👁️ $Trump Dump Stumps Chumps

Of Memecoins, Liquidity, and Valuation. Also Elon Musk is a Nazi, Crime is Legal Now, and other non-surprises.

I am incredibly sorry for that headline, it will doubtless happen again.

It’s a grim fucking day out. Trump has set the tone for the next four years by grifting his supporters (and greedy bystanders) one last time before he returns to the White House, and Elon Musk made even clearer what he actually cares about.

It Was a Seig Heil

Let’s just get this out of the way, and you can unfollow or send me a nasty email if you disagree, but come the fuck on. The idea that he’s “beaming out love” or whatever is simply pathetic cope, and it’s extra pathetic because even tolerating this for a second implies that you get off on the idea of sending people to camps, but also want to be mealy-mouthed about it.

Ask yourself: Does that look like the face of a man sending love to a crowd, or a man who wants to re-found Rhodesia outside Midland?

Have the spine to believe what your own eyes are telling you. You owe God that much, at least, for creating you.

OpenAI Is/Is Not on The Verge of Building God

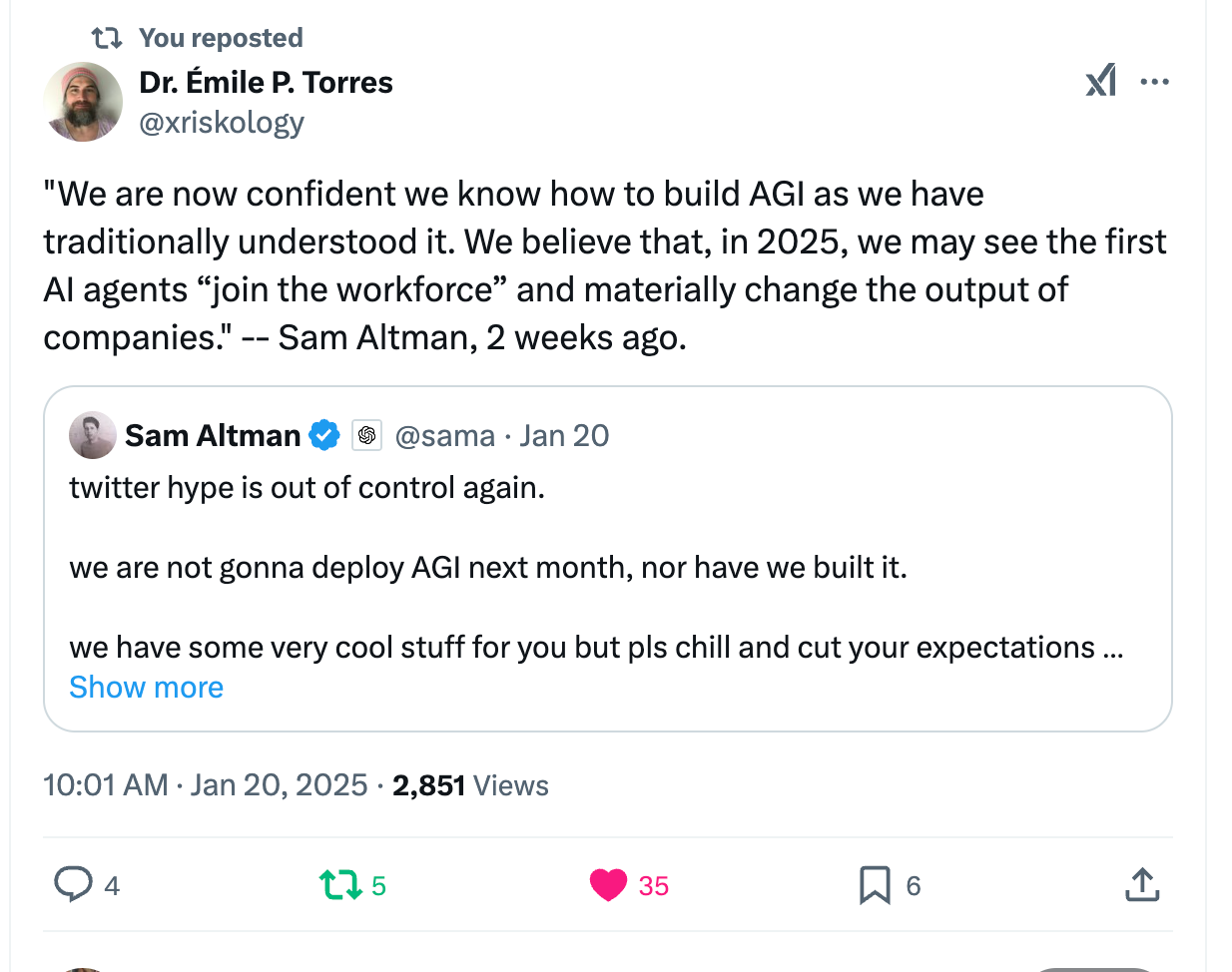

Obviously Sam Altman is running a con based on the alluring lie that his company is building a Gangster Computer God that will fix climate change and fill the void in your Stanford-conditioned soul. But sometimes you have to pump the brakes, even if it means contradicting your own previous hype. Or maybe, just maybe, Altman foresees bubbles popping if he doesn’t fulfill his prior promises and is trying to very, very gently let the air out by asking people to “chill and cut your expectations.”

Worldcoin’s Eyeball Scan is Being Exploited by Gangsters (Of Course)

Oh and by pure coincidence, it’s another Sam Altman grift! Remember Sama’s circa 2021 plan to distribute Universal Basic Income using a crypto token called Worldcoin distributed via menacing eyeball-scanning “orbs”? Remember how it was never clear why Worldcoin itself would have any value (CD Link*)? Well, according to DLNews, gangsters in Berlin are bribing “homeless people, refugees, and drug addicts” to get their eyeballs scanned and hand over the crypto. Also highlighted in the story, Worldcoin’s value has tanked 85% since last March, so expect the entire thing to be mothballed soon.

Sam Altman is either an idiot who doesn’t understand finance or scaling, or he’s a liar whose genuine goal is to sell bad ideas to credulous venture capitalists. There is no third option!

*(On top of the disastrous editorial issues I’ve highlighted, CoinDesk’s website has become a buggy, unreadable, memory-leaking mess. I still want to link my old pieces, at least until the spineless cowards at Bullish delete them, but the site might very well freeze your laptop. Consider yourself warned.)

Gambling at the End of America: Trapped in the Maw of a Stillborn God

“A culture as committed to preying upon and immiserating its most vulnerable citizens as ours turns out to be a culture where people will retreat into various escapes/addictions, such as gambling or substance abuse.”

All too appropriate for this week, Ed Ongweso at The Tech Bubble has a brutally bleak look at the rise of gambling as the King of American Vices. We stare down the face of doom, but we’re ready to win it all back in one big trade, one roll of the dice. Or at least, we will numb ourselves with the repetition of it. Ed cites a Chris Hedges interview with a terrifyingly insightful observation from a gambling expert:

“What they’re playing for is not to win, but to stay in the zone. Winning disrupts that because suddenly the machine is frozen, it’s not letting you keep going. What are you going to do with that winning anyway? You’re just going to feed it back into the machines.”

The TikTok Hostage Deal

TikTok was banned under Biden, at right wing insistence, all the way to the Supreme Court. And now magically Trump will reverse that! Even I have to admit, it’s amazing strategy and the Democrats walked right into it. Because they’re actually stupider than Trump, which is really the scary part about all of this.

Hindenburg (Research) Down

The fiery, principle-driven short-selling firm Hindenburg Research has announced it will wind down. One might guess this was related to political events, and it’s no doubt that in an environment with no government oversight of financial scams and frauds, short-selling will become even more risky. But in fact, the decision is apparently a personal one by founder Nathan Anderson, who started Hindenburg in 2017 and now says the work became all-consuming. I can certainly identify with that, having now pivoted away from my own investigative work with some relief.

I have a particularly personal attachment here, as Hindenburg and I were picking through the garbage of Trevor Milton and Nikola Motor at around the same time, when I was at Fortune. We wish ex-Hindenburgers the absolute best.

The $TRUMP Memecoin Meltdown

So right before being inaugurated, the now-President of the United States ran a crypto scam! Time really does move fast, Sam Bankman-Fried thought he’d have to wait a decade or so to get the chance to do that.

There’s an immense amount to say here, but I want to talk about financial math first and foremost. The thing to know about $Trump, the thing most people didn’t seem to understand and that many headline writers couldn’t be bothered to, is that there’s this concept called “float.” That’s the percentage of any token, or any asset really, that’s circulating on the public market. For $Trump, the float was 20% of the total supply. (In fact, if the float is non-insider holdings, it’s probably less than 20%, according to some sleuthing of disguised wallets (CD Link).

And here’s where the real magic of crypto scamming comes in: when someone buys a bit of that 20% float, the price is determined by demand for the circulating supply, not the total supply. But that price is then also used to set the price for the 80% that isn’t circulating, with a metric known as “Fully Diluted Valuation.”

So in simplified terms: imagine 20 people want to buy $Trump, there are 100 total coins, 20% float. Those 20 people buy 1 token each at $1. According to FDV, the value of all those tokens - all 100 - is now $100. You basically created $80 out of nothing! (A major element of the FTX scam was the use of a “low float, high FDV” token called FTT as loan collateral.)

But now imagine the same 20 people spend the same $20 on a full 100 $Trump tokens, paying 20 cents each. The FDV is just $20, that sucks! But it’s also actually more accurate.

This is the first thing to keep in mind when you see headlines about $Trump reaching a “value” of $35 billion dollars. That didn’t really happen - according to CoinGecko’s more realistic metric of actually circulating tokens, “Market Cap,” $Trump peaked at about $14 billion and is now worth more like $8 billion.

And while he and the team are undeniably making a mint off the initial sale, that market cap will continue to wither away. DJT isn’t walking away with $30B, or $10B, or even probably $5B, because he’s not going to be able to sell most of the 80% still sitting on the sidelines.

Because the other important lesson here is about what’s called “liquidity.” $Trump has been listed on some centralized exchanges, where things work a little differently, but it’s fundamentally a Solana-based shitcoin that can only be sold into however much liquidity it’s paired with in on-chain swap pools. I’m not looking that up for you, but believe me brother, there ain’t $5 billion of exit liquidity on Solana waiting for $Trump to hit a sweet spot. In a DEX pool, prices are often quite directly based on liquidity matching, so as the USDC/TRUMP pair drains, the price anyone is getting for $TRUMP will go down - and if some insider tries to sell a huge tranche, the price will go down fast.

The Trump team has already taken the proceeds of the initial sale and used it to buy millions of dollars worth of Bitcoin, Ether, Chainlink, AAVE, and other alts. To which I must first say, thanks to MAGA for pumping my bags, I didn’t expect that. Anyway what the team is doing is called dumping shitcoins ($TRUMP) and using the proceeds to buy real assets (BTC, ETH).

If you’ve spent the last decade convinced that all crypto is a scam and so learning about it is pointless, I’m sorry, you have lost that bet. It’s far too late for you to ever catch up, but here’s the short version: $TRUMP does nothing. BTC, ETH, and LINK all do something.

Selling one to buy the other is what’s known as a “rugpull” or an “exit scam” - and they’re legal now. Stay frosty out there.

I'm writing this comment almost a month later, and the number of times I've seen that salute is frankly stomach churning. You can't open a website with any algorithmic f***ery, which is almost all of them nowadays, and not see that. Still. Almost a month later.

My take is Musk is a salesman. Always has been. He sells to VCs and investors normally, and his gestures are usually not scrutinized this much by the general public. Further, most of his salesman existence has probably not been while operating on as much drugs as he has been lately. I think he was trying to pull off a derivative of the Laura Ingraham 2016 RNC move.

I wouldn't be surprised if some Cambridge Analytical type told him that when Ingraham did it, whether she intended to do it the way she did or not, it didn't affect those who already disliked her or Trump strongly. Or liked her or Trump. Instead it had a desired effect on a small, but crucial, type of alt-right supporter. The ambiguity was just enough that those who wanted to see it, did. Also the ambiguity conflates something everyone normally agrees is bad, fascism/nazism, with something normally everyone can agree is subjective, the interpretation of gestures. This conflation can thus erode our collective vigilance against fascism and authoritarianism.

Musk, though, was high as a kite and not a polished television personality. Thus, I think it was intentional, and I think his intention was to make it slightly ambiguous, and I think, and hope, it backfired.

Though what I really hope for is an awareness by the general populace of the non-gestural actions that occur and matter. Which are unambiguous. DOGE is threatening the life of every (non-billionaire) American, simply by taking away the fairly cheap protections we have to live free, safe, healthy, and happy. And probably threatening everyone on Earth, regardless of financial and regional status, or if they were foolish or manipulated easily enough to vote for Trump.