👁️ FTX's "Full Recovery" Is Utter Bullshit

Crypto holders are recovering 20%, not 118%. Also Brock Pierce x Trump; Pig Butchering in First Person; and more.

Welcome to your weekly Dark Markets news roundup. The past week has been predictably thick and fast with fraud-related stories, most of them involving the incoming Trump administration. In case you missed it, don’t forget Sunday’s excerpt of Stealing the Future, focused on the depiction of 30 year old Sam Bankman-Fried as a “child.”

These weekly roundups often include a brief essay down at the bottom, but this week’s is both short and particularly important, so it’s right up top.

FTX Crypto Holders Are Only Getting 20% Back

Back in May, the FTX Estate managed by Sullivan and Cromwell announced that “Nearly all” victims of the FTX fraud could expect 118% repayment. It was obvious even at the time that this was far-fetched, and with recovery payments now beginning to roll out, just how fraudulent the claims were is becoming clear.

The core of the illusion is this: cryptocurrency holders, whose property was stolen by Sam Bankman-Fried and funneled into his mother’s Mind the Gap PAC, cult-like institutions such as the Center for Applied Rationality, and startups like Anthropic built largely on the “AI Doom” fraud, will be repaid at the petition date prices of those assets.

That is, the bankruptcy petition date of November 11, 2022.

This anchor point enables the misrepresentation of the recovery rate, in two ways. First, and more defensibly, the victims have lost out on the massive appreciation in the value of most of their assets in the two years since FTX’s bankruptcy. To take the most common example, the price of Bitcoin on the bankruptcy petition date was roughly $17,000, and its current price is a little over $97,000. This means victims whose Bitcoin was stolen by Sam Bankman-Fried will receive about 16% of what they would have had if they had held those assets to the present date (possibly plus some interest, though that might only be going to dollar holders, still unpacking all of this). Importantly, many Bitcoin holders in particular could have been expected to hold for a recovery - the market had already been totally fucked by other collapses, so if you were still long Bitcoin, you were a true believer.

Petition-date pricing is baked in to the way bankruptcy works, even though the treatment of these assets as “property” under FTX’s user agreement was interpreted by some as supporting the case for in-kind repayment.

But it’s the second deceptive element of the recovery calculation that’s truly dirty work. While November 11 is the bankruptcy petition date, FTX actually froze customer withdrawals on November 7, sending a shockwave through crypto markets that tanked the value of assets like Bitcoin.

Between November 7 and November 11 2022, cryptocurrency indexes dropped 15%.

This means that even leaving aside appreciation since 2022, FTX crypto depositors are being reimbursed at just 85% of the actual value of their holdings when the exchange collapsed. Put slightly differently - Sam Bankman-Fried’s own crimes made it cheaper for him to “repay” the people he defrauded.

This is in itself arguably just a matter of bad luck and accounting weirdness. But what’s striking is that the media has uncritically parroted the declaration of a “full recovery” or even “118% recovery,” instead of turning their fucking brains on for even the length of a paragraph. I have already particularly highlighted the gormless propagandizing of the New York Times’ David Yaffe-Bellany, a Yale legacy whose uncle is a colleague of Barbara Fried’s, and who wants to make sure everyone knows that “some of those investments [SBF made with stolen money] actually turned out to be really good.”

To state outright something that has floated between the lines here for a while, and that will be a strong thread in my forthcoming book: People like Yaffe-Bellany and Michael Lewis have been frantically, aggressively trying to "fix” the Sam Bankman-Fried story, years after the fact.

The question now is: why?

News of the Weak

Evan Wright’s Exceptionally Suspicious Suicide

Thanks to some connections made via the Zizian Affair, I’ve been seeing a lot more parapolitics on Twitter*. One of these new connections recently re-upped a story I had missed: the July 2024 “suicide” of Generation Kill writer Evan Wright. That death quickly followed Wright’s announcement that his next book would be about his experience in a Federally-funded youth “reform” program called The Seed. Wright had previously reported about CIA racketeering and murder.

This history has become bizarrely relevant to my book on FTX, via my digging into the extreme edges of Rationalism, including the Zizians, Leverage, and the Vassarites. While it’s all conjecture at this point, a great deal of what these people got up to resembles the programming techniques tested by MKUltra, and later continued in these teen reform programs. Remember that at least some of Eleizer Yudkowsky’s initial funding came via Peter Theil, who among other connections is now a major backer of Palantir, a defense contractor.

*I know that with Elon going full Nazi, a lot of people are hesitant to stay on the platform. I am at least for the moment rationalizing it to myself as maintaining a bastion of internal resistance.

Trump’s Hell-Bound “Heretic” Practices the Fraud She Preaches

As a finance writer, I’m particularly interested in the history and danger of the so-called “Prosperity Gospel” that increasingly dominates the American Evangelical wing of Christianity. In essence, it is a total inversion of the substance of Christian ethics, perverting Christ’s teachings of humility and generosity into what amounts to “Fuck you, I got mine.” It’s very American and even more Trumpy, and now one of its leading proponents, Paula White will head the Trump administration’s faith outreach efforts.

But that is not remotely all: White is a truly accomplished financial fraudster. (With thanks to a tipster on Twitter.) Through her so-called “ministry,” she sells idolatrous fetishes meant to make followers rich, which of course won’t work (but do mean she’s damned to burn in Hell for all eternity). And get this - she allegedly gained illicit access to the bank accounts of classic rock band Journey. White is based in Florida, where all the other Best People come from.

Brock Pierce Invited to Trump Inauguration

One of our old friends is back in the news. Brock Pierce is a longtime crypto grifter and cofounder of Tether, who has been linked to both Jeffrey Epstien and Bryan Singer. Pierce was accused of participating in the sexual abuse of a cast member of Singer’s first X-Men film. He was reportedly invited to the Trump inauguration by Steve Bannon.

CertiK Audited Cambodian Slavers

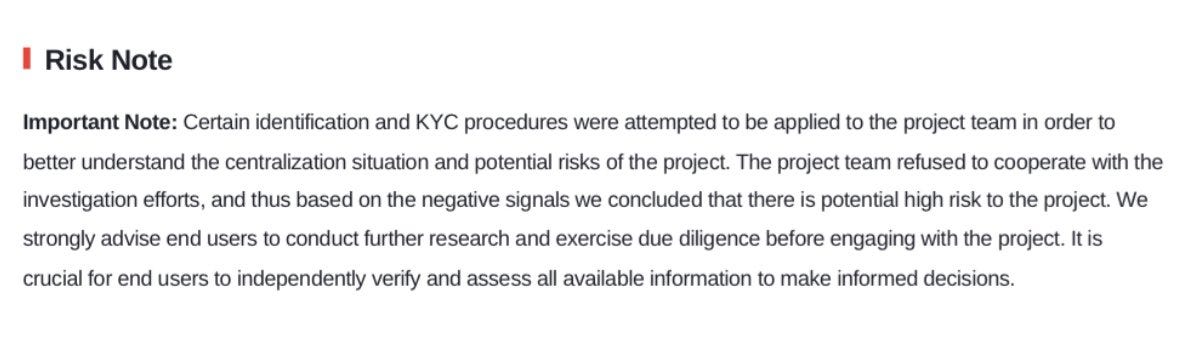

Security researcher and longtime Etherean Taylor Monahan has spotted an incredible bit of work by the crypto “auditing firm” CertiK, which provided an (admittedly, low-scoring) security audit for Huione, an online black market alleged to involve human trafficking and pig-butchering (read on for another pig-butchering story).

A CertiK representative has claimed that the audit was commissioned deceptively by a third-party front, preventing them from connecting the audited code to the criminal enterprise. However, check out this caveat Tay found in the CertiK report, and ask whether you’d put your name on it:

AG Pam Bondi Closes Russian Oligarch asset-seizure unit

Trump’s AG Pam Bondi (who in the spirit of generosity and in contrast to most of these poison-chuggers, looks incredible for 59) has shuttered the Department of Justice unit, the Kleptocracy Asset Recovery Initiative, focused on tracing and seizing the assets of Russian oligarchs and other global strongmen.

A First-Person Account of “Pig Butchering”

Strong recommend for this firsthand account of “pig butchering” at Unchained by my former CoinDesk colleague Nelson Wang. Nelson is incredibly brave in his transparency here, discussing why he was at a moment of vulnerability for a romance swindle, and walking through the slow escalation of an uncannily convincing simulation of messaging with an alluring stranger. The simulation included a spectacular array of online profile details, and a carefully mimicked schedule that the simulated stranger stuck to assiduously. Nelson also has a rundown of advice for avoiding these scams, including, first and foremost, never responding to messages from a stranger online. Ever.

A related plug: Another ex-CoinDesker, the excellent analyst George Kaloudis, recently published a short story in Matchbook Lit, a grim bit of magical realism about the repression of the Greek Orthodox Church.

Physical Media is Back

Thanks to my background in media theory, I was always skeptical of streaming, especially for music and film (TV was always “streaming”!). For 25 years I’ve hung on to huge amounts of physical media, to the point that I have a small, not-exactly-cheap storage unit here in Brooklyn that’s largely a book, CD, tape, DVD, and vinyl archive. Embedded has a conversation with Allison NB, a Gen Z (Millenial?) advocate for physical media. Among the reasons she rightly cites for pivoting back to physical, one of the reasons I never gave up my stuff myself, is that art can disappear from streaming without warning, for obscure business or even political reasons, but if you own a physical copy, it’s yours effectively forever.

"

The question now is: Why?

"

I wondered if the answer might simply be in the Michael Lewis Wikipedia page. And sure enough, the question was answered in the first two paragraphs.

"Lewis wrote Moneyball: The Art of Winning an Unfair Game (2003), in which he investigated the success of the Oakland Athletics baseball team and their general manager Billy Beane. His 2006 book The Blind Side: Evolution of a Game was his first to be adapted into a film, The Blind Side (2009). In 2010, he released The Big Short: Inside the Doomsday Machine. The film adaptation of Moneyball was released in 2011, followed by The Big Short in 2015.

"Lewis's books have won two Los Angeles Times Book Prizes and several have reached number one on The New York Times Best Seller list, including his most recent book, Going Infinite (2023)."

The man wants a movie deal and accepting that he's been wrong in his book would likely jeopardize it.

"

a lot of people are hesitant to stay on the platform. I am at least for the moment rationalizing it to myself

"

“At least for the moment” often becomes “only for that moment.” And often that “moment” is thought in retrospect to have been too long.

"

https://www.hollywoodreporter.com/lifestyle/lifestyle-news/strange-saga-jeffrey-epstein-s-link-brock-pierce-1240462/

"

Holy f'ing ponziballs... This is insane. I haven't finished reading and already I'm amazed. I mean, I've read a little about Pierce, but this is crazy.

The Trump connections are concerning for their more current implications, but this also gives a ton of credence to the connections to SBF and child abuse predators made in the last Substack, I.e. the book excerpt Child of the Man.

So one thing not reported enough is the Tether connection to SBF (Alameda helping with, possibly, money laundering for the Chinese via Tether). Now, I have made a few jokes that SBF's just too young to have gone to Epstein's island (okay, too young to go there for reasons other than to be abused). But the number of interactions with those who did frequent that island, are just too rich. And of course the Bahamas aren't that far to that island either.

Now, you might ask why bother with connections?

A) Because sexual abuse, understandably, occurs mostly behind closed doors. Which means allegations need to consider circumstantial evidence, and often needs a lots of it. Which means we need to collect all that we can, as best we can, to then carefully weigh each piece, and finally look at it in totality.

B) Child abuse is simply indefensible. It just is. Few things are, but child abuse is.

Let's say your locality makes it illegal to hold crypto. Well, there are a lot of reasons why one might argue that such a law shouldn't exist. Such as an authoritarian state might be using state-approved financial instruments simply to surveil and oppress you, perhaps because you are of a political/religious minority. But who runs the authoritarian state? Adults. Consenting adults. Consenting adults that quite possibly may be consenting to hurt you, take away your life, liberty, and pursuit of happiness. Children are not concenting adults. And they definitely not oppressors. They are incapable. And history has no evidence of systematic oppression of adults by children. It's a laughable concept. Thus, anyone who hurts children, particularly in unequivocal ways, such as those in the sex abuse cases of Epstein, simply have no defense.

Unfortunately, it's so self-evident, it is almost blinding. Something as laudable as protecting children can easily be used as a scapegoat for authoritarian behavior. For example, taking away net neutrality in the name of protecting children. Because who would supposedly be in charge of what you can do on the internet once net neutrality is gone? ISPs. ISPs are run by consenting adults. Consenting adults who absolutely have a history of abusing their power as monopolies. Putting power in the hands of abusers in the name of prevention of abuse.

It's complex, but I think that's why the stories of connections do need to be told, the circumstantial evidence presented in detail and in context. So that instead of people thinking, “woah, crypto bad,” they think, “woah, what's up with Tether? How come I never hear about this kind of stuff with, say, Circle? Seems like it's not a crypto thing. But, a Tether thing. And, woah, what about these stories of these people they associate with? What does this say about anyone willing to have themselves ‘tethered’ with such connections?”

“

However, check out this caveat Tay found in the CertiK report, and ask whether you’d put your name on it:

“

Which name? You mean the nom-de-internet I myself use for anything crypto?

Consider someone might want to write about someone who is rich and powerful, and likely a vindictive fraudster. Should the writer use their own name, when they themselves are not rich and powerful? When they are unlikely to get any riches or power from it? Of course, using a pseudonym would make it difficult to get published, or keep anything published, as any publisher could then turn around and perversely use the anonymity of the author as an excuse to squash after the fact. But is it worth it to publish under normal identity when it's so high risk and low personal reward? Did Satoshi Nakamoto think that when they invented Bitcoin anonymously it was likely going to make them rich or more likely a target?

I too think Certik is a joke. Or rather their audits are. But not for being willing to certify even though the team wants to stay anonymous.

In fact Certk can probably argue: “Hey, all we are saying is we did some kind of glancing in their general direction, and that's all our certification attests to when you actually read the fine print. And really, we could do the most thorough audit in the world of some existing code, and they could push an upgrade the next day, and not recertify the upgrade, making the certification useless, and still advertise the stale certification, and most people would have no idea. It's all theater based on vibes when it comes to most audits as much as it is vibes assuming governance tokens and protocol votes will actually have the final say in what happens in these ‘decentralized’ apps we certify.”

I'll admit, Certik has proven to be pretty bad compared to other services, like Immunefi, whose big bounty program is considered one of the best, if not the best. But the problem isn't with Certik’s willingness to work with anonymous individuals. It's their willingness to work with just about anybody and though they will say when their rubber stamp is a rubber stamp, they don't seem to care when customer after customer claims a low-fee, rubber-stamp audit is more than that nor reveals when their audit becomes stale. That's the big problem. They should be putting those “D”apps on blast (not Blast, of course, no way that airdrop thirst trap scheme would have worked during a crypto winter) when they pull that s***. The fact Certk doosn't tells you all you need to know.

“

A First-Person Account of “Pig Butchering”

“

That was heart wrenching. And I bet not even that unusual. Probably many “pigs” intend the same as him to never send money, to be wary. And wouldn't if it weren't something as weird as crypto where it seems like, yeah, someone can be really rich almost randomly. (No, they can't. But, yes, it is often presented that way.) In a multiverse, he got fatted up 999 times, and didn't get slaughtered. But 1 time. Something happened, one bad day, one transgression, followed by another, and suddenly he can't tell his family how deep he’s in. In the non-multiverse, after 998 more pig attempts, “she'll” get her slaughter from someone else. What's that they say in cybersecurity? Blue team has to win every time. Red team has to win just once.