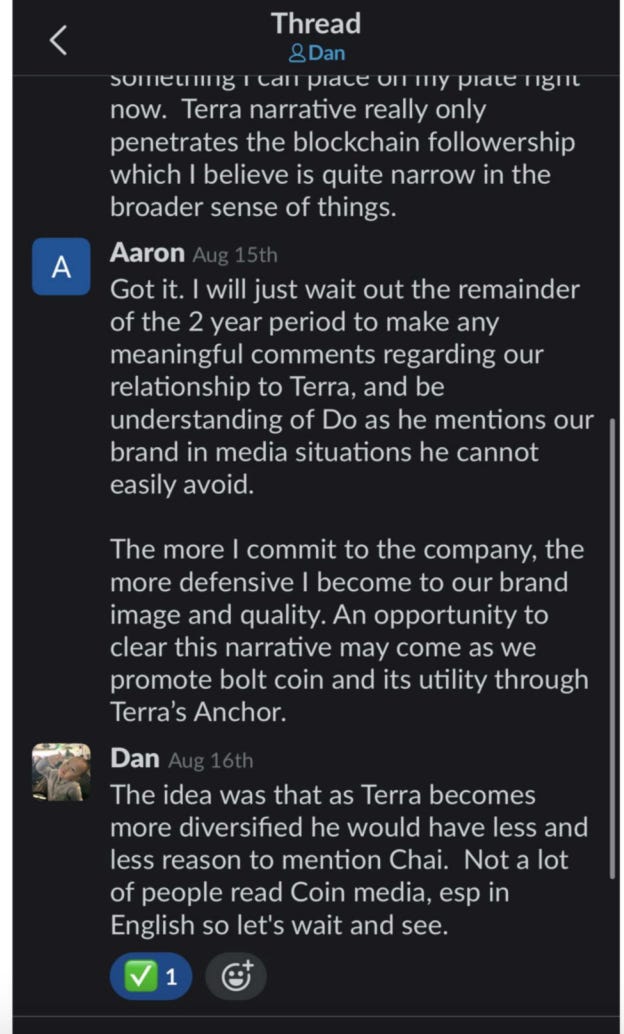

Do Kwon repeatedly and publicly claimed Chai was using the Terra blockchain to clear and settle its transactions, but this was false. Daniel Shin was apparently fine with Do lying about this. The below messages, from prosecution evidence, show Shin and former Chai Chief Product Officer Aaron Myung discussing that they won’t dispute Do Kwon’s false claims that Chai runs on the Terra blockchain. Myung was a cooperator who also shared recordings of conversations with Shin and Do.

Do Kwon was already known to have falsified blockchain records (quite a feat) to falsely show Chai transactions on Terra. According to a witness, 45% of all token movements on Terra from June 2021 to May of 2022. And here’s a recording of Do Kwon and Myung, which at the very end includes Do discussing a “Gentleman’s Agreement” that the Chai team not contradict his false claims about Chai and Terra.

First comment. This post is interesting me because it mentions four individuals, all of whom raise questions of moral (as opposed to strictly legal) behavior.

1. SBF (an acronym, it stands for some guy's initials).

2. Elon Musk (not someone I want to write about, since he has a reputation for actively going against detractors, and, you know, is every once in a while the richest person on earth by some metrics).

3. Jump Leader (which if whistleblower is right, is really Bill DiSomma--which doesn't exonerate Kanav Kariya completely if he knew what happened, but at least gets sympathy from anyone who ever had to do something icky that their boss wanted them to do).

4. Mister Mango (what I call Avi Eisenberg, because I always forget his name).

Of these four, who might be the most unethical?

1. Let's start with SBF. His behavior can always be distilled to two things: A) No one wants to think of themselves as a bad guy. B) Regardless of how smart you are, you can always take logic and introspection to the point that is most convenient to you and no further. Slavery is my favorite example of how lots of people could conveniently not think of themselves as bad people, e.g. Thomas "All Men Are Created Equal--Ignore That Sally Hemings Thing" Jefferson. I was using slavery as an analogy for SBF on the CoinDesk (RIP) Discord back when SBF hadn't yet completely cratered. SBF is probably the worst offender because he broke the simplest of moral rules: Don't Lie and Don't Steal. Over and over and without compunction. Humans are creatures of habit. We shouldn't do any of those even once because then it'll be easier to do them more often. SBF is so far gone, he probably worries about accidentally doing something like his projected image and then getting on the slippery slope of being honest and fair. Because, you know, can't ultimately become a really, really good guy to everyone else and not just himself any other way. Based on what we know (which is a HUGE caveat, because he didn't keep his mouth shut nearly as much as the next two probably know to do, so who knows how really bad they are), probably most unethical.

2. Elon... I'm scared of this dude. Let's just say that he claims to be for free speech, but clearly not the kind that is critical of him. Further, I find it extremely hard to believe that he believes his own claims. Self-driving cars are next year (ever year for the last ten years jalopnik.com/elon-musk-tesla-self-driving-cars-anniversary-autopilot-1850432357), etc. But, again, the brain has lots of nice ways of convincing itself of things, even if it's just for the few seconds it is saying whatever convenient thing it is saying (e.g. to investors). There is something about the flavor of his lies. When they are about hot-button topics it's easier to get distracted by what they are about (note www.rollingstone.com/culture/culture-lists/elon-musk-twitter-zuckerberg-lies-1234808808/ is it the lies or what they are about that get the most opprobrium)? But ultimately, they are lies. Do Not Lie. And per that last link, the fact that he's aligning more and more with, well, stuff that 1700s slavery states would have liked, doesn't help. It's convenient for him. He may not be wanting slaves to pick cotton (or mine opals) but he probably wants the nice juicy tax breaks and super-rich-people-influence of a political party that manages to be powerful despite its overall lack of popularity. A party that gets its power partly due to the 1700s slave states and the compromises that were made for them. Regardless, Don't Be Racist is a pretty clear moral rule. I don't know how SBF felt about his mom, but we know how Elon felt about his dad, and if he's sliding towards becoming more like that, it's not a good thing. (E: Please don't come after me.)

3. Jump Leader. Backroom deals are not very crypto ethics. So that’s bad on its own for anyone claiming to be crypto and not TradFi. But after the Jump bailout, after Do Kwon kept up the lies that his “perpetual motion machine” (DZM uses this term, as have I for a very long time, it definitely is the best way to describe the scheme), Jump had a responsibility to reveal what it did. Ethically, that is (maybe legally). This is clearly a lie of omission. Which are tricky ones to morally judge. They can’t be looked at in isolation. Perhaps if they had nothing else visibly to do with Terra Luna, it might even be /somewhat/ excusable (per number 4 to follow, it’s notoriously hard to short sh*t, so options are limited). But “Jump Crypto was active in the Terra ecosystem, frequently posting governance proposals and heavily invested in the project, including building a Terra cross-chain bridge and co-leading a $1 billion capital raise to seed the Luna Foundation Guard.” www.coindesk.com/business/2023/02/17/jump-crypto-is-unnamed-firm-that-made-128b-from-do-kwons-doomed-terra-ecosystem-sources/ In this context, it’s definitely an egregious lie of omission because they are actively saying that Terra is up-and-up per everything else. So, it broke Don’t Lie. Once that I know of. But when it’s that big and that hard… For such a huge, massive fraud like Terry Luna. One time is bad enough.

4. Mister Mango. I need to know more about this case. No one is giving it the justice (no pun intended) it deserves to really look at where he lied and/or possibly stole. The first question I have is regarding any User Agreements he had with Mango or the external markets he used to influence (manipulate? It may be semantics, but I do think important to think about) the oracle(s). What makes that tricky is User Agreements, particularly EULAs but others as well, are the one area I think everyone knows is the most fraught with moral ambiguity. Many are written with neither the intention to be read nor understood. Many are written not because the writer actually cares about what the signee does, but what a regulatory agency might do to them. Many of them are written not just to avoid legal ramifications, but to put in spurious arguments that can be used to litigate another into submission with the huge resources they have. And sometimes, they just don’t exist. I can say one thing, I have NEVER seen a DeFi protocol have in its user agreement “And must agree not to do any activity that can materially and to an extreme degree—as considered reasonably extreme by a jury of peers—affect the oracle prices of any financial instrument that they are involved with using the protocol.” Or some such. If it exists in an agreement, it’s not prominent. And I will leave it to you to guess if I read every user agreement, I will not try to guess if you read all 56 pages of the EULA every time you buy an iPhone (www.businessinsider.com/apple-terms-and-conditions).

And it could be such a line would be ridiculous to put in anyway. Or try to follow. But Mr. Mango, he was like “yep, I did this.” He didn’t hide it. There’s “talking too much” when you’re SBF and you’re just trying to manipulate public opinion. And then there’s this, where I think the guy is more like Hannibal Buress asking “why are you booing me? I’m right!” And then there’s doing financial moves that really hurt other investors when you’re super rich, doing them over and over, doing them with your own products and companies, and will attack your detractors. And then there’s doing something that hurt other investors, even if it is just once, but on such a huge, billion-dollar scale while again telling everyone that the protocol involved is the best thing in the world.

But the thing with Mr. Mango is… I just don’t know enough. I do know there’s not enough ways to short bad finance or bad code. With regards to bad code, I bet whitehats feel a bit icky having to exploit first and then ask for 10%. And whitehats usually just have to risk time, not funds, for the most part. Bad finance? That Hindenburg guy is probably risking his life every time. Shorting has infinite downside, while longing has infinite upside. I know that about finance and code, but I don’t know enough about the guy who is Mr. Mango. And, should code be law? Well, I prefer that than, say, the kind of law that is a giant tax cut being put in right after a bigot who lost the popular vote gets into power. But I’m not talking law so much. Yes, legality is important. But how ethically wrong was what Mr. Mango did? Is Mr. Mango at least the least unethical of this bunch?