Stealing the Future: The Horse’s Mouth

Sam Bankman-Fried's version of events - and what it revealed about his mind.

It’s now the first week of October, which means I have less than four months to turn in my manuscript for Stealing the Future. It’s a daunting timeline, frankly, given my endless ambitions for the book - but knowing where to prune and tuck those ambitions is also part of the task at hand. (And a big thank you to all you premium supporters - your contributions are still vital to this project. As I’ve mentioned, this is not some big-money book deal! Or even, for now, a medium-money book deal.)

Regardless, we’re really in the thick of it now. Just to clarify a decision I’ve been acting on for a bit now, that means that the Dark Markets podcast is on hiatus - but will likely restart in 2025 after this manuscript is squared away.

Below, you’ll find a modest excerpt about SBF’s strange insistence, throughout his downfall, on a clearly untrue version of events - and what we can learn from that strange commitment. But first, a few notes about the research and writing process.

After a veritable year of rest and relaxation (by my own maniacal standards - I only sucessfully started a new company), it’s time to really get back to work. Above all, that means more reading. I’ve been writing about rebuilding focus for a couple of years now, including writing about reading and research methods.

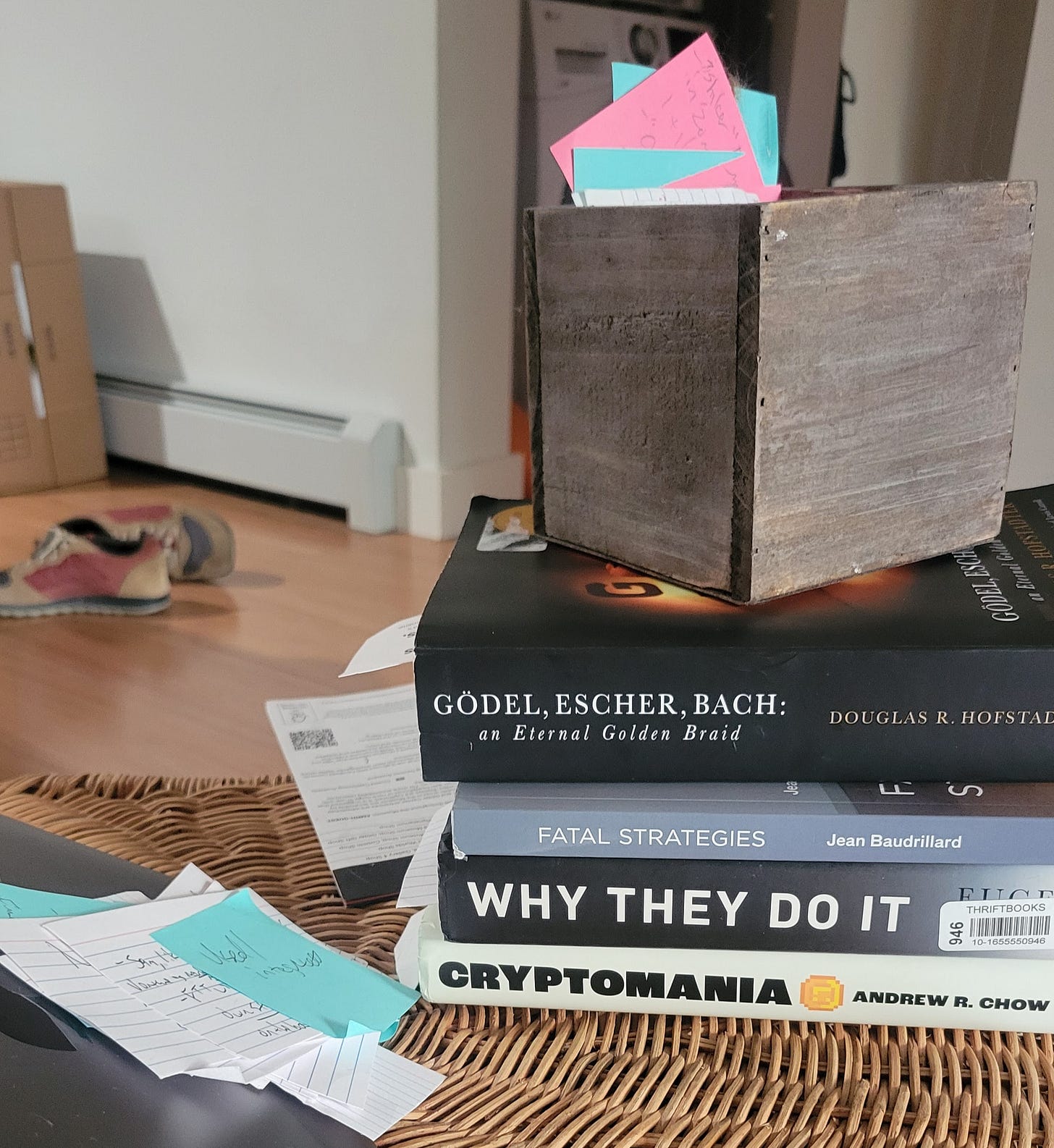

So a quick check-in as I actually apply these methods to a book seems appropriate. I snapped this quick shot during a recent research session.

The content of these books ranges the spectrum from abstract to concrete. Andrew Chow, one of my fellow soldiers in the trenches of the SBF trial, has written what I think might be the best of the many reported books about the crypto bubble, including a very nuanced and thoughtful version of the SBF story. At the other end of that spectrum us Hoftsader’s Eternal Golden Braid [EGB]: it’s perhaps a bit of a fool’s errand, but I’m hoping to gain a deeper understanding of the Incompleteness Theorem, and from there of the possibilities and limitations of both artificial intelligence, and predictive analytics.

I don’t actually feel that reading several books at once is the ideal approach, but it’s an accommodation I’m making to my still slowly-reviving focus. When I sit down to read, I tackle the hardest thing first (In this case, EGB), and then work my way up to the most straightforward read (in this case, Cryptomania, which is a pleasure). There is one upside to this approach, which is that the ideas cross-pollinate.

You can see here that I’ve taken up an entirely new tool for this project - taking notes on index cards. They go into the box you see there, where they will wait to remind me to include particularly juicy passages or important parts of the story. One thing I’m realizing as I write is that there is simply so much detail to Sam Bankman-Fried’s story, so many layers and nuances, that writing it is a deeply iterative process - it requires revisiting the basic sequqnce of events again and again, and letting myself be reminded of the many branching paths.

And now, your weekly draft excerpt of Stealing the Future: Sam Bankman-Fried and the Tech Utopians.

***

Judge Kaplan had only passed his judgment after Sam Bankman-Fried made one final statement. It was one last chance to explain himself in a way that might elicit a shred of sympathy, that might provide some meaningful explanation of his actions.

Instead, Bankman-Fried simply repeated the same disproven claims of victimhood that had fueled his defense, the same false narrative that he had first spooled out more than a year earlier during a shambolic post-collapse media tour.

“I made a series of bad decisions,” he said in part, standing behind the defense table, seeming listless and confused. “They weren't selfish decisions. They weren't selfless decisions. They were bad decisions ... And those culminated with a bunch of other factors, along with the liquidity crisis for Alameda in November of 2022. It wasn't bankrupt. FTX wasn't bankrupt. Alameda wasn't bankrupt. There were no losses to socialize to customers.”

He returned, at least three times in a few minutes, to his insistence that his crimes had simply never happened. Repeated in a catechistic drone, like the working of prayer beads, this blunt insistence that no money was ever lost was one of the stranger features of Sam’s apparent state of self-soothing delusion.

Keep reading with a 7-day free trial

Subscribe to Dark Markets to keep reading this post and get 7 days of free access to the full post archives.