👁️ Why Do They *Really* Hate Crypto? (News for 1.23.24)

Also: Tether has the Money, and Jamie Dimon thinks Satoshi is Immortal

Welcome to your Dark Markets news roundup for January 23rd, 2024.

If you haven’t yet, check out my conversation with FTX chronicler Tiffany Fong, the second episode of the Dark Markets podcast. We have some very interesting episodes coming up, as well, so be sure to subscribe wherever you listen to podcasts!

Second, please take a moment to vote in the poll below. It will be a big help as I continue to grow this project, and work to give you, my readers, exactly what you want.

In Today’s Edition:

Tether Has The Money

The SEC’s Case Against Coinbase Looks Shakey

Jamie Dimon Thinks Satoshi Nakamoto is a Deathless, Vengeful Revenant

Crypto Hate is Really About Global Sanctions

SamSnacks: What if SBF’s Selegaline Patches Made Him Crazy?

CryptoSplained: What is Restaking? Could it Break Ethereum?

My 2019 Devcon Presentation, as a Treat

Last but not least, BILLY MCFARLAND IS BACK

Dark Markets Weekly News Roundup for January 23, 2024

Joe Bankman and Barbara Fried seek Dismissal of Clawback Suit: The FTX estate wants back the $10 million that Sam Bankman-Fried gifted to his parents under pressure. Joe and Barbara are seeking dismissal, in a standard procedural move that’s unlikely to go anywhere at all.

As Tiffany Fong told me in our recent podcast interview, even Sam Bankman-Fried “seemed like he gave that money sort of begrudgingly … he was like, ‘I didn’t feel really good about that … My Dad just really wanted it.”

Donald Trump Issues Ordinals: It is, as they say, so over. Our 45th (and 47th?) President has decided to spam the mempool with some sort of bonus token for his latest NFT collection. Ordinals were cool for a few minutes there, but looks like it’s time for Udi and Eric to pack it in. Sorry bros.

Justin Sun Spoofed Huobi/HTX’s “Proof of Reserves”: I mean, of course he did.

Billy “Fyre Festival” McFarland is Out of Jail: And has immediately begun promoting “Fyre Festival II”. Get your tickets now!

The GAO Says Crypto Will Interfere With U.S. Sanctions: The U.S. Goverment Accountability Office has published a new report, “Effectiveness of Economic Sanctions at Risk from Digital Asset Growth.” Whenever you’re confused by the behavior of anti-Crypto zealots like Gary Gensler or Elizabeth Warren, this is the real explanation. They are willing to sacrifice individual citizens’ rights to the American imperial project. As Henry Farrell and Abraham Newman describe in their recent book Underground Empire, American power now rests on controlling global networks, including the Internet, and above all, global finance.

Jamie Dimon Believes Satoshi is Immortal (Or perhaps a Tulpa): At a Davos interview on January 17, the JPMorgan CEO said that when Bitcoin’s 21 million token cap is reached, “Satashi [sic] is going to come on there, laugh hysterically, go quiet, and all Bitcoin is going to be erased.” That would be in the year of our Lord 2140. And here you thought Jamie didn’t like us. H/t to the Castle Island boys for this gem.

Mr. Beast and Elon Musk Ran Deceptive Ads: A video by YouTuber Mr. Beast posted to Twitter/X now appears to have been a clumsily disguised ad. Mr. Beast promised to “share revenue” from the disguised ad, even though ads obviously don’t generate revenue. So there might be an argument for some kind of financial fraud here, but this story is still developing.

Nightshade AI Poisoner is Live. Nightshade, a tool for embedding invisible patterns that screw with image generators that want to harvest your intellectual property, is now available for download.

SEC’s CoinBase Case Looks Shakey: Last Wednesday saw an extended (but standard) hearing in Coinbase’s motion to dismiss the Securities and Exchange Commission’s lawsuit for acting as an unregistered securities broker. Judge Katherine Polk Failla seemed notably sympathetic to Coinbase’s arguments that the SEC was exceeding its mandate, increasing speculation that this pro-forma hearing might lead to an actual dismissal. A decision on the motion will not arrive for a few months, though.

I find a dismissal highly unlikely, but Coinbase does seem to be on solid ground, particularly in their simple, straightforward rebuttal of claims that their staking service is a securities offering.

Tether Has the Money: Cantor Fitzgerald CEO Howard Lutnick last week further affirmed earlier statements that Cantor custodies many of the assets backing the Tether stablecoin. Further, he said that he and his team have reviewed Tether’s balance sheet, and that Tether “have the money they say they have.”

This is absolutely not a formal audit, and certainly Cantor has motive to not say, like, “yeah our client might be running a fractionalized fake-dollar printer.” But it is fairly reassuring to hear from an organization wth Cantor’s stature.

This is unlikely to silence “Tether Truthers” who have made it their identity to claim that the Bitcoin market is fueled by unbacked fake Tethers. But as more restrained and precise Tether critic Bennett Tomlin points out, the real question isn’t whether Tether has the money *now.* It’s whether it had the money at every point that it claimed full 1:1 backing.

Paul Woodruff has Passed Away. This one is mostly personal. Dr. Woodruff was one of my philosophy professors in undergrad, and a titan of that world. Reading Plato with him (in his own translation) was a life-changing experience. He passed away at age 80 in September of 2023, but I just found out about it last week.

Rest in Peace, King.

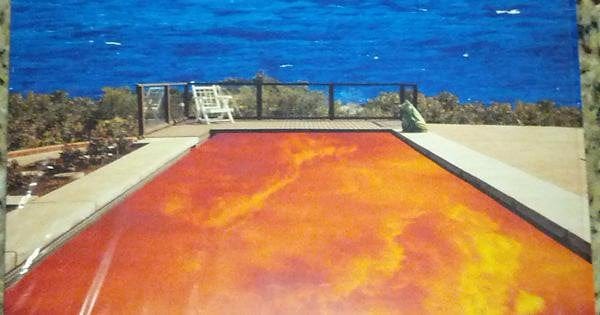

McLuhan on the Blockchain, Revisited

I’ve recently realized that my 2019 Devcon 5 presentation is on YouTube. I didn’t even realize they taped it! “The Invisible Obelisk: Marshall McLuhan and Media Studies on the Blockchain” is an introduction to the truly big picture of how blockchains fit into the history of media, and why they represent a fundamental step-change. The talk is based on my 2019 book “Bitcoin is Magic,” and you can also read the first two parts of the essay it’s based on right here at Dark Markets.

SamSnacks: What if Selegeline Turned SBF into a Compulsive Gambler?

In addition to longer installments in my SBF book project, I’m going to have to start sharing smaller thoughts in this new newsletter section. Yes, I know that name stinks.

I have written extensively about how Sam Bankman-Fried’s ideological upbringing made him far more willing to take risks - because he believed the universe was solvable, and that he had unique gifts to solve it.

But I’ve also said that these ideas, from his mother and William MacAskill, encountered his unusual brain in a very specific way. And now I’m thinking that maybe it wasn’t just his own brain, but the seeming drip feed of stimulants and antidepressants he was chugging.

I’m finally looking back at some previous investigations of his pharmacopia, and particularly the fact that he was known to have used Emsam patches, which contain the drug Selegaline. Selegaline is linked to impulse control disorders including pathological gambling. Open Emsam patches were visible on SBF’s desk in press appearances, and they were part of a pre-trial motion to get Sam drugs for his trial.

Which, as we saw, didn’t really help with his impulse control when he ultimately got on the stand.

CryptoSplained: Restaking and its Risks

Welcome to another new section of the weekly Dark Markets roundup. Each week, or close to it, you’ll get a hopefully brief, hopefully clear and simple explanation of a new or important concept in cryptocurrency. The goal is to make it useful for both crypto natives and the crypto-curious. For now, I’m calling it “CryptoSplained,” though agin, I get that that’s pretty terrible, and it will probably change. This week, we’re talking restaking.

One of the technical innovations in crypto that I didn’t pay enough attention to in 2023 was “restaking.” Very broadly, restaking is a novel way to build new networks on top of (mostly) the Ethereum network, by extending Ethereum’s own security architecture. The most well-known restaking protocol is called Eigenlayer, which began growing stratospherically in December 2023 and now holds nearly $1.8B worth of ETH.

Ethereum’s security architecture (after the September 2022 Merge did away with proof-of-work) is called “proof of stake.” Owners of ETH tokens can “stake” them in long-term lockups, in exchange for the right to act as validators, managing transactions on the Ethereum network (in reality, most stakers delegate to professional validators). Validators are kept honest by the threat of “slashing,” an economic penalty that can take away staked funds.

In the simplest terms, restaking lets the same ETH secure both Ethereum, and other application layers built on top of Ethereum. Eigenlayer and other restaking protocols let the same ETH used to stake the main chain be “re-staked” for validator privileges (or the equivalent) on other protocols built on Ethereum. Eigenlayer also lets these layered protocols add more slashing conditions of their own, without changing the terms of base ETH staking. This is distinct from the model used by “Layer 2s,” which issue their own token security incentives.

Or, as Eigenlayer is described by Consensys in a very nice blog post: “This primitive enables the rehypothetication of $ETH on the consensus layer.”

*Record Scratch*

Yes, that’s right, rehypothemothafuckincation. Many people who understand it better than me see restaking as a strucural risk comparable to the risk that compounds when lenders re-lend the collateral backing a customer’s loan - collateral they do not own. That comparison becomes clearer when you learn that a big part of the restaking sales pitch to stakers and validators is that they can earn incentives on their restaked ETH, in addition to the staking returns from the base chain. That seems concerning as a set of market motives.

Ethereum cofounder Vitalik Buterin himself has worried about the risk of restaking, which he said could “overload” Ethereum’s consensus model. (At least at the time of writing, unfortunately, Vitalik’s website seems to be down, but here’s the archive). Vitalik’s argument focuses in part on the fact that validating is actually work. That is, multiplying staking duties mean stakers are spread thin and might, for instance, start providing bad data as a shortcut. More generally, Vitalik makes the timeless point that more complexity always equals more risk.

One more specific concern is that if Eigenlayer stakes are slashed (forcibly unstaked and seized) en masse, it could destabilize underlying Ethereum security. These and other worries are laid out in this (surprisingly adequate) CoinTelegraph piece. I’m a bit unclear on the point about slashing risk, frankly, because restaking doesn’t actually grant Eigenlayer the ability to slash tokens staked on Ethereum mainnet. That is, you can be slashed from Eigenlayer without being slashed on Ethereum. In fact, to restake to Eigenlayer you don’t even put up your actual ETH (which is locked), but your liquid deriviative tokens - stETH, cbETH, etc. I can’t think of how that gives Eigenlayer any influence over underlying ETH staking.

Vitalik himself, in fact, writes that “dual-use of validator staked ETH, while it has some risks, is fundamentally fine,” so he seems to not share the slashing concern, either. “But,” he continues, “attempting to "recruit" Ethereum social consensus for your application's own purposes is not.”

In other words, if I read him right, it’s not so much about financial risk as it is about diluting intention.