Fast Analysis: Salame (DOESN'T) Flip on SBF, New Crypto Privacy Models (and Reader Surveys)

Sam Bankman-Fried is cooked, y'all.

Welcome to the Thursday edition of the Flesh/Markets News Roundup (sexier/funnier name tbd).

A reminder: this the LAST FREE EDITION of Flesh/Markets’ biweekly news roundup, before we go premium next week. To avoid missing any installments, please pledge a subscription. I have big plans for what I’m building here, and your support is more important now than ever.

Also, whether you plan to become a paid subscriber or not, please scroll down to the Reader Surveys below. Your input on scheduling and subject matter will be a huge help.

Finally, please share Flesh/Markets with friends and colleagues who might be interested. I’ve been blown away by the support already – let’s keep this going.

Markets

Markets are flat. It remains to be seen whether there is in fact a post-summer pickup, but I think it’s likely. The SEC’s loss in the Grayscale ETF case primes the pump for major breakout moves in Bitcoin in the coming weeks/months, and for better or worse everything else will go with it.

Ryan Salame Pleads Out

News this morning that Ryan Salame of FTX has pled guilty to criminal charges. The specifics are scant for now, but among Salame’s roles in the FTX Crime Family was acting as a cutout for donations of customer funds to Republican candidates. The (like, genuinely unbelievably stupid) idea was to funnel all donations to right-wing candidates through Salame, to preserve the image that Sam Bankman-Fried himself was a “Democratic megadonor.”

This speaks to the deep, dark cynicism of the operation, and of SBF’s soul. He believed that the most effectively altruistic thing he could do was pretend to be a progressive, while in fact playing both sides of the aisle in pursuit of his real goal – crypto legislation that would have benefited his business, and possibly enabled him to keep the scam running longer. So campaign finance fraud should be in the mix for Salame.

But of course what really matters here is that we’re just a few weeks away from the start of the Sam Bankman-Fried trial (which it seems I may be covering in person, more to come on that). Salame’s plea strongly implies he has agreed to testify against Bankman-Fried. He’s the last major FTX executive to flip, which will almost certainly make Sam’s life a lot harder in court.

The even larger story here is that, true or not, Sam Bankman-Fried’s Democratic cosplay in turn raised suspicions about his relationship with the Biden-appointed Gary Gensler, who by some interpretations gave special access or privileges to FTX. Some of the reactions here have been very stupid, such as the idea that the SEC accelerated Sam’s arrest to somehow help him. But the reputational damage has been real.

Privacy Pools, ZKPs, and post-Tornado Cash Privacy

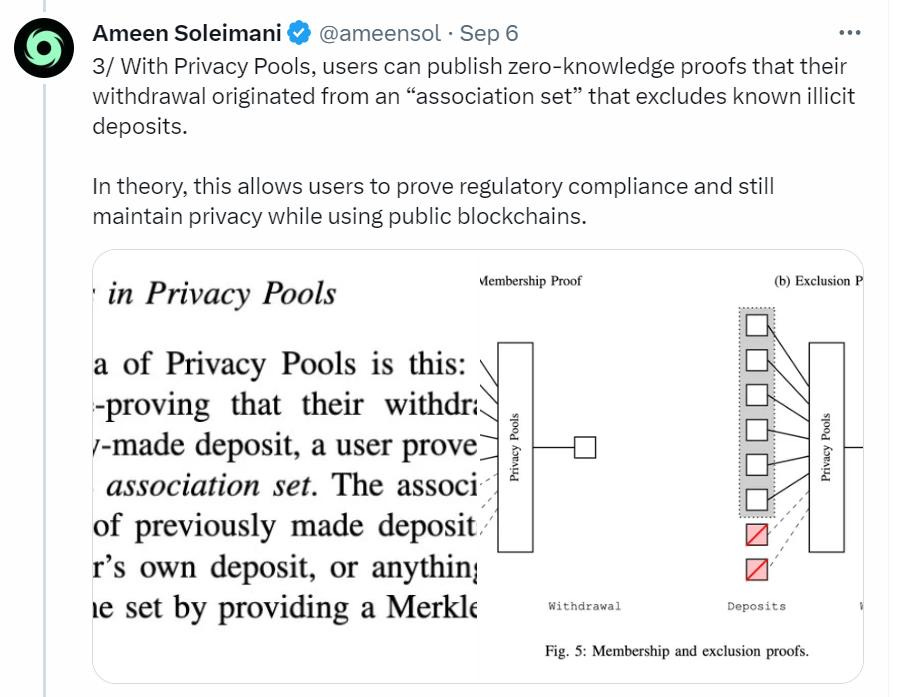

On Wednesday, Ethereum developer Ameen Soleimani announced a new research paper written with Vitalik Buterin and others: “Blockchain Privacy and Regulatory Compliance: Towards a Practical Equilibrium.”

The paper proposes a new method of anonymizing transactions and accounts, while allowing a user to affirm – still anonymously – that their funds aren’t from criminal sources.

The proposal is unsurprisingly complex, but it relies on a single key concept, what might be the most underrated innovation in crypto – zero-knowledge proofs.

Zero-knowledge proofs, or ZKPs, rely on hashing algorithms to process data in such a way that it can be confirmed without being known. The classic example of this is getting carded at the liquor store – in a traditional context, a clerk would have to look at your driver’s license before selling you beer. That means the clerk knows your birth date – a genuine security risk!

But a driver’s license built as a zero-knowledge proof would allow the clerk to confirm that you’re over 18 without actually learning your birthday. This is a clear security and privacy upgrade, and it can be applied in a variety of contexts.

The new proposal from Soleimani and Buterin – which is for now theoretical – is to use ZKPs to attest to the sources of funds in a mixing service. (They don’t call them that, they call them Privacy Pools, but I don’t immediately see a deep distinction).

This is important – and we’re working backwards a bit here – because blockchains by default are very bad for privacy. For architectural and security reasons, all transactions and accounts are public. It turns out it’s often very easy to connect those to real people, and it’s only getting easier over time.

Workable mixers that don’t violate major sanctions regimes could turn out to be an important solution.

Reader Surveys

As I build out this information product (shudder) I want to make it as useful as possible for both current and future readers. Please help me out by answering a few questions!

Thanks for taking the time. Final warning - make a premium tier pledge to make sure you get these roundups starting next week!

Thanks,

David