FTX Book Subscriber Preview: SBF: The Boy Who Wasn't There

Introduction, Part 2: Blitzscaling

Welcome to the second installment of previews of my book on Sam Bankman-Fried and FTX. This is the second half of the book’s opening introduction. You can find the first half here.

In the New Year, expect not just continuing updates but more opportunties for subscribers to interact and give feedback. These previews, remember, are first or rough drafts, and I appreciate any and all comments (for instance, in the last sample, I got Sam’s birth order wrong - than you for the corrections!).

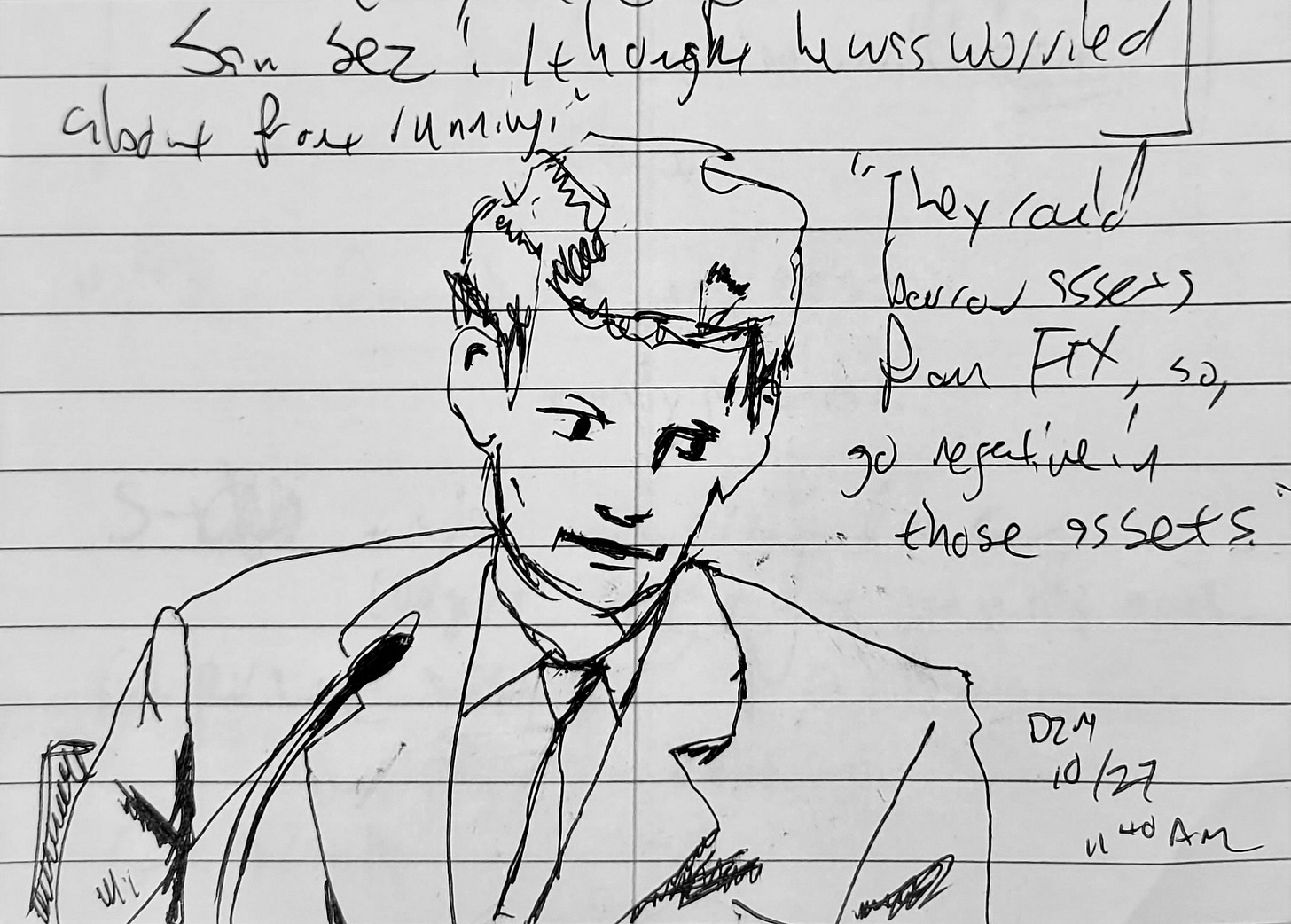

If you want to support the book, and especially if you aren’t yet a subscriber, consider bidding on my courtroom sketches. While they’re being auctioned as NFTs, you’ll also receive the physical original sketch and a lifetime subscription to the newsletter.

And now, on to the excerpt.

The Boy Who Wasn’t There: How Sam Bankman-Fried Stole the Future

Introduction

Part 2: Blitzscaling

A group of tech-friendly young scholars at Oxford had coined the term “effective altruism” to describe a purely rationalist and utilitarian approach to being more effective at making the world a better place. This ideology, much like the Bankman-Fried’s liberalism, was a nice-sounding sentiment that hid cataclysmic traps. And by the time Sam Bankman-Fried came along to play poster boy and funder for the Effective Altruists, the group had already begun to reductio itself well past the point of absurdum.

The movement had initially concluded that one of the best ways to improve the future of humanity was to buy cheap, effective mosquito netting to send to malaria-impacted areas of the world. But just a few years later, their utilitarian belief that future humans were morally equivalent to those alive today had turned Effective Altruism into something stranger. Specifically, the EAs started to get scared that a future artificial intelligence would destroy the human race. So instead of funding mosquito nets to protect living humans from malaria, they started funding think-tanks where their friends would contemplate how to better control artificial intelligences – a supposed threat that, despite tech-industry propaganda, doesn’t even exist yet.

The utilitarian, future-focused mindset also came to enable Sam Bankman-Fried’s misuse of FTX customer funds. Bankman-Fried had lived a luxurious lifestyle, including penthouse apartments and private jets, partly thanks to misappropriated funds. But much of the money had been invested: either in huge-dollar endorsement deals intended to attract more customers, or into even younger startups Sam thought could grow.

Sam seemingly knew that others would think it was wrong for him to do what he was doing – after all, he lied about it in public, and to FTX staff. But in some sense, he thought he was doing the right thing, even when he was lying. The normies of the world, those not as smart as his parents had assured him he was, needed the safety of firm rules like “don’t lie” and “don’t steal.” But as he told one of his co-conspirators, a utilitarian worldview had no room for such niceties. What mattered – the only thing that mattered – was results.

Keep reading with a 7-day free trial

Subscribe to Dark Markets to keep reading this post and get 7 days of free access to the full post archives.