👁️ Gifts are Not Effective - They're Better Than That

Why holidays are not utilitarian, featuring Marcel Mauss and Claude Levi-Strauss.

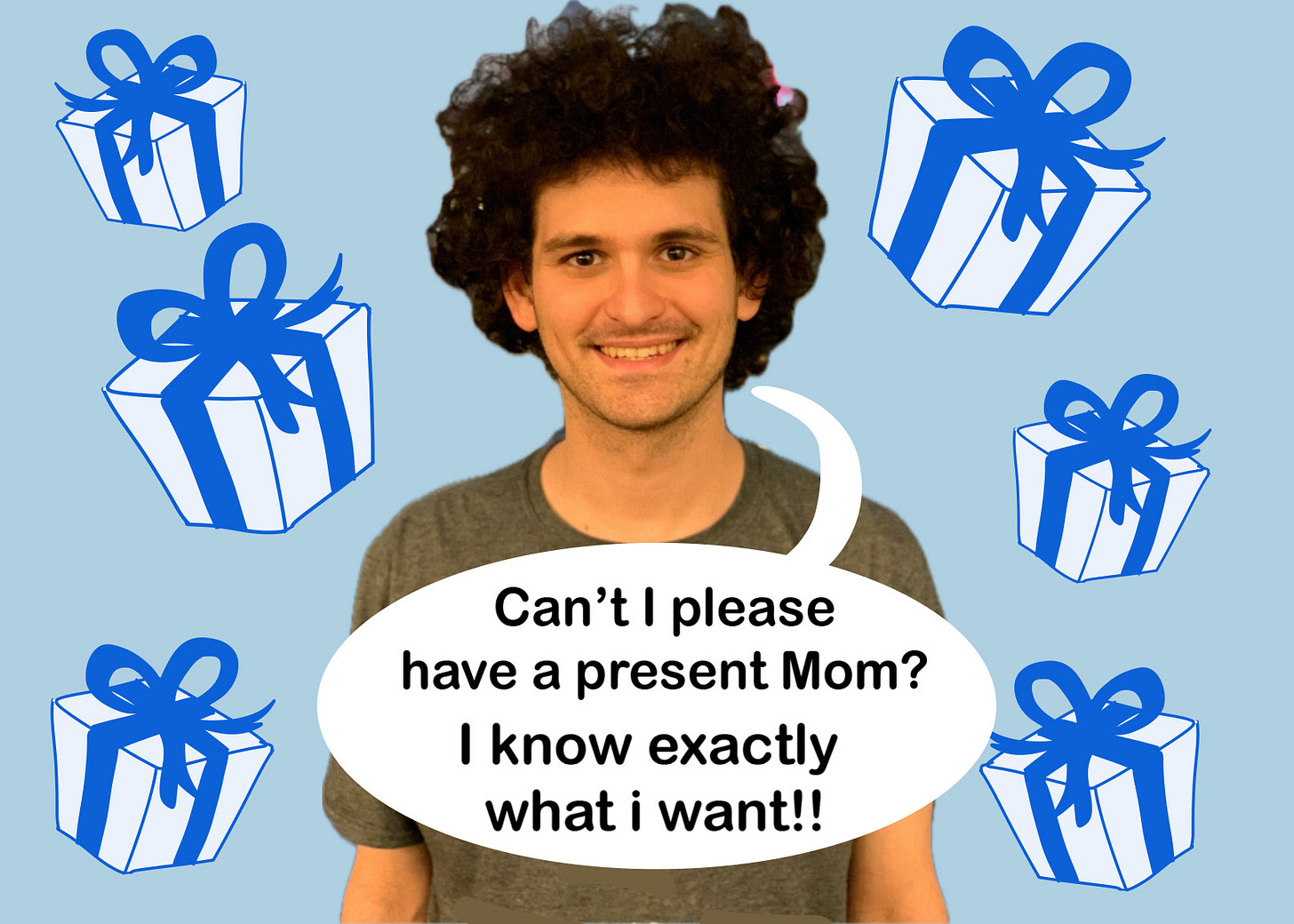

Someone recently referred to me as being “obsessed” with Sam Bankman-Fried, which I guess is fair. His story embodies the bad thinking about money and society that has driven us to the brink of crisis - including, for this holiday season, his feelings about gift-giving and its inefficiency.

First, news in brief.

GM Abandons Autonomous Taxis: General Motors is effectively shuttering Cruise, its self-driving subsidiary. I wish this one was a clearer repudiation of self-driving as such, but Elon Musk’s Tesla has that taken care of thanks to its growing litany of failures and investigations. Instead, it seems somebody at GM woke up and remembered that they’re in the business of selling cars, not rideshares.

Lil’ Wayne Scammed COVID Relief: This one is truly depressing. Business Insider found that Lil’ Wayne, Alice in Chains, and Chris Brown were among the big-name musicians who reaped millions of dollars from COVID relief programs, then spent it on things like buying plane tickets for women. It’s quite depressing (especially Wayne’s involvement) and probably nothing will happen because Trump.

Bullish is Burning CoinDesk to The Ground: The new owners last week disastrously intervened in my former employer’s editorial work, then laid of basically the whole leadership of the newsroom. Read my summary here, including background on Bullish and EOS (which has now become the most-read piece ever on Dark Markets). And please, send positive thoughts to the good journalists left behind in a truly cataclysmic situation.

$QUBT, a Quantum Computing Stock Scam: Back in I want to say 2018 a failing beverage company called Long Island Iced Tea rebranded to Long Blockchain, did nothing else, and (briefly) saw its stock soar. Now a company formerly known as Innovative Beverage Group is doing Long Island Iced Tea for Quantum Computing.

The Gift that Gives More: Marcel Mauss and Sam Bankman-Fried

One of the more profoundly unnerving anecdotes told about Sam Bankman-Fried in Michael Lewis’ uncanny document Going Infinite is this description of the family’s treatment of gifts and holidays.

“They celebrated Hanukkah but with so little enthusiasm that one year they simply forgot it, and, realizing that none of them cared, stopped celebrating anything … They didn’t do birthdays, either. Sam didn’t feel the slightest bit deprived. “My parents [Sam told Lewis] were like, I dunno, ‘Is there somthing you want? Alright, bring it up. And you can have it. Even in February. Doesn’t have to be in December. If you want it, let’s have an open and honest conversation about it insted of us trying to guess.’” Sam, like his parents, didn’t see the point in anyone trying to imagine what someone else would want. The family’s indifference to convention came naturally and unselfconsciously.”

First, this particular anecdote has since been contradicted - though I can’t relocate the source, unfortunately, I have since read Joe Bankman saying that birthdays were pretty much normal around the house, and that in fact it was Sam who might have encouraged the dropping of gift-giving. This is one example of the broader way I’ve come to see Lewis’ work - as containing some reportorial truth, but mostly being valuable for chronicling the mythology that Sam is trying to sell Lewis.

As loathe as I am to give him any credit whatever, Lewis at least occasionally puts some ironic distance from this mythology and his own authorial voice. Though not, seemingly, in this case - his coda framing the no-gift attitude as “indifferene to convention” certainly sounds like he’s praising it. This recurs throughout the book - Lewis frames nearly anything “unconventional” that Sam does in laudatory terms, including things that seem not just idiosyncratic but pretty objectively bad. It’s part of Lewis’ larger project, never entirely abandoned when things took a turn for the worse midway through writing, of making Sam Bankman-Fried a hero.

Here, the myth is something like: giving gifts is stupid and inefficient, because I don’t really know what you want, and the ceremony of birthdays and holidays is arbitrary. So just tell me what you want, when you want it, and we’ll treat it as if it were the same as a big to-do.

This is great because, taking it as Sam’s version of events, it drives home perhaps the overriding theme of my reading of him: that Sam Bankman-Fried is a simpleton, a rube, a dumb guy’s idea of a smart guy. Because gifts, as an aspect of human society, are obviously anything but a pointless waste. In fact, their very inefficiency performs exactly the kind of magic that Sam’s stunted little brain and heart could, by his own confession, never process: The elevation of material or economic goods into something beyond a mere contractual obligation.

The study of the role of gift-giving is in fact the foundation of modern sociology, through the work of Marcel Mauss (1872-1950) and, following him, Claude Levi-Strauss (1908-2009). They were both fascinated with even more seemingly absurd processes of gift-giving than our own, most notably the Native American “potlatch.”

In very broad strokes, the potlatch is a festival of excess and even waste, in which the wealthy members of a community share, exchange, and even destroy wealth. The potlatch is simultaneously a display of power and an imposition, in a gentle and affirmative way, of mutual obligation among members of a community. Mauss finds that there is a kind of spiritual aspect to gift-giving, and locates generosity primarily in exchanges with the mythical world - with “the beyond.”

(Here is an apparently full .pdf of Mauss’s “The Gift.”)

This is not the place for a full explication of the social analysis of gift giving, but the basic concept is sufficient. Following Mauss, philosophers and sociologists including Levi-Strauss and Georges Bataille have focused on the gift as a process of binding through excess. Not an economic binding per se, though the equivalency or non-equivalency of exchanged gifts is its own kind of math.

But very broadly, the excess or waste or ceremonial silliness of gift-giving is the point, and in it you can see the creation, at least in the most optimistic framing, of something like love and community. Of course this isn’t simple, and gifts can also be forms of power, negativity, imposed obligation, etc., just like any aspect of human society - the truly fundamental element of the gift is reciprocity, which can be positive or negative. What makes the reciprocity of the gift unique is that it is not clearly defined, that it is extensible, that in its very structure there is some excess, some left-over obligation that can never be truly wiped out.

Sam’s desire to reject gift-giving entirely, or to project that rejection onto his parents, encapsulates the fundamental lack, or rejection, that structured his life and led to his downfall. He wanted no excess, nothing that could not be calculated. The purely economic relation is different from the gift in that it involves no true reciprocity, because the purely economic relation, captured in numbers, can be cancelled out. (This is why money is a bad gift - it can be easily returned.)

So this holiday season, remember - it’s wasteful and silly, but that is the point. The alternative when we abandon gift-giving, with its built-in excessive share, is to be merely economic animals, and to find that we have nothing left over at the end.

“

Now a company formerly known as Innovative Beverage Group is doing Long Island Iced Tea for Quantum Computing.

“

So I share the skepticism on Ai at its current frothy levels. But not on quantum computing, which I've been reading about for decades now. A bit more frothing, and then maybe.

But actually my view of the two are very similar. The hardware matters. The software, eh, it matters, but not so much from an investment perspective.

GPUs are hugely important, they do very cool things, and CUDA is technically software but it's really part of a hardware package. Without it GPUs likely wouldn't be as important.

So when an AI company says “our software will use AI to provide recipes for consumers! eAItre we'll call it! Sure the first recipe was for ‘Pizza a la Glue,’ but we'll get it fixed before our 2-inch runway runs out. It'll be revolutionary!” Run. (Viable software companies that AI-wash otherwise useful, and actually not very AI, features are a different thing.)

Maybe AI will get to that point, but why assume this one company will have the magic (pizza) sauce? Or, if it does, that a bigger company won't copy it and tack it onto the SaaS subscription bundle you already have? Or some open source solution will make it irrelevant? Crypto is software that can be anything. And anything a small token creates, a big token can incorporate in a soft or hard fork. Thus market cap is usually king.

Ditto, I'm not too excited about Arqit for just that reason. Just software, no hardware. But Ionq, D-wave, and Rigetti (and a number of big players, Google, IBM, etc) are doing hardware, mixed with software, but not just hardware. And so is/was a company called QPhoton.

Per this https://www.fool.com/investing/2025/01/03/is-quantum-computing-stock-a-buy-right-now/ QUBT acquired QPhoton. For the writer of this article, that wasn't enough. Just another cash grab rebrand like this crypto article he links to https://www.fool.com/investing/2017/12/29/a-dumb-trend-with-bitcoin-and-blockchain-stocks.aspx .

That second article mostly aged well, with one exception: RIOT. The difference between Long Blockchain and Riot Blockchain (later Riot Platforms)? Long never actually bought any bitcoin mining machines (hardware) https://en.m.wikipedia.org/wiki/Long_Blockchain_Corp . Riot did.

With QPhoton, that previous article didn't specify but QUBT bought hardware with complementary software https://thequantuminsider.com/2022/05/24/quantum-computing-inc-announces-agreement-to-acquire-qphoton/ and https://thequantuminsider.com/2022/06/16/quantum-computing-inc-closes-acquisition-of-qphoton/ . That's what makes it more Riot Blockchain and less Long Blockchain.

What about the origin story? Does it matter that Berkshire Hathaway was a textile manufacturer? No, that was just the direction Buffett first went and the name stuck from then on. I'm not saying QUBT is run by a Buffett-level genius. Just not someone Long-Blockchain-level dumb. Dumb enough to change the name only and basically nothing else.

If I had to guess a long term winner it would likely be Ionq, and stock reflects that. Or Google if the AI, search-engine ensh**tification, and overdue-monopoly busting doesn't destroy it before Willow has a chance to redeem it. But I wouldn't try to guess specific winners because before the dot-com bust I'd probably have guessed Cisco based on the aforementioned. Cisco wasn't a complete loser though is my point. That and QUBT does not seem to be another Long Blockchain.

“

(This is why money is a bad gift - it can be easily returned.)

“

Well, you mentioned Native Americans… What about Asians? They might beg to differ. Note, a lot of it is one-directional. To kids. To newlyweds. Adult to adult outside of events that are not predictably and annually affecting both (holidays and birthdays) is rare. And indeed would negate each other. Newlyweds need money for a house, not air fryers! Every physical gift to a kid is a white elephant the parent will need to put into the toy box at night. Honestly, American consumerism is out of control. If we gave time, homemade gifts, etc. That would be different. But I'm not sold that I need to buy.