Hello, and apologies for the stretch of unplanned silence here. The short version of events is that I went to the Devcon Ethereum conference earlier this month, and got myself sick and exhausted enough that I needed to take it easy and recover last week.

But I got better! And this email is a quick roundup of a few of my personal highlights from the conference. If you’re not familiar, while it’s focused on Ethereum, Devcon is probably the most important conference for discussing advances in crypto writ large, with a particular focus on technical deep dives.

The following post summarizes my three biggest takeaways from this year’s event:

Why “Maximum Extractable Value” is a systemic threat to Ethereum.

The Cypherpunk ethos on encouraging display.

Moving Castles: On-chain gaming with artistic ambition.

I also wanted to share a bit of a road map for the next few months of the newsletter. As many of you probably know, my overriding focus right now is writing Stealing the Future, my book about Sam Bankman-Fried, Effective Altruism, and Rationalism coming next year from Repeater Books. I’ll continue sharing samples of that work-in-progress with supporters here.

But with things increasingly stable at Trithemius (my comms shop, which you should check out if you’re working on an ambitious tech project), and cryptocurrency markets entering yet another cycle of insanity likely to be followed by destruction, other issues also need addressing. Just a few on the docket:

Why is Microstrategy ($MSTR) trading at such a huge premium to the Bitcoin on its balance sheet, if that Bitcoin is the stock’s main asset?

The “memecoin meta” and the scourge of Pump.Fun in the Gambler’s Economy.

“Towards a Horror of Economics”: This is an essay I’ve been thinking about for close to a year, but the memecoin situation and the Trump election make it newly relevant. It seems clear that we have moved beyond any notion that classical economics and rational choice theory can explain the movements of financial assets, and what we are left with is an economy seemingly guided by man’s oldest and greatest fear: the unknown.

To make sure you have full access to these and other deep dives on crypto and finance topics – including the following Devcon post – please become a supporter below.

The Bangkok Dev Plague (A Note to the Ethereum Foundation)

Before getting to the substance of this year’s Devcon, a note on planning. Devcon is organized by the Ethereum Foundation, and by all accounts they do an incredible job. One of their mandates is to make sure Devcon rotates among different regions of the world, with the goal of making the conferece as accessible as possible to people all over the world - Ethereum is, after all, a global system.

That’s a noble motive for holding this year’s conference in Bangkok, Thailand, which is both geographically accessible to a ton of people in southeast Asia, and economically accessible as a developing country. Unfortunately, that noble motive doesn’t change the fact that Bangkok is an extremely polluted and dirty city, as well as having one of the highest traffic fatality rates of any city on Earth.

The air pollution (on top of heat and humidity that’s still considerable in November) was what really laid me out personally, and I also caught a moderate dose of food poisoning after daring to eat in a (very clean-seeming!) open air market just once. I wasn’t the only one who got sick for a significant portion of the conference: again and again, I talked to people who found themselves fighting against sinus infections or food poisoning, huddling in their hotel rooms for days at a time instead of participating.

And now, a full week after the end of the conference, channels are ablaze with talk of “Bangkok Dev Plague.” Everybody gets sick when they travel, but this is next level. We’re all dying out here, man. Personally, my sinuses still hurt like hell.

But if I’m honest, the traffic was just as much of a hindrance to the energy and mixing that actually makes a conference like this worthwhile. Bangkok’s streets seem to almost totally lack functioning traffic signals, instead constituting a continuously moving mass poised to crush a pedestrian at any moment.

Bangkok does have a very nice metro system, but it won’t get you everywhere, and even walking a few blocks to get to the trains involves literal risk to life and limb: Thailand as a whole is one of the ten most dangerous countries in the world for traffic deaths, and Bangkok alone suffers 27,000 deaths a year. Compare that to a little over 1,000 deaths per year in New York, with a roughly similar population.

All of this matters because a good conference requires chance connections and social hangouts that are far less likely to happen if attendees are sick, terrified to go outside, or both. I know this doesn’t describe every single attendee’s experience, and I know Bangkok has some fantastic attractions that some attendees really enjoyed. But I’m at a conference like this to work and network, and Bangkok just wasn’t a great setting for that, for me and many others.

Yes, I’m literally complaining about first world problems, and again, I support having these events in a variety of settings. But I’m unconvinced that “affordable and accessible” has to be synonymous with “dangerous and inconvenient.”

Devcon 7: Key Takeaways

Highlights from Taylor Monahan

First, for the real ETH, governance, security, and DeFi heads, I want to direct you squarely to this thread of picks by Taylor Monahan, one of the leading devs on the MetaMask wallet and a deeply enmeshed Etherean.

Of her many picks, I particularly endorse Lefteris Karapetsas talk on the reality of DAOs:

And also Evin McMullen’s talk on the long history of Cypherpunk - one example on the theme, which I’ll expand on below.

Finally, shout out to my friend Greg Rocco at Ethereal, who talked about why, yes, market demand really does matter to your product roadmap.

MEV: The Phantom Menace

By far the most important insight I got from Devcon, mostly gleaned from side conversations rather than formal presentations, is the problem of MEV. MEV, aka “Maximum Extractable Value,” formerly known as “Miner extractable value,” may be leading to more centralization and extractive behavior by a few key intermediary service providers, which undermines the entire premise of the cryptocurrency project.

In very broad strokes, MEV describes forms of front-running and order manipulation that block-builders can execute on Ethereum. When you broadcast a transaction to the network, it goes through a bidding process for inclusion in a block of transactions - but the sequence of order placement can amount to a transfer from the person executing the transaction to the agent building the block. The classic example is a “sandwich attack,” in which a block builder puts a buy order right before yours, jacking up the price you pay - then puts a sell order right after yours, meaning they capture the price appreciation triggered by both orders, and you lose money.

Big picture, MEV has a lot in common with payment-for-order flow and the way that data gets used to scalp buyers in traditional markets. A lot of tools have emerged to try and solve the MEV problem, for instance “preconfirmations,” but many such solutions charge their own fees. The broad worry is that all the intermediaries extracting MEV, and fees for helping traders avoid MEV attacks, are parasitic - extracting value from the chain in a way that undermines it long-term.

This isn’t a theoretical argument: ETH as an asset has wildly underperformed the broader cryptocurrency market for the past couple of years, with the ETH down roughly 35% against BTC over the last year. Conceptually, the argument could be made that that looks a lot like a rake being taken off the top by MEV extractors.

In coming weeks I hope to dive deeper into the issue, so if you have some insight or a take, pitch in a comment below!

Cypherpunk’s Not Dead

The most amazing thing I saw at Devcon, and a good indicator of why it’s still one of the most important crypto conferences in the world, is that there is at the very least a LOT of signalling about the actual fundamental reasons we’re doing any of this: privacy, autonomy, and censorship-resistance.

It’s extremely important to keep this stuff alive as a North Star for crypto, even as we see completely zero-sum games like memecoins and AI scams take over mindshare. Obviously a lot of the public is composed of the desperate, shortsighted, and ignorant, but there will always be some portion of that group who can make the transition to a more principled stance, as long as the actual ideas are still being kept alive, and fought for.

Cypherpunk-themed talks were everywhere, but here are a few highlights for your review:

DarkFi Kills Glowies by Amir Taki - Arguably the most hardcore cypherpunk in Ethereum, presenting a new anonymous L1. “If you’re not afraid, you’re probably not doing anything important.”

Make Ethereum Cypherpunk Again by Zach Williamson

A New Cypherpunk Generation by mf

Financial Nihilism vs FOSS Culture by Eleftherios Diakomichalis

Reading the Cypherpunk Mailing List by Porter Adams

This Cursed Machine: Crypto Gaming With Real Vision

What’s the problem with “on-chain gaming?” Well, because so much is financialized in real-world terms, it can be immersion-breaking. Like, do I want to sit down and play a game for relaxation, if there’s the outside chance that the value of a house is on the line? On the other hand, if you have an ‘on chain game’ without enough things financialized, collectible, or valuable, a lot of people will complain: the ones who are there for the money, at least.

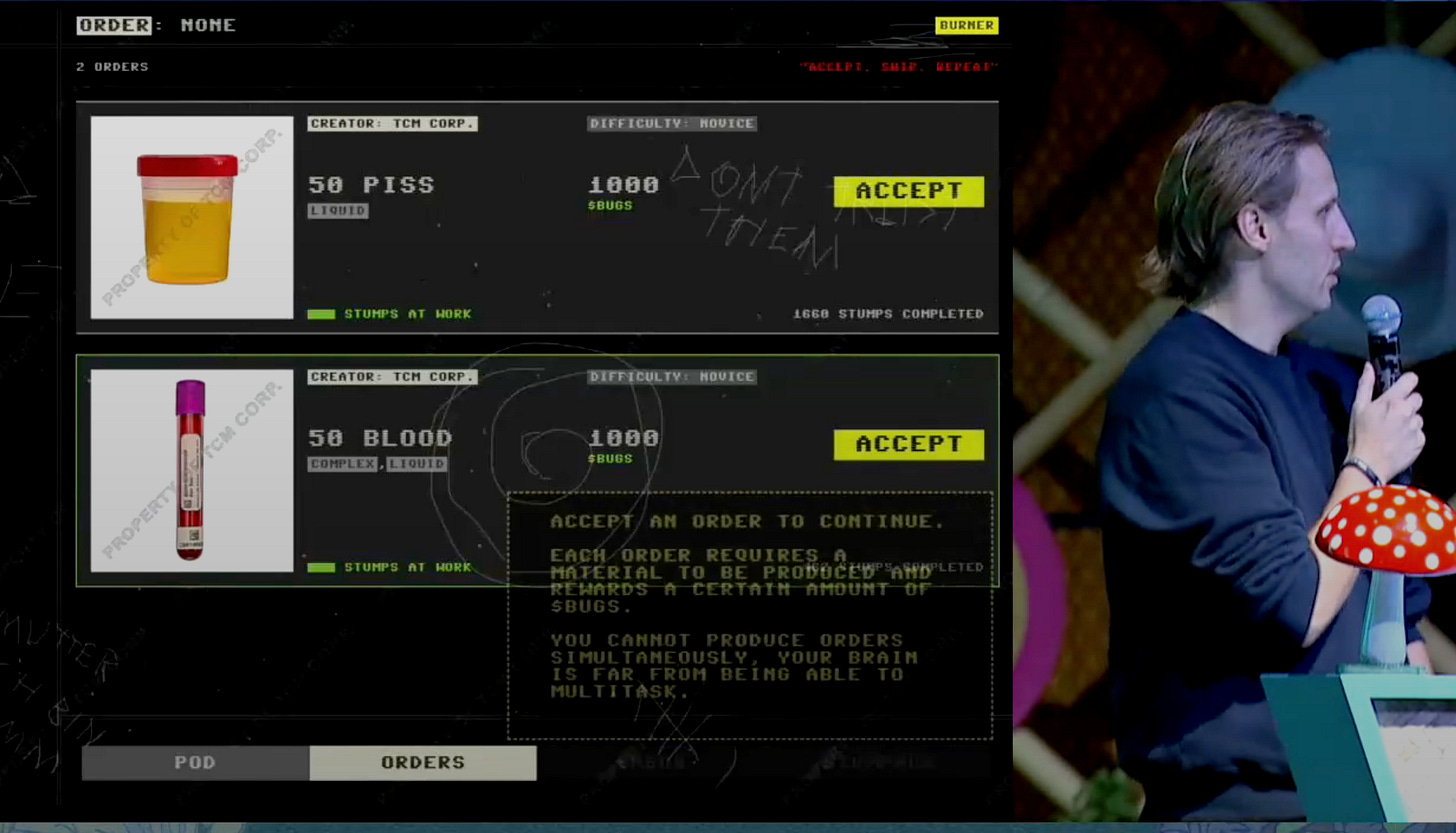

One solution is to make a game that is *about* producing and trading useless widgets, and occasionally getting brutally hacked for your entire net worth. That game is/was called This Cursed Machine, and the “postmortem” presentation by developers Moving Castles was easily the most exciting thing I saw at Devcon.

That’s very personal, to be clear - this is a project with a bizarre, confrontational MS-DOS aesthetic and a bonkers game design philosophy that isn’t particularly likely to become the next pay-to-earn phenomenon.

What’s brilliant about This Cursed Machine, and the planned followup Our Degenerate Town, is that they decided to go for the worst of both worlds - and make that the core of the gameplay. The setting is a dystopian worker’s hellscape in which you play as a ‘stump’ who has to harvest ‘bugs.’ It’s shoves the economic relationship in your face, making the game itself a comment on the very idea of blockchain gaming.

Yet at the same time, the in-game assets are truly worthless, generated by an endless faucet, and apparently not that hard to hack. As the devs described, a ‘hack’ actually became part of the narrative of the game, which, to me, is art. This is still basically at a conceptual/demo stage, but I expect some really exciting things from Moving Castles.

MEV " if you have some insight or a take"

No surprise... I do! So Solana didn't catch my interest when it first came on the scene. Another cheaper/faster, blah blah. Easy to promise when the chain is new and barely used. But then I read about Proof of History and got /very/ interested.

Proof of History was going to be the MEV killer we needed. Egalitarian. Your timecode is your transaction order. FIFO. Beautiful. Solana, though, would then have moments of spam and a lot of downtime. Did they get clever and figure out a way to avoid the spam without losing the beauty of FIFO?

No. They just scrapped what made Solana unique and went straight back to bribery. About a year or two later, after reading about PoH and getting excited, I read about "Priority Fees" and losing all that excitement, as Solana then becomes just like all the others. I honestly don't see what it offers that is unique anymore.

The solution for How Solana Could Get Its Groove Back is to fork solana and remove Priority Fees, or possibly make an EVM L2 that has Proof of History (the core value of Original Solana) for transactions on the L2 prior to finalizing on Ethereum.

What about the underlying problem, though? Spam to the point of network congestion? Because PoH with spam is not an effective solution to MEV.

When there's an imbalance in the difference of supply vs demand and an uneven allocation of resources, the general idea is to have pricing smooth things out. It works, but leads to MEV, and taken to its logical conclusion, game theory shows the one with the most resources, even in “fair” random games of chance, after enough rounds, will win all the resources. Pricing allows the rich to pay for, say, an arbitrage opportunity that is outside the possibility of the rest, giving the edge that wins over all possible opportunities. Thus the rich wins more "rounds." Thus one person controls everything. Thus a trend to, and eventually complete, centralization (barring an event outside of a closed system, of course).

The solution is generally two fold: taxes and socialized services. Taxes reallocate from the richest to the poorest, erasing the benefit of having more resources for every contest/wager. Socialized services keep at least some services that are absolutely needed from being at whim of ruthless game theory.

What's an absolutely needed service? Uptime. So some taxes can be used to make sure the chain (e.g. PoH Solana, let's call it PoHS) never crashes. Spam happens? Spend tax money on increased infrastructure. Whatever is left, goes to the poorest (e.g. those who have and made the least on PoHS). Presumably those spammers spam to make money, so they'll get taxed if they do. Takes away the incentive. It's not like using a stick instead of a carrot. It's just using the stick later. Not upfront as price, but later as taxes.

Of course, now you have the bigger problem of determining value for taxes. And getting those taxes. Easiest way to prevent tax dodging is to sanction or deport them if they don't pay. E.g. Don't pay, don't get to put transactions on PoHS, at least until you've both paid taxes and the tax dodging penalty. This could be extremely effective as a way to prevent removing any gains. For price, I'm afraid it's gotta be oracles, but it should be acceptable.

The logical question is how to prevent bridging off the chain, prior to paying taxes. The best way is only use official bridges, and only very simple ones. Like you can bridge SOL, BTC, or ETH. You lock the token, and then it appears on PoHS. You can bridge exactly the same tokens that you bridge there during any tax season. But any extras only after you calculate your taxes. Spammers thus will be stuck.

Of course a system of taxes and socialized essential services could possibly work even with current models of MEV and bribe-for-order-flow. But I still like the beauty of FIFO, and the fact that PoH seemed to offer that, and penalizing spam abusers after the fact. Because it gets rid of sandwich attacks, you are just left with new problems to figure out like accomplishing taxes, which may require some human involvement, without your “government” getting destroyed by rich humans. But, that took like 200 years to happen in the US. You may have some time.