👁️ Kanav My Money Back?

They had to Kariya him out of Jump Crypto. Also: Synapse Insanity, Lambda Loonies, and CertiK Psychos.

Welcome to the Dark Markets weekly news roundup, and oh boy, it’s a jiggler. Apologies to the forgotten person on Twitter I stole the title joke from, I regret nothing.

If you missed it, please check out my podcast episode with Crypto Critics Corner.

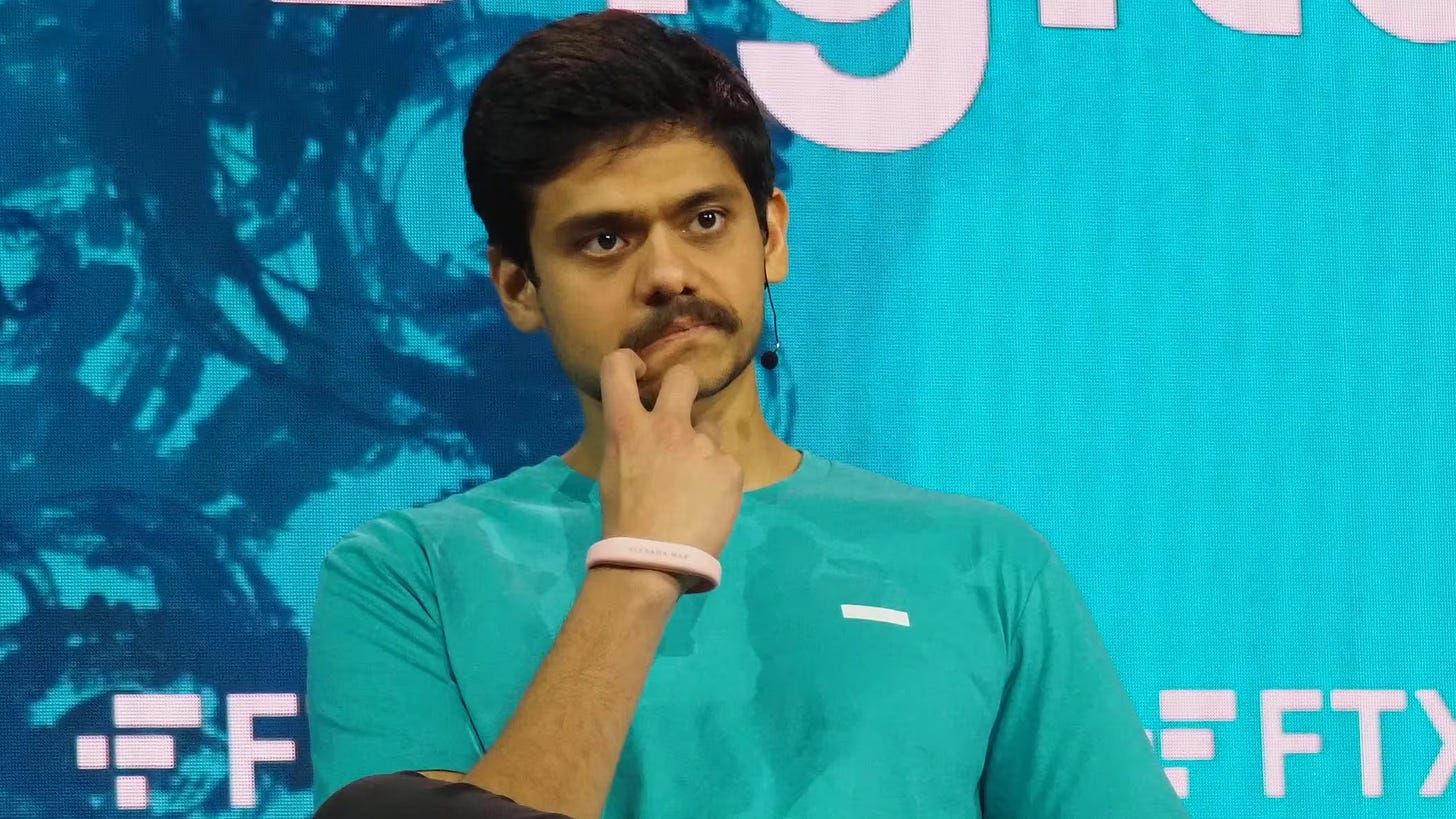

Kanav Kariya, who was likely a material accesssory to the massive Terra/Luna fraud, is leaving Jump Crypto. His ascension to head the crypto desk of a major trading firm at the age of 25 always looked like either window dressing or desperation: being a coked-out, autistic teenager is maybe helpful as an actual day-to-day trading grunt, but strategy should be kept as far from these people as possible.

Kanav proved this in many ways! Most obviously, on his watch Jump Crypto allegedly cut a deal with Do Kwon to change vesting conditions for its UST holdings, in exchange for Jump helping return UST to its peg. This was in connection with the summer 2021 depeg, not the later, terminal depeg in May 2022.

I speculated in my Crypto Crooks documentary series that Jump had collaborated with Terraform. And it looks like they really did!

What this apparent deal with Kariya accomplished was to prop up the UST stablecoin despite its obvious structural weakness, appearing to “prove” that UST’s stabilizing algorithm worked. That attracted tens or hundreds of millions more in retail deposits after Jump’s secret, fraudulent intervention. So if you happened to move into UST after about May of 2021, it’s probably not too late to consider a class action civil suit against Kanav Kariya personally! Just a thought.

When asked about this arrangement, Kanav Kariya plead the fifth amendment. Jump Crypto/Jump Trading may still be under SEC scrutiny because of this skinny dumbass, and now it’s facing a fresh CFTC inquiry, according to Fortune.

And of course, that’s not all! Jump was also in the blast zone of the $325m Wormhole Hack, which is particularly dumb because that was a clunky bridge mainly for the purpose of moving tokens affiliated with Axie Infinity, an incredibly low-brow project for a firm like Jump to get involved in.

The Synapse Collapse Will Turn You Into the Joker

If you understand crypto tech, that is. Synapse was, in essence, a service to coordinate balances between “neobank” front ends and the actual banks that hold the money for services like, say, Mercury (Mercury split from Synapse years ago, apparently spotting the trouble there early. They’re also, full disclosure, my business bank.)

If you’re in crypto, you’ll probably recognize that this sort of multiparty balance coordination might benefit from, say … a decentralized honest ledger? And ooh boy you’re about to see why.

Because apparently Synapse fucked up its centralized ledger. Its record of incoming customer deposits doesn’t line up with actual deposits in its partner banks, including Evolve.

The Federal Reserve has now hit Evolve with a Cease and Desist placing stricter limits on its fintech engagements. This is closing the barn door rather late, and drives home how under-regulated fintechs that act like banks are.

However, I think the most important take here is this: what Synapse was doing should have been on a private blockchain. There, I said it! Coordination between a small group of not-entirely-mutually-trusting players? That’s what this stuff is for!

Fast Crimes at Lambda School

Want to know how a startup can lie with statistics? The manipulation of graduation and placement rates by the now-defunct Lambda School is the perfect case study.

One more piece of evidence that every attempt to divert funds from public secondary and postsecondary education is based on fraud.

CertiK is Certifiable

Amidst all this failure and rot, though, one sterling counter-example stands out. CertiK, a soon-to-be-defunct smart contract auditing service, has engaged in some of the most unhinged behavior I’ve ever seen from a doxxed organization.

In broad strokes, CertiK hacked the crypto exchange Kraken for something like $3 million, instead of engaging in proper white-hat disclosure processes. They then sent the stolen funds through Tornado Cash to disguise their involvement, and refused to return the funds to Kraken for nearly two weeks.

According to Kraken, CertiK reps seemed to imply that they were blackmailing the exchange to return the money in exchange for an enterprise contract, which … how do you calculate the CAC of your executives winding up in prison?

The money has since been returned, but don’t go anywhere, we’re just getting started. Yesterday came an almost unrelated bit of heinously bad-faith, and probably criminal, activity from CertiK. Check this shit out.

To summarize @h0wlu’s whole thread, “OpenBounty” appears to be a man-in-the-middle bug bounty hijacking scheme. It looks like the right place to submit bugs for platforms like Arbitrum and Uniswap.

But it is not!

Former Monero lead dev Ric Spagni was not the only one to point out what this means: CertiK/its affiliates could have submitted these bugs themselves to collect the bounties … or it could just have done the hacks, which, given the Kraken situation, they seem fine with!

Finally, and most incredibly of all, as of this morning, the “Shentu Foundation” (lol) has deleted a Medium post that previously connected Shentu to CertiK.

So now they’re actively destroying evidence? Maybe not in an “obstruction of justice” sense, but definitely in a “why would you do this if you’re innocent of the crime” sense.

Many, many crypto pros are incredibly pissed at CertiK over this. And maybe worse than pissed, they are confused, because none of this actually makes sense …

Until, that is, you look at the cap table! CertiK was funded by three of the worst actors in venture capital: Tiger Global, Softbank Vision Fund, and Sequoia Capital. I challenge you to name three venture funds that are more in love with giving money to frauds and criminals.

You can’t!

Quite a bit going on in here.

"always looked like either window dressing or desperation"...

Recall "👁️ Jump Trading Colluded with Do Kwon: Whistleblower" from DZM on April 2nd:

"On that note, Hunsaker also testified that Bill DiSomma, not Kanav Kariya, was the 'real boss' of Jump Crypto. It always seemed odd that Kariya, who is very young and started at Jump as an intern, would be made head of the new Crypto arm. This suggests Jump itself was engaged in a long game that planned for the possibility of fraud, and need an insignificant fall guy to eat the heat."

Why would Hunsaker lie about this on stand? Further it makes perfect sense. The real "window dressing" is the crypto on all this TradFi nonsense happening with private, centralized institutions dealings where none of the important bits are on any distributed ledger for anyone to see.

"Jump was also in the blast zone of the $325m Wormhole Hack, which is particularly dumb because that was a clunky bridge mainly for the purpose of moving tokens affiliated with Axie Infinity, an incredibly low-brow project for a firm like Jump to get involved in."

I remember the Wormhole bailout. I didn't understand it at the time and I still think we haven't learned everything there is. No one had previously done such a huge, almost altruistic move. Jump was just an investor, why cover other people's losses? Now I don't believe in altruism from CeFi. SBF offering to bailout BlockFi and Celsius and others, I believe, was all to hide previous dealings. I believe it was related to the whole GBTC rehypothecation BS that all three of them were involved in, along with Genesis and 3AC, which blew up so spectacularly that it probably led to DZM no longer writing for CoinDesk. If I recall it all correctly. So I bet there is more going on with the wormhole bailout. Just like there was with Luna which was notably not publicized (as it absolutely should as it proved it only survives via ponzi).

And Axie Infinity? Of course they were in on that! Play to Earn is just as ponzi as sham algorithmic stablecoins that just use prior investors to pay the next. And Axie was as big in P2E as Luna was in algostable. It made /perfect/ sense.

"However, I think the most important take here is this: what Synapse was doing should have been on a private blockchain. There, I said it! Coordination between a small group of not-entirely-mutually-trusting players? That’s what this stuff is for!"

Disagree. I think this should have been on a ZK public blockchain where the information is encrypted from viewers, but the underlying chain is sufficiently secure, e.g. such as by using the security of a sufficiently decentralized chain like Bitcoin or Ethereum. A ZK rollup of Ethereum with the important bits encrypted might have been the best solution. A private blockchain still goes on the internet. Airgapped intranet... Maybe. But in this case, it would be internet. I'm not convinced that's much more secure than sufficiently encrypted public blockchain which is less mutable.

"Many, many crypto pros are incredibly pissed at CertiK over this. And maybe worse than pissed, they are confused, because none of this actually makes sense …

"Until, that is, you look at the cap table! "

That's a good point. But another is that a lot of audits are theater. Get their stamp and immediately "upgrade" it into meaningless. A niche type of audit company that I think we should have should also be keeping tabs on the (d)apps they certify and warning people loudly (not just the devs but users etc.) if they change their code after they have been certified without getting it recertified first. Would it make their work more expensive? Yeah. Would it make development slower? Much more so. Would it make the cert more meaningful? Absolutely.