👁️ Tesla is on Fire ️🔥

Profits tanking, resigning accountants, warranty fraud, oh my. A full rundown.

Just one story today: Elon Musk has spent ten years building a fragile web of hype and speculation. Now he’s tearing it all down. A disastrous earnings report follows waves of executive resignations - and fresh dirt on alleged warranty/odometer fraud that I first investigated five years ago.

These changes in Tesla’s warranty provisioning were key to its rally-triggering [2019] October Surprise. If Tesla had set aside the same warranty amount per non-leased delivered vehicle in Q3 2019 as it did in Q3 2018, it would have cost $204.7 million, or $66.7 million more than the actual Q3 provisioning. That money would have ultimately come out of Tesla’s quarterly bottom line, wiping out nearly 50% of the profits the carmaker declared for that quarter.

Back in March, I predicted that Tesla was entering a fatal downward spiral, but holy shit, I did not think it was going to happen this quickly. In the earnings report that dropped yesterday, the EV maker posted a nearly supernatural 71% year-over-year decline, down to $400m from $2.4 billion in the first quarter of last year. EPS of 27 cents per share is a catastrophic miss from analyst estimates of 41 cents.

In a decade of covering earnings reports (including many of Tesla’s), I genuinely can’t recall ever seeing anything like it. Headlines are focused on the backlash to Elon Musk’s political activities, and with a miss this bad, there’s not much of an alternative rationale. And indeed, on yesterday’s earnings call, Musk said he would refocus on Tesla.

Bloomberg rightly points out that you might not want Elon more involved, really. But that promise, plus more hot air about Robotaxis coming to Austin soon, actually sent the stock up after hours, because I guess people like being poor. The Robotaxi thing is particularly galling, because even in the unlikely event it’s delivered after ten years of broken promises, Waymo is already running well-regarded robotaxis in several cities, which means Tesla is playing second fiddle.

But as I pointed out in March, the unwind is only possible because Tesla has been a basket case of missed promises and cultish hype. Before the market open on Wednesday, Tesla’s price-to-earnings ratio is a staggering 116, compared to what was once a standard P/E of around 25. Tesla is essentially a meme stock, in other words - and its cultists are actually talking about the incoming crash as a *buying opportunity*.

(I hope to dive more into the psychology of the Teslarats at some point, but I would speculate there are two groups: longtime investors motivated by green energy ideals who are having trouble letting go; and those who worship wealth itself, out of animal subservience to a percieved alpha.)

Read More: Bed Bath & Qanon: The Grim Psychology of Stock Cults

There has also been some speculation about the connection between the earnings report and the April 10 resignation of director of accounting controllership Harsh Rungta. The fringe possiblity suggested by the timing is that even the terrible numbers might not be entirely real - and we’ve seen a ton of evidence that Musk and Tesla have no compunction about massaging numbers. (See below for new evidence of long-term warranty accounting fraud.)

Rungta’s departure follows the resignation of David Lau, VP of Software Engineering and a six-year veteran. It’s now officially a wave: other resignations include principal engineer for crash safety in computer-aided engineering, Petter Winberg, CIO Nagesh Saldi (back in October), head of product launches Rich Otto back in May of 2024, and, to just quote Yahoo! Finance for expediency:

“Otto’s exit coincided with the resignation of the senior director of charging infrastructure, Rebecca Tinucci, the director of new product introduction, Daniel Ho, and the senior vice president of powertrain and energy engineering, Drew Baglino.” Believe it or not, the list actually goes on.

The Other Shoe Drops in Tesla’s Odometer-Warranty Fraud

A proposed class-action lawsuit reported by Reuters claims that Tesla has been accelerating its odometers to reduce the coverage the car’s receive under warranty. The lead plaintiff organizing the suit claims that his 2020 Model Y’s odometer ran a staggering 15% fast, “based on his other vehicles and driving history, and for a while said he drove 72 miles a day when at most he drove 20.”

This will become more interesting when it goes from one lead plaintiff to a class action with more rigorous evidence, but it caught my eye because it rhymes with allegations that Tesla underfunds its warranty reserve, which I investigated in-depth about five years ago at Fortune.

That story is unfortunately rigorously paywalled, but I dug up a draft of my March 2020 piece. Here are some excerpts from that draft, including some draft data.

Tesla’s current rally arguably began when its reported profits in the third quarter of 2019 blew away Wall Street predictions. The stock jumped nearly 18% in after-hours trading on October 24th, the day the results were released, and has climbed steadily since. The results were referred to by analyst Garrett Nelson at the time as “pulling a rabbit out of a hat,” but it might be more correct to describe them as pulling several different rabbits out of several different hats. One rabbit, as Fortune has previously explored, was the realization of nearly $30 million in revenue for the troubled release of a feature called Smart Summon.

Critics, from credible stock analysts with mild concerns to short-sellers who stand to benefit from pushing their critiques, claim that a much bigger rabbit came from Tesla’s warranty accounting.

… [The] ‘warranty reserve’ is considered a cost, reducing the profitability of each car in proportion to the predicted amount needed for future warranty service. Tesla’s warranties last as long as 8 years, or between 100,000 and 150,000 miles.

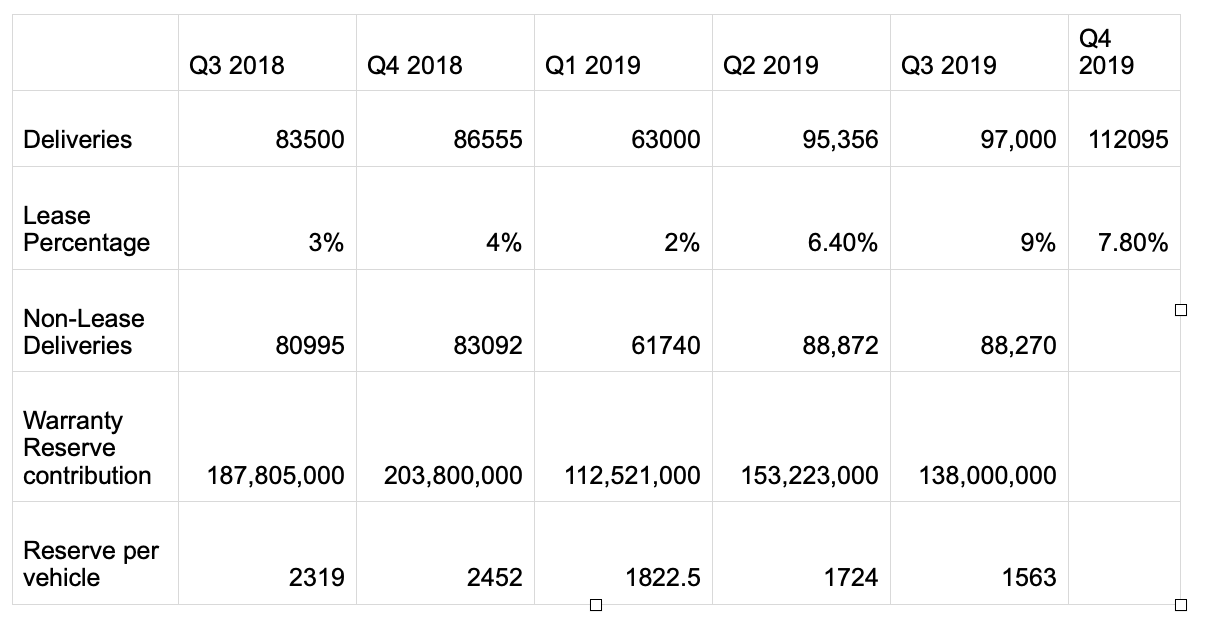

Over the course of 2019, Tesla appears to have steadily reduced the amount of money it budgets for warranty service for each car. The relevant numbers come from Tesla itself, in its quarterly announcements of vehicle deliveries, and statements of its warranty reserve budget in quarterly financial filings to the SEC … a clear trend emerges from the available data. Starting from an estimated $2,319 per car in Q3 2018, the reserve allocation declines to just $1,563 per car by Q3 of 2019.

These changes in Tesla’s warranty provisioning were key to its rally-triggering [2019] October Surprise. If Tesla had set aside the same warranty amount per non-leased delivered vehicle in Q3 2019 as it did in Q3 2018, it would have cost $204.7 million, or $66.7 million more than the actual Q3 provisioning. That money would have ultimately come out of Tesla’s quarterly bottom line, wiping out nearly 50% of the profits the carmaker declared for that quarter.

At the time, the argument made by Tesla bulls was that electric vehicles were less prone to breakdown than ICEs, and so lower warranty funding was justified. But Tesla’s recent track record of recalls and fires and manufacturing defects has made that claim implausible at best.

Tesla stock has come to structurally resemble the Enron fraud. Its stock has been juiced again and again by a mix of hype about humanoid robots and similar bullshit, and extremely suspect accounting which - if the odometer class action plays out - may amount to outright fraud.

if it walks like an enron & squawks like an enron . . .