👁️ Tesla's Robotaxi is "Desperate," and Trump Media is a Massive, Legal Con

Plus: The End of the Future of Humanity (Institute)

Welcome to the weekly Dark Markets news analysis roundup. A few notes.

First, if you’re curious about the kind of weird, scary financial structures you can only experiment with in the Wild West of Decentralized Finance, be sure to check out my interview with Zane Huffman, CSO of Bloq. This episode is the second to feature an added bonus section for premium subscribers - this time, some advice for aspiring crypto traders.

Second, we have such a bumper crop of news about Effective Altruists, AI doomers, and Extinction-risk fantasists this week that I’m introducing a new section, titled, for now, Rationalism is Going Just Great. It is of course named in honor of Molly White’s excellent Web3 is Going Just Great.

Finally, remember, if you like what you’re seeing, please subscribe rather than “following.” Following connects us via the Substack app, but doesn’t add you to my email list.

In This Issue:

Ghostface Killah linking up with Ansem?

SEC DEBT Box Lawyers Resign After Sanction

Jane Street has Secrets in India

Trump Media is a Massive, Legal Con

Tesla’s Robotaxi “Feels Desperate” Ahead of Earnings

ZKasino’s Uniquely Bizarre Rug-Pull

Scott Galloway is Shilling for Craig “Faketoshi” Wright

IRS Releases New Crypto Reporting Form

Rationalism Is Going Just Great

Timnit Gebru and Emile Torres’ Long-Awaited TESCREAL Paper

Nick Bostrom’s Future of Humanity Institute Shuttered

John Naughton Calls AI “Bust”

Daniel Dennett Passes Away at 82

Will Eigenlayer Destroy Ethereum?

Please check out the newest episode of the Dark Markets podcast to learn more about the weirdest (and some say riskiest) new structures in crypto: the restaking protocol Eigenlayer, and the derivative stablecoin Ethena.

Are Eigenlayer and Ethena Time Bombs ... or is it just Post-Terra Trauma? w/ Bloq CSO Zane Huffman

In today's show, we dive into the risks of two major new DeFi products: The restaking protocol Eigenlayer and the yield-producing stablecoin Ethena. We get insights from a top-tier degen: Bloq CSO Zane Huffman. Huffman walks us through the time a restaking protocol blew up on BNB, and its consequences.

Ghostface Linking with Ansem(?)

This tweet from my favorite rapper is almost certainly not what it seems. On the surface, it’s an extremely famous guy hearing about a huge crypto-trading influencer (or just a guy who got lucky on Solana) and shouting into the void looking to connect. That doesn’t sound very plausible? So the more likely explanation (at least to my paranoid brain) is that this is the teaser for some kind of endorsement or partnership that has already been negotiated.

SEC DEBT Box Lawyers Resign After Sanction

Two lawyers who represented the Securities and Exchange Commission in its case against Utah crypto firm DEBT Box have resigned under pressure. The SEC was sanctioned for abuse of power in the case after it made false statements about the intention of DEBT Box principles to move funds out of the U.S.

Michael Welsh and Joseph Watkins were reportedly told they would be fired if they didn’t resign. Watkins was the agency’s lead investigator, and Welsh’s arguments were specifically cited in the judge’s sanctions.

But clearly, these two lawyers are being thrown under the bus.

They were acting in accordance with a broader set of assumptions and agendas coming from the very top of the SEC - above all, chair Gary Gensler. Gensler has used far subtler deceptive tactics, including putting forward the Potemkin firm Prometheum as a stalking horse, as part of a sweeping, legally tenuous crackdown on cryptocurrency sometimes referred to as “Chokepoint 2.0," after an illegal Obama administration program that interfered with banking.

For more insight on what motivates Gensler’s aggressive windmill-tilting, check out my conversation with risk manager Austin Campbell, who has watched Gary closely since the CFTC days.

Jane Street Has Secrets in India

Sam Bankman-Fried’s former employer is entangled in a lawsuit over what it alleges is the theft of trade secrets by former employees. Matt Levine describes how, in this case, that’s trade secrets in both senses.

Apparently what got stolen and ported over to a new firm called Millenium involves some kind of arbitrage in India. And it’s lawyers for Millenium, the defendants, who reportedly keep “accidentally” revealing the nature of the trade, probably even further destroying the profitability of the ideas Jane Street was suing to protect. An excellent troll all around.

Trump Media is a Massive, Legal Con

All SPAC offerings should be considered attempted frauds until clearly proven otherwise, as I’ve been warning since Chamath Palihapitiya began his rampage of ripping off Facebook grandpas back in 2020. Why else, after all, would you use an issuance method whose main features is being able to solicit investment without actually disclosing details about the company getting the money?

(In fact, new SPAC rules have recently been imposed, seemingly in response to such shenanigans.)

But of all the scammy SPACs issued by shameless grifters (Clover Health CLOV 0.00%↑ is a truly impressive 94% off its peak), there’s no question that Donald Trump has mastered the form. Matt Levine accurately describes DJT 0.00%↑ as a more legit version of a crypto shitcoin - an instrument signifying nothing except vibes and social media chatter. Trump Media’s trailing year revenue was something like $4 million dollars, and its valuation is nearly $5 billion, even after substantial post-issuance drops.

That’s a P/E ration of, let’s just save some math and call it “infinity.”

There’s no question the gambit is wiping out a whole lot of small, retail investors with unflinching faith in Trump. This account of Trump Media “investors” in the Washington Post makes clear that the constituency is largely people who don’t understand how investing or the stock market work. Many have chosen to believe that the price drop in DJT - which will continue - is the product of a liberal media conspiracy, instead of the fact that the company has no real product or revenue.

You may find it tough to empathize with these victims, but their politics don’t make them uniquely vulnerable to scams – this is just a scam that happens to exploit their politics. Remember, a lot of people got washed on Clover, and there was no political angle there at all.

ZKasino’s Uniquely Bizarre Rug-Pull

New in the annals of “never invest,” a purported crypto startup called ZKasino - I’m sure it’s something having to do with anonymized gambling - raised a reported $35 million in ETH, promising that the investments would be “bridged back 1:1 ratio in 30 days.”

The clear implication is you’d be able to get your ETH back - which is admittedly a weird thing to claim about an investing round?

But anyway they didn’t mean it like that, not at all. Instead of giving anybody back ETH, they unilaterally swapped all investor funds for their own token. So maybe it’s 1-to-1 in the sense that you give them 1 ETH, you get back 1 of their made-up casino token?

There’s a rundown of the situation here, and also a thread from one of ZKasino’s investors, who admit they “made a mistake.” Apparently the ZKasino principals also have some known history of shady behavior, so there’s a lesson in this. A lesson absolutely nobody seems to ever really learn.

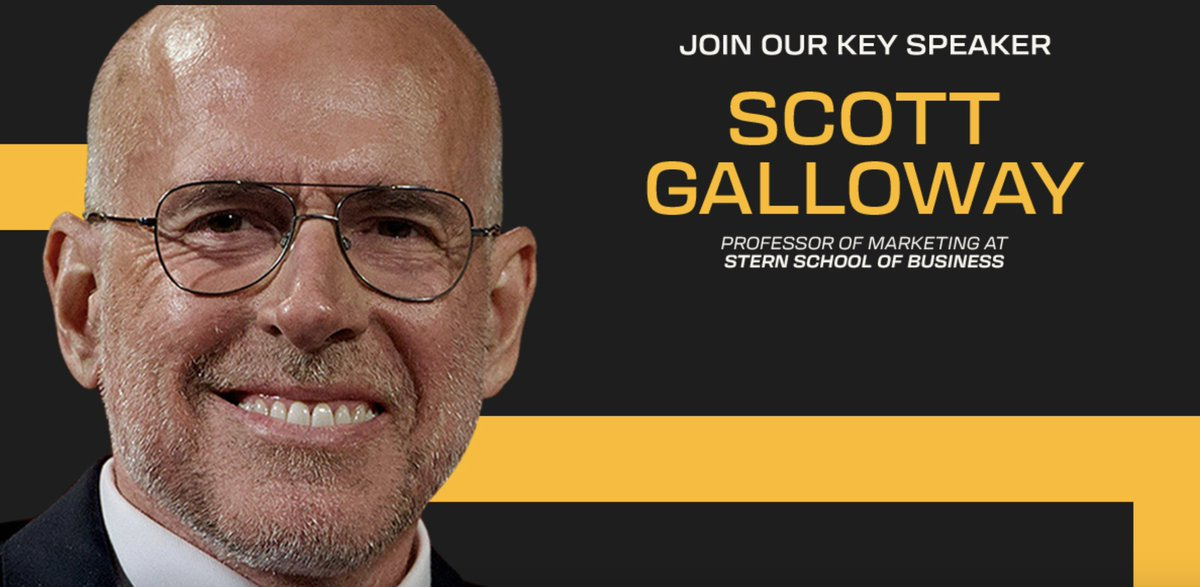

NYU’s Scott Galloway Caught Shilling for Craig “Faketoshi” Wright

This is just fucking bizarre. Researcher @cryptodevil spotted Scott Galloway, a famous tech and business Guy, appears poised to speak at the London Blockchain Conference next month. LBC is effectively run by the BSV crew that includes Craig “Faketoshi” Wright, who has claimed for years to have been the creator of Bitcoin.

But a U.K. judge recently ruled unambiguously that Wright is a fraud. Other speakers have dropped out of the LBC conference, leaving Galloway embarrassingly alone on the Keynote Speakers page. According to CryptoDevil, allies have made sure Galloway is aware that he’s cosigning a fraud, and Galloway is pondering his options.

I guess we’ll get to find out just how little NYU pays, or just how little Galloway gives a shit about cashing a check drawn from the proceeds of a massive, global fraud.

Additionally: Wright has now dropped the absurd ‘Tulip Trust’ proceedings that attempted to move Bitcoin (BTC) into his possession. And read Cryptodevil’s report from last days of Craig Wright COPA Trial.

IRS Releases New Crypto Reporting Form 1099-DA

The U.S. Internal Revenue Service has released a new tax form, 1099-DA, for reporting digital asset transactions. It will be required from exchanges and other facilitators starting in 2025.

Crypto partisans including CoinCenter’s Peter Van Valkenburgh are concerned the form asks for far too much information, including transaction IDs and other details that could be used to de-anonymize entire constellations of activity.

Here’s a fairly neutral overview.

Tesla’s Robotaxi “Feels Desperate”

Back when I was reporting on Tesla’s accounting practices for Fortune, a major source of insights was a pseudonymous Twitter Guy going by Montana Skeptic. He’s since revealed his real name (Lawrence Fossi) and launched a Substack.

Tesla’s earnings call is tonight at 5:30 ET, and they’ve really been dancing hard. We got a Katy Perry Cybertruck endorsement, which I’m tempted to call a Kiss of Death in itself given what we know about Perry’s willingness to take checks for just about anything via Michael Kives.

But more substantively, Tesla have pivoted entirely to the promise of future “robotaxis,” which Fossi describes as “desperate.” It’s desperate for very obvious reasons: Robotaxis require self-driving, and after nearly a decade of promising that technology, and charging people for it, Tesla hasn’t succeeded in creating it.

Doubling down on that makes it even more obvious what Elon Musk has been engaged in for nearly the entire lifespan of Tesla as a corporation: Brazen securities fraud.

Rationalism Is Going Just Great

You’ve seen bits and pieces of my interest in “rationalist” movements here or on Twitter. The connections to my interest in financial fraud are nuanced but clear and manifold.

Rationalism, or the belief in a fully scientifically comprehensible, materialist, and naively predictable universe, underpins the “expected value” gambling of Sam Bankman-Fried; his mother’s utilitarianism; and the misguided futurism (and personal ethics) of the Effective Altruists. Rationalism, and specifically the branch overseen by fake “philosopher” Eliezer Yudkowsky and his LessWrong cadre, is also a huge part of the ongoing fraud against the investing public by Artificial Intelligence grifters at Stanford and elsewhere.

Remember, it’s rationalism, not rationality, that we have issues with. The deep irony of the rationalists is that their twisted, narrow ways of thinking lead them to conclusions that exemplify the very biases they supposedly aim to squash.

Future of Humanity Institute Closes

Ding dong, this dingdong is dead. After nearly 20 years providing a platform for people less openly racist than founder Nick Bostrom, the Future of Humanity Institute at Oxford is closing, and Bostrom is leaving his professorship.

There’s no question this is related in multiple ways to the downfall of Sam Bankman-Fried. Bankman-Fried funded many of the same causes and groups FOHI did, and the backlash against Effective Altruism he triggered certainly tarnished FOHI’s and Bostrom’s halos. But more directly, rumor has it the closure was a response to the discovery of racist emails by Bostrom, and what many – including Bostrom’s own EA disciples – saw as his non-apology-apology for them.

That discovery was made in early 2023, and I believe it was a consequence of the heightened scrutiny of the movement after the FTX collapse (though I may be mistaken there.)

Anyway, I’m sure Bostrom have no trouble collecting checks from other crypto-fascist techies.

General Artificial Intelligence as a Eugenicist Project: Timnit Gebru and Emile Torres’ Long-Awaited TESCREAL Paper Arrives

Dr. Emille Torres (@xriskology on Twitter) has for many months been teasing a collaborative paper with Timnit Gebru, the Google AI ethicist who was actually fired for truth. The paper was released this week at First Monday, and it formalizes numerous points that have been floating around among those of us trying to take the hot air of Yudkowsky and his ilk.

Torres and Gebru aim to explain why AI Doomers are actually AI shills; why the quest for General Artificial Intelligence is rooted in transhumanist eugenics; and why transhumanism, extropianism, singulitarianism, cosmism, rationalism, effective altruism, and longtermism constitute a “bundle” of related, toxic ideas.

I haven’t had a chance to read it through yet, but watch these papers for a more in-depth response.

John Naughton Calls AI “Bust”

Noughton, a scholar of the history of technology at Open University, writes in The Guardian that we’re now in the “euphoria stage” of AI hype, and poised for a collapse as profit taking sets in. I agree with his well-argued case, so this IS financial advice: If you haven’t already made AI-linked investments, now is a bad time to. If you’re holding those investments, dump them while you can.

Daniel Dennett Pases Away at 82

This is by no means a victory lap. But the passing of one of the “New Atheists” who helped shape the rationalist movement is certainly a moment for necessary reflection. Dennett, among other positions, staked out the same very strong determinist view of humanity that was shared by Barbara Fried, and that ultimately influenced Sam Bankman-Fried’s approach to risk.

Regarding GhostFace, I actually did a bit of research on GhostFace when reading Brady Dale's book on SBF. GhostFace is no stranger to crypto. On page 163 of "SBF," Brady Dale writes "CREAM … reference to … ‘Cash Rules Everything Around Me’". The reality is stranger.

It may be that CREAM (Finance) is a reference to (or IP theft of) Cream (Capitol) which is indeed a reference to C.R.E.A.M. (song). Or it could just be another Newton-Leibniz thing of independent discovery, just maybe not one as important as calculus.

Ghostface Killah is from Wu-Tang and was prominent on their C.R.E.A.M. track . During the ICO craze of 2017, Ghostface co-founded a crypto startup called Cream Capital (not CREAM Finance) with the intention of ICO. The other co-founder was Brett Westbrook (not Jeffrey Huang of CREAM Finance, mentioning in this section of "SBF"). Brett Westbrook explicitly said their “Cream” “stands for Crypto Rules Everything Around Me of which we have been granted a trademark by the USPTO (United States Patent and Trademark Office)" https://www.cnbc.com/2017/10/04/wu-tang-clans-ghostface-killah-is-backing-a-cryptocurrency-venture.html .

After 2017, it seems the ICO was cancelled https://www.theverge.com/tldr/2018/7/22/17510130/cryptocurrencies-celebrities-scam-paris-hilton-steven-seagal-akon-mayweather. Their website creamcapital.io is currently down, and likely has been since December of 2022. A cached version of the site from that time states they were trying to build “the world’s largest cryptocurrency ATM network” https://web.archive.org/web/20221202192144/https://creamcapital.io/. Notably in 2017, Brett Westbrook was mentioned as part of the team as CEO https://web.archive.org/web/20171107011407/http://creamcapital.io/meet-the-team/. But by 2020, he was no longer mentioned on that same page, and in fact no CEO was being listed at all https://web.archive.org/web/20200804000508/https://creamcapital.io/meet-the-team/.

Then, around the same time in 2020, Jeffrey Huang, who is indeed connected to Taiwanese hip hop (per "SBF"), founded CREAM Finance https://www.crunchbase.com/organization/cream-finance but at no point was there any mention of any connection to Cream Capital. Notably, at some point, CREAM Finance started putting on their website: “C.R.E.A.M. Crypto Rules Everything Around Me”—a slogan, again, supposedly trademarked by a different, seemingly unrelated entity. So, ultimately, CREAM Finance is a reference to C.R.E.A.M. the song, but possibly also a little known entity that actually had a member of Wu-Tang at least nominally on their team.

----

So, not so weird that Ghostface is again after that crypto, crypto token y'all.