The Child is the Father To the Man

Why Sam Bankman-Fried struck a minor chord with some major players.

Welcome again to our continuing flood of new subscribers. This is your semi-weekly draft excerpt of “Stealing the Future: Sam Bankman-Fried, Elite Fraud, and the Cult of Techno-Utopia,” coming this October from Repeater Books. Paying Dark Markets supporters have full access to dozens of these excerpts, along with less formal commentaries on Bankman-Fried, his criminal trial, his mother’s work, Effective Altruism, and Rationalism. If you enjoy this newsletter, please consider supporting my work.

Bankman-Fried’s metaphorical death was preceded by a ritual transformation: his fellow travelers, and lingering elements of public perception, worked to turn him into a child. He had been marketed in those terms during his heyday - boy genius, wunderkind - so this was no radical reversal. But it seemed to accelerate in the course of his downfall, with a raft of headlines referring to him as a “boy king,” “golden boy,” “Crypto whiz kid,” “Blue-eyed boy,” “boy wonder” and in one literary turn, “The only living boy in Palo Alto” - all this when he was 30 years old.

In his much later reflection “Sam Bankman-Fried, a Personal Verdict,” Michael Lewis illustrated the obverse working of the Sam-shaped hole: not just how the public and prominent supporters were drawn in by the allure of what Sam Bankman-Fried claimed to be, but how Sam learned, by an escalating series of rewards that no material failure seemed to halt, to make those claims. As his victims were falling into him, Bankman-Fried was constantly learning to take on a more enticing shape.

Lewis points out, in part rightly, that Sam’s slovenly hair and dress had come naturally to him before they had become conscious elements of a public deception. He didn’t create his public image from scratch. Instead, as Lewis perceives, “at some point after he became a public figure … he no doubt noticed that other people seemed to be charmed by his look.”

There are obviously exceptions here - childishly tangling his shoelaces in front of Congress, falling asleep or playing video games in front of investors, and trading luxury cars for modest sedans were all conscious strategies. What Lewis really gets wrong, though, is that idea that simply continuing a native slovenliness is “different from creating a persona to deceive others.”

Here Lewis recapitulates the misconstrual of the human psyche, and perhaps of the structure of reality itself, that crippled the Rationalist and Effective Altruist projects from the start. It is the same misconstrual that poisons any intervention into human society governed by the Logic of the Code: Lewis assumes there is some “real” Sam that predated his assessment by the world, and that remained true after he entered the public eye.

This parallels the naive literalism of the Effective Altruist’s faith that controlled trials will unveil the most “effective” way to improve the lives of distant others, and the Efficient Markets theorists insistence that the price of an asset mirrors the linear pull of demand in the real world. In fact, Sam’s decision not to change was a performance, just as a market price bears the premium of mythology, just as, Baudrillard wrote, “those questioned [by the development researcher] always behave as the questioner imagines they will and solicits them to,”

Sam didn’t create his image, but he recognized that others projected something onto his projected indifference. It was the tech world’s code for a mind so expansive and intense that the “real world” barely existed. It signaled total commitment, nominally to innovation, but in the last instance, to making money. Clearly, even if he’s too good a writer and thinker to have left no exit ramps in his various texts, Lewis himself was among those most hypnotized by this specific alignment of signifiers, more deeply enthralled by Sam than Kevin O’Leary or Bill Ackman.

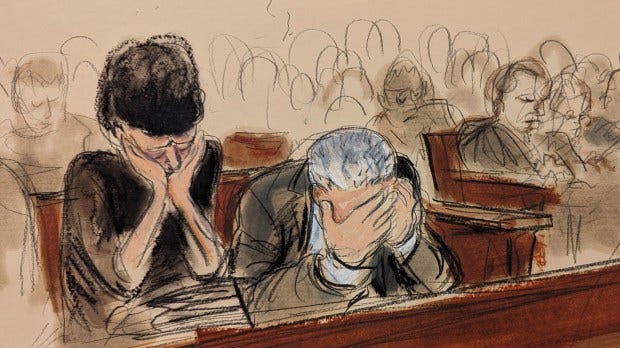

But all of these figures, in their misperception of Sam Bankman-Fried, are only the tallest of the flowers who turned to him, as if towards the sun itself. Tens of thousands of people wanted, even needed Sam Bankman-Fried to be the thing that Ian Ayres and John Donohue doggedly insisted he was. If some were quicker to resist that hypnosis once the money was clearly gone, or once the guilty verdict was announced, or once the chains around Sam’s ankles jangled out of the side door of Kaplan’s courtroom for the last time - they were still, for however long, hypnotized.

I am not simply here to attack Michael Lewis or anyone else - I am here to do worse than that. The credulity of these wealthy, accomplished titans was a mere symptom: nothing but epiphenomena.

Keep reading with a 7-day free trial

Subscribe to Dark Markets to keep reading this post and get 7 days of free access to the full post archives.