👁️ The Great CryptoPunk Caper

How to buy a $1.5 million NFT for $30,000. Also: FTX Whistleblower payouts; Eric Adams in trouble; Ryan Salame plays the reverso.

Hello, and welcome to your (slightly off-schedule) weekly Dark Markets news roundup. ICYMI: over the weekend I wrote about the flaws in IQ as a theory of intelligence, and how those problems feed into the currently-collapsing Artificial Intelligence bubble.

In this Issue: NYC Mayor Eric Adams is in some major shit; A memecoin church in shambles;

CryptoPunk: The Art of the Steal Totally Legal Purchase

Last week saw a weird little incident that offers some important insights, and questions, about automated smart contracts and the on-chain economy. The short version is that, thanks to a poorly-designed mechanism and some apparent inattentiveness, a group who collectively held an asset valued at around $1.5 million sold it for roughly $30,000.

And there’s no indication that the buyer did anything wrong - they were, it appear, just smart and lucky.

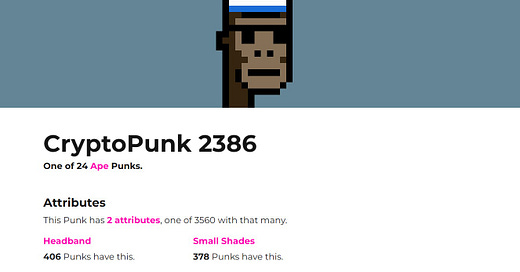

Here’s the asset in question, CryptoPunk 2386. Now, I’m sure plenty of you are already busy sneering at so much as the existence of a piece of digital art worth $2 million, but CryptoPunks are genuine pieces of art history, very distinct from cash grabs like Bored Apes. The main distinguishing factors are the CryptoPunks were among the very first NFTs created; and that all of their art is on-chain. You can read more here about why CryptoPunks are significant, and this is a bigger dive into the aspects of NFTs that aren’t bullshit.

Anyway, that’s a subordinate issue here. Punk 2386 is worth about $1.5 million, and that’s that. What’s interesting is that Punk 2386 was “fractionalized” in 2020, with shares split between about 250 holders, according to CoinTelegraph. The fractionalization was performed using a platform called Niftex. Part of the story is that Niftex is no longer a going concern, so the “front-end”, or website interface, has shut down.

But the true magic of crypto (sincerely) is that the closed front-end doesn’t effect the immutable smart contracts on the blockchain. Presumably most of the holders of the Niftex-generated shares, and the associated contracts, weren’t tech-savvy enough to monitor them after the front-end went away – but someone else was.

One of the functions available based on the Niftex fractional shares was what’s apparently known as a “shotgun” - the ability to propose a sale at any given price. A prospective buyer saw this opportunity, and proposed a price of 10 ETH - or about 1% of offers that were then outstanding for Punk 2386 on public-facing marketplaces like OpenSea.

The function gave a 7-day period in which any current holder could counter or beat the offer, but it seems the offer was barely noticed. One shareholder supposedly tried to counter the offer, but fell short by a small amount of available funds because of gas fees. Again, this frankly can be attributed to a lack of technical skill compared to the eventual successful buyer.

This undeniably stinks for the 250 or so people who lost, I would guess, a lot of money. On the other hand, the buyer’s actions were completely in accord with the rules those 250 people agreed to when they decided to share custody of an extremely expensive asset.

There was no hack, there was no rug-pull, there was no market manipulation - just hundreds of seemingly inattentive owners.

FTX Paid $25m to Silence Whistleblowers

An examiner overseeing FTX’s bankruptcy says the exchange paid as much as $25 million to would-be whistleblowers who spotted problems with the exchange’s operation. Most of these would have likely been conducted by Dan Friedberg, the shady lawyer inexplicably selected by Joe Bankman to oversee every legal aspect of the incestuous Sam Bankman-Fried empire.

The $25 million number may be inflated, though, since FTX.US leader Brett Harrison claims $16 million characterized as a payout to him was now-worthless equity that was part of his resignation agreement. That, of course, could have included an NDA, but Harrison denies any financial quid-pro-quo.

NYC Mayor Eric Adams is in Very Deep Shit

While I have little political ground with Adams, a right-wing Democrat, I didn’t initiall hate him as a theatrical, slightly absurd presence in the Mayor’s office. And in my opinion, the Mayor of New York can have a little bit of corruption, as a treat! But it looks like Adams may have gone too far: federal investigators have seized a plethora of electronic devices from members of his administration, and resignations are reaching a fever pitch. Three members of Adams’ team have resigned in just the last few days, including the Police Commissioner.

What remains unclear is what exactly is being investigated, but Adams has been linked to at least two incipient scandals: what looks an awful lot like influence peddling by Turkey, and his relationship to Lamor Whitehead, a pastor described by the New Yorker as “a con man.”

The Weird-Ass Prometheum Saga Continues

There will someday be a deep dive to do on Prometheum, a shambolic organization that has become (at the very least) a convenient stalking horse for the SEC’s crypto crackdown. Claiming to be “the regulated crypto exchange,” Prometheum has now officially opened for business - however much of that there might be.

Liar Justin Sun is Mad People Don’t Trust Him

Justin Sun, a mega-scale con artist who made likely billions of dollars by copying the Ethereum code and calling it Tron, has finally started facing some consequences for his years of chickenshit behavior. His association with a custodial product called WBTC, or Wrapped Bitcoin, caused a loss of confidence - given that he has left similar assets undercollateralized in the past. Now he’s mad that Coinbase is launching a competing product, which he hilariously described as “a dark day for Crypto.” Sun is arguably the last major crypto con-man still pulling off the pretense of legitimacy, but he may be slowly getting the idea that there are consequences for his track record of chicanery.

The Smoking Chicken Fish in Bad Decline

A “memecoin church” is falling apart after the “pastor” allegedly abused his position to cut side-deals that benefitted them personally. This is slightly interesting for its conjunction of New Atheist-style Flying Spaghetti Monster satire and naked grifting – a theme we’re seeing in other parts of the culture, as well.

EToro will Halt Most U.S. Crypto Trading After SEC Settlement

Gensler’s campaign forges onward. EToro for a time was trying hard to break into crypto trading, and sponsored a lot of conferences from around 2019-2021. But now they’ll be limited to digital commodities including BTC and ETH. The tiny settlement - just $1.5 million! - frankly suggests to me that EToro never made much headway in getting actual U.S. users.

Ryan Salame Withdraws His Withdrawal (?)

FTX co-conspirator Ryan Salame has had a complicated few weeks. Salame pled guilty last year to participating in campaign finance fraud as part of the FTX Crime Family. As part of this plea, he testified that he hadn’t been offered any further inducement or “deal” by prosecutors.

But last month, Salame’s onetime girlfriend and failed congressional candidate Michelle Bond was charged with campaign finance fraud for her use of funelled FTX money. (As I pointed out at the time, this seems deeply unjust given that Barbara Fried has faced no similar charges.) Salame then attempted to withdraw his guilty plea, on the basis that he had lied during his initial plea, and that in fact the DOJ had promised not to prosecute Bond if Salame pled guilty - but there was no clear evidence of the existence of such a deal. Kaplan was apparently none too pleased about this admission, and threatened Salame with further sanctions.

I’m honestly not sure I’ve got this entirely right, and it barely matters, because it’s just performative procedure: as of now, Salame is still headed to jail on October 11. All he’s really accomplished is to demonstrate that his brain doesn’t work much better than SBF’s, including an inability to keep his lies pointed in the right direction.

"seemingly inattentive owners."

Or, as someone who's been around DeFi long enough, simply not technically advanced enough (or have resources that are technically advanced enough).

Being an early adopter / hobbyist can be fun, and, unless you waste away all your airdrops on leverage via quasi-gambling, fairly lucrative. (May have felt a pang or two on SBF being called a fool for falling for over leverage. I still don't think leverage should be kept away from the non-accredited. I think if it was as available as lottery, then maybe we'd have an equivalent quip to "the lottery is a tax on people who are bad at math" for leverage. Right now we just have Charlie Munger's opinion on it with regards to women and other ways lose money. Not really enough "common knowledge" to convince the multitude, or at least the same ones who know better than to play the lotto.)

The big danger with DeFi, besides also scams and hacks, is dead projects with lack of documentation. Heck, this can happen even when a project is still alive and running. Could be, like, one dev who barely has time to look at his Discord server, much less answer questions. Documentation? Yeah right.

When everything was a uniswap v2 clone, or masterchef contract, it really didn't matter. LP breaker tools were readily available. But once it got more complicated, the more important it was that there would be emergency withdrawal functions--and documentation on how to use them--that you could do through etherscan or another blockchain explorer even if the frontend died (and maybe IPFS/permaweb frontends).

Documentation matters because you might figure out by name the right function, but then the blockchain explorer asks for Parameter A and B and given zero info on what these are or how to provide them. /Maybe/ nowadays you can copy and paste all the contrart's code in AI (and all the other contracts it references) and get an answer, but I doubt it.

That is if it's open source! People think open source is just some hippy bulls--t. It's not. With closed source, it's like a lifetime guarantee from a company. That is not dependent on just /your/ lifetime. It's dependent on the company's lifetime too.

If it's closed source, and the developers disappear, and your assets are stuck in some contract... Exactly what are you going to do?

And if you think "the world's computer" and the rest of the EVM compatible chains don't need /other/ computers the vast majority of the time, you are sadly mistaken. Off chain computation is almost always involved. So when the developers' AWS instances go dark (if you think they are using DePIN, ha!), what do you think you can do?

Like how exactly are these people supposed to get a notification that someone has bid on their fractional NFT? Hmm? Do you think Ethereum does that?

It doesn't.

Do you think it's easy to develop some boutique solution for that to be done on someone else's code by anyone but an experienced Web 3 programmer?

It's not.

AI definitely is not there. You can't go up to ChatGPT and say "hey, here's my Ethereum address, can you watch this for me? Let me know if there's something I need to. Like someone's going to low-ball and steal my fractional NFT. Thanks! Ta ta for now!"

Anyway, it sucks. You have to ask yourself if the potential airdrops are worth it. And probably not in many cases. Use boring sh-- like Aave and stay away from the bleeding edge.

As for Justin Sun and WBTC... This article has said it best of any I've read:

https://protos.com/how-involved-is-justin-sun-with-bit-global/

If that doesn't bother you, I don't know what will.