👁️ You’re Getting 100% (Of the 26% We Decided We Owe You)!

The FTX liquidation team has its own motives for misrepresenting the recovery process. But they're helping the Bankman-Fried apologists.

Happy Tuesday, readers. Today’s edition of Dark Markets includes a very restrained experiment: three new sections. Below the News roundup, you’ll find headings for “Reads,” “Pods,” and “Books.” They’ll guide you to longer articles worth a look, podcasts worth a listen, and to … yes, Books. These won’t necessarily be about financial stuff! So, a little pudding with your veg.

Of the 26% of Your Money We Think We Owe You, You’re Getting 100%!

That’s the basic logic by which Sullivan & Cromwell, the law firm overseeing the FTX bankruptcy, has been promoting the fiction that it is securing a “full recovery” for creditors, including depositors, ripped off by Sam Bankman-Fried.

This idea is the best kind of correct – technically correct – while in substance it is a dangerous and utter lie.

You have probably seen the headlines, such as this incredible howler at the New York Times. It is an egregious misdirection, justified by only the thinnest of language games.

Here’s the actual truth: FTX depositors will get roughly 26% of the current value of cryptocurrency held on the exchange at the time of its 2022 collapse. On the petition date in November of 2022, Bitcoin (which is a decent proxy for broader crypto prices) was worth just $16,600. Today it’s worth $63,000, or about four times as much. This is an artifact of how the bankruptcy process works, but it’s also a choice by Sullivan & Cromwell, who rejected creditors’ petitioning for full asset recovery.

There are a ton of other headlines that are essentially identical - at CNBC, you name it. That’s because, according to FTX victim’s advocate Sunil Kavuri, Sullivan & Cromwell actively pitched that messaging to journalists. Which makes sense! It’s their job to get all the creditor’s money back, so if they’ve done that, it makes sense they’d celebrate the victory - even if it’s kinda sorta not true. And the ugly truth is that most journalists just print the press release, as long as it’s from an impressive-sounding firm.

The 26%/100% recovery would just be unlucky timing, except that FTX played a role in driving prices down to $16k by the day of its closure, in at least two ways. First, worries about FTX’s stability began on November 2 of 2022, and drove the price of Bitcoin down by about 20% in the week before the exchange fully collapsed. In other words, FTX gave itself a 20% discount on future repayment to customers, just by being so shitty.

More nefariously, though, we now know that FTX had been driving down the price of Bitcoin and other cryptos systematically for *years*, because it was selling its customers what’s known as “paper Bitcoin.” That is, FTX didn’t actually hold a large proportion of the Bitcoin that customers thought they were buying, or had actually sent the exchange.

Back in March, FTX recovery CEO John Ray III said that FTX had only 105 Bitcoin on hand at the time of its bankruptcy, but owed customers more than 100,000 BTC. The real Bitcoin had been lent or sold, so the fake balances created an additional market supply of 99,895 imaginary Bitcoin, which would have suppressed overall prices. It was only about half of a percent of total Bitcoin supply at the time, but a significantly higher proportion of *circulating* Bitcoin, which actually determines the open-market price.

But because of the way bankruptcy works, depositors will be getting back the $16k, not their Bitcoin, which is now worth much more. That’s leading to genuine and dangerous public confusion - if FTX can pay back deposits, why is Sam Bankman-Fried in prison?

Of course, even if the deposits had genuinely been paid back in full, Bankman-Fried would be a deviant criminal. As Judge Kaplan put it at trial more than once, if you rob the Federal Reserve, then win at roulette and pay it all back, you still robbed the Federal Reserve.

But the reality is, even that’s not reality. The reality is that SBF spent billions of dollars on stadium naming rights, political donatinos, and bribing Chinese officials and also Katy Perry, and most of that money is never coming back.

News Analysis in Brief

Sam Bankman-Fried Still Thinks He’s Innocent (Puck) - In the first interview with SBF since his pretrial release was revoked last August, we get essentially nothing new or interesting. SBF still insists on his innocence and still thinks he has a chance on appeal. Sam’s unwavering denials have been incredibly frustrating, but they make sense when you accept that SBF is a sociopath.

According to clinical psychologist Martha Stout (“The Sociopath Next Door,”), Sam’s illogical denials fit a very consistent pattern:

“Sociopaths are infamous for their refusal to acknowledge responsibility for the decisions they make.”

The Package King of Miami - New York Magazine brngs us the story of Matthew Bergwall, a talented 21 year old college kid who got sucked into the shameless Miami grindset hype machine, decided it was cool to defraud major retailers for millions of dollars, and now faces decades in prison.

I reached out to Brett Johnson, a security consultant and reformed cybercriminal, for further comment on the story.

“What I think is interesting about Matthew Bergwall is he didn't need the money. That's the case of many of the Fraudsters the FBI arrested during Operation Chargeback. They came from good homes, upper class families, enrolled in top schools, and had bright futures ahead. But they chose the thrill and online status that comes with cybercrime.

“It used to not be like that. It used to be that people engaged in online crime because they were disenfranchised and saw little other way to get ahead. From Shadowcrew, to the Ukranians, to various persons of color--Most engaged in cybercrime because they needed the money. That's changed. We are seeing more and more engaged because of the thrill.”

Biden Promises Veto of SAB 121 Reform. In one of the strangest (but not really) political moves of the past six months, the administration is saying it will reject any attempt to change a rule that effectively prevents banks from custodying crypto-assets on behalf of customers. It’s a rule that increases investor risk by pushing activity offshore, and that’s ultimately what financial regulators actually want for crypto.

NASDAQ finds $3.1 Trillion in Global Money Laundering (Crypto Not Mentioned). Speaking of U.S. crypto politics, this is inconvenient … a new study by NASDAQ finds that $3.1 trillion dollars worth of illicit funds flowed through conventional banks in 2023. That includes $782 billion in illicit drug money and $346.7 billion in funds from human trafficking. The report does not mention illicit flows from crypto, because compared to those numbers, the crypto volume is insignificant, at $24.2 billion.

GameStop Surges as Redditor Roaring Kitty Returns. The guy who set off the GameStop meme stock frenzy has reactivated his account. Naturally, GameStop is up nearly 100% on the news, because yeah, sure.

Comedian Gets Live Evidence of Effective Altruist Orgies. In a viral TikTok, a comedian doing crowdwork struck gold when she found an apparent Effective Altruism-adjecent audience member. The intelocutor described a “math cult” centered around “Silicon Valley, Oxford, and Boston” - and said she was “near” “at least two orgies.” Ick.

Reads

Egirl Capital, in four parts (Mike Crumplar)

I don’t know if I *entirely* understand the point here: A four-part, “novelistic” (that is, sort of winding and dilatory) account of hanging out with people named like Misha and Donk in midtown Manhattan. The Dimes Square scene, to be clear, was always square and lame, and now it’s also pretty much over, so these people who took a post-ironic ‘playful’ rightward pivot look like the naive, thoughtless little children that they always were. Mostly, this deep dive confirms just how little “there” is really there.

Remembering Steve Albini - Leo Galil (Chicago Reader)

The loss of Steve Albini last week was shocking - the Nirvana, Pixies, and Jesus Lizard producer was in his early sixties. This account from his home in Chicago is a near-complete profile of Albini’s accomplishments, and just as importantly, his ethos: “He had no tolerance for greed or bullshit.” Words to live by. (Leo Galil is the great Jessica Hopper’s husband.)

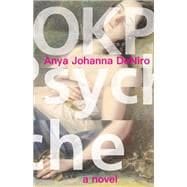

Books

OKPsyche - Anya Johanna DeNiro (Small Beer Press)

I’m truly blessed to live in New York City, where among other pleasures I can go to KGB Bar once a month and hear some weird fiction being read live. I went to last week’s reading sight unseen, and was blown away by DeNiro’s subtly dreamlike account of wrestling with gender transition and family. It’s not a ‘fantasy’ book in any pat and easy sense, but if you’re a careful reader it’s not too different from the experience of getting lost in a fae woodland.

When I first read about FTX creditors getting more than expected because of the price of BTC going up, I immediately thought about Mt. Gox.

Many commentators have mentioned the smoke and mirrors in not getting repaid in kind but repaid in dollar values. Notably, though, no one (that I've read) has mentioned those two extra points by DZM: 1) BTC was lower in value at bankruptcy because of the FTX story just prior to bankruptcy and 2) the amount of circulating BTC was far less because FTX were trading vaporcoins thus price should be higher due to less trading supply.

1 may not apply so much to Mt Gox, as creditors are generally getting "in kind" reparations. 142K BTC out of 850K BTC. (Pretty similar ratio to the approx 25% FTX is getting. But of course, when Mt Gox was hit BTC was worth MUCH less than $16000, so more upside in the longer wait.)

"Founded in 2010, Mt. Gox was once the biggest Bitcoin exchange in the world, estimated to facilitate around 70% of all BTC transactions before its implosion. The exchange lost 850,000 BTC in a security breach in 2014, becoming one of the biggest crypto bankruptcies ever.

"Mt. Gox is expected to repay its creditors 142,000 Bitcoin and 143,000 in the forked cryptocurrency, Bitcoin Cash, in addition to 69 billion Japanese yen ($510 million) by October 2024." https://cointelegraph.com/news/mt-gox-confirm-bitcoin-addresses-repayment

But what about 2? The fact that the amount of real BTC was faked? Note according to the previous article 70% of all trading was done on Mt Gox. So fake BTC is even more important there.

"Karpelès insists that he didn’t know the exchange had been bled dry until he checked the cold wallets in mid-February 2014, but there are flaws with this claim. Mt. Gox had started experiencing bitcoin withdrawal issues as far back as August 2013, which should have raised red flags. And yet Karpelès seems not to have considered Mt. Gox was underfunded, despite the exchange having been the victim of multiple hacks in its lifetime." https://www.coindesk.com/consensus-magazine/2024/02/28/mt-gox-what-we-still-dont-know-10-years-after-the-collapse/

I'm not sure if knowing if the BTC were gone actually matters or not to the inflating of price by making more BTC seemingly liquid. But clearly there was half a year of missing funds. How might that have impacted prices?

Again, we're talking in kind reparations. So the price of BTC at the moment that the BTC was recognized as gone might not matter /if/ the price effect goes away over time after the missing BTC is realized. But it could be the price effect doesn't normalize. It could be the BTC would be worth even more now, had the loss been known 6 months earlier.

I don't know, but I do think it's fascinating that the fake BTC that faked a glut of supply was artificially decreasing BTC price while the intentionally locked up FTT that faked a lack of supply was artificially increasing FTT price. Thus, Alameda using inflated FTT as collateral to borrow deflated BTC on FTX, is just doubly comical.

Anyway, all this is why reparations need to always be in kind unless it is a reparation of a financial instrument entwined with the entity that is providing reparation. E.g. If an investor has company stock, and the company does some malfeasance which caused the investor to lose that stock, then the investor probably shouldn't be given back now worthless stock in a bankrupt company. In all other cases, reparation in value as opposed to in kind is almost always BS.