Sam Bankman-Fried is the New Face of Evil

In a tour-de-force sentencing document, SBF's prosecutors demonstrate his knowing, repeated, long-term choices to defraud thousands of innocent victims in service to his own ego.

Update 4/14/24: On March 28, 2024, Sam Bankman-Fried was sentenced to 25 years in Federal prison. Bankman-Fried’s own final statements at the sentencing hearing were a damning confirmation of the prosecution’s characterization of him as a deceitful, blame-shifting little schemer. Judge Lewis Kaplan didn’t hand down as much time as I hoped for in this April piece, but he nailed Bankman-Fried’s character to the wall in a way that was even more deeply satisfying.

On Friday March 15th, the team of prosecutors who convicted Sam Bankman-Fried on seven counts of criminal fraud published their sentencing recommendations for the FTX mastermind. They recommended Sam be sentenced to 40 to 50 years in prison, and I believe they’ll get what they’re asking for.

More importantly, the charging document itself is, in a word, a heartbreaking masterpiece. It lays out, in tightly condensed form, the series of decision points at which Bankman-Fried knowingly chose to steal customer funds to fuel his ambitions. At some of these points, the document makes clear that those close to Sam actively warned him of the risk of what he was doing – and he did it anyway.

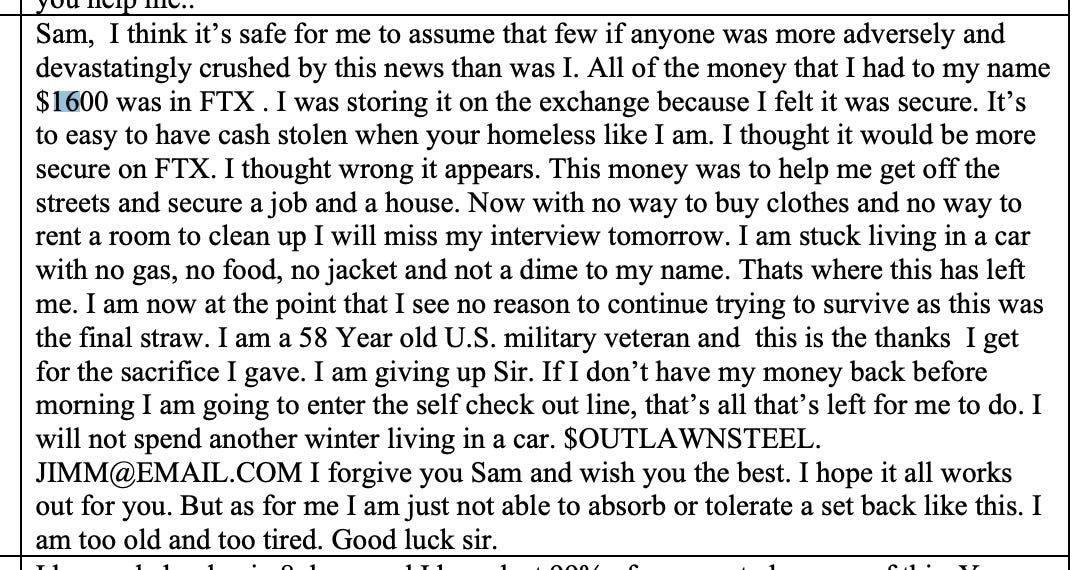

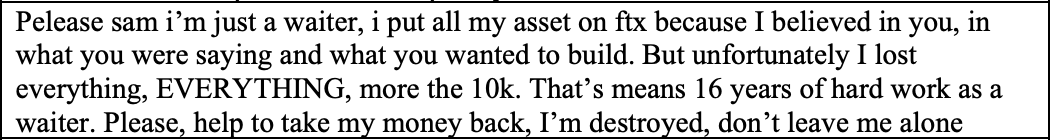

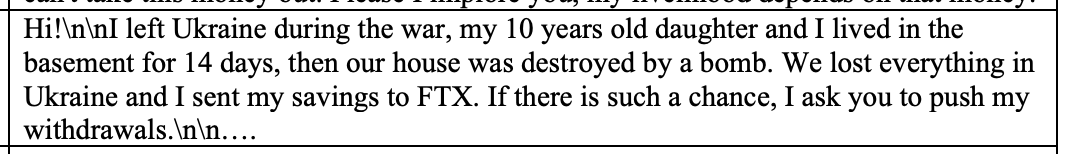

The charging documents also contain, in the form of desperate, tragic Twitter DMs sent to Sam after the collapse, accounts from some of the countless average people whose lives were wrecked by Sam’s knowing decision to use their money to pursue personal glory and validation.

One story here can stand for the whole. A person going by the tag OUTLAWNSTEEL describes themselves as homeless and a military veteran, and having put $1600 dollars on FTX because they were afraid of having cash stolen in the streets. That money was their stake to get an apartment, and after the collapse of FTX, they alluded to contemplating taking their own life. (There’s good evidence this story is real, but we don’t yet know what happened next.)

Finally, the charging file contains a sickening document, written by Sam himself in the days after the collapse, laying out dozens of ideas for rescuing his own image. These aren’t strategies for actually fixing anything, they’re purely about manipulating perception – Sam’s true strength.

He contemplated, for instance, going on “Tucker Carlsen” where he would “come out as a republican” and “against the woke agenda” - confirmation that his professed moral stance was just a marketing tactic. Here is a man with no center - no real self at all.

Together, these elements paint the true picture of Sam Bankman-Fried: a reckless megalomaniac, willing to literally steal from the homeless to fill the void of his own existence, willing to fabricate any baseless yarn that might extricate him from the consequences of his own pathetic failure.

The fact that he rationalized this using the utilitarian thinking of his mother and the Effective Altruists only makes him more worthy of serious punishment – these are entire movements full of future con artists, their “longtermist” rationales locked and loaded. They must be sent the clear message that their worldview is dangerously wrong.

This is who Sam Bankman-Fried really was, and who he always will be, whatever glamour mealy-mouthed apologists and obfuscators like Michael Lewis might try to resummon around him. I’ve toyed with it before, worried around its edges, approaching the idea from various angles. But this document is so striking I’m finally comfortable saying it:

Sam Bankman-Fried is evil.

But just like that thing they say about unhappy families, every evil person is evil in a different way. Even in this golden age of scammers and frauds, Sam Bankman-Fried’s is the most unique story of evil in a long time.

And as much as he is individually responsible for his own depravity, it is also the depravity of our fallen age.

The Litany of Shame

Before diving in to the chronology of his crimes and their impacts, I want to quote the government at some length. What follows is from page 5 of the charging document, and should be required reading for anyone who has ever thought, for a fraction of a second, that Sam Bankman-Fried was anything other than a remorseless, sociopathic predator – a wolf in boy’s clothing.

“Having set himself on the goal of amassing endless wealth and unlimited power—to the point that he thought he might become President and the world’s first trillionaire—there was little Bankman-Fried did not do to achieve it.

“While he did not spend the money he stole on nice clothes or cars, that does not mean his life has not been defined by excess. The trial record puts the lie to the statements in his submission that he was ‘never motivated by greed’ and ‘eschews materialistic trappings.’

“Using customers’ and investors’ money, the defendant bought luxury real estate; he made risky investments that he otherwise could not afford; he made charitable donations (for which he still takes credit) using other people’s money; he made political contributions using other people’s money to get unrivaled access to political leaders; he promoted his company in a Super Bowl ad; he named a basketball arena after his company; and he paid for access to celebrities, to name just a few of the things on which he spent money.

“And unlike so many defendants before this Court, there are no persuasive mitigating conditions to explain his criminal conduct. His crimes are not the product of dire financial circumstances, passion or impulse, or a momentary lapse of judgment.”

Points of Moral Failure

The brilliant core of the prosecution’s case against Sam Bankman-Fried at trial was a detailed chronology of moments when he knowingly chose to use FTX customer funds for investments or other operating expenses. These are the moments when we see the real Sam, behind closed doors, unambiguously stealing billions of dollars from his users.

These moments are reiterated in the new documents, in a tight recitation that makes them even more gobsmacking than they were at trial.

The most important takeaway is this: Sam Bankman-Fried did not suddenly find himself, in late 2022, in a crunch that forced him to cut corners. He was not forced into fraud by bad market conditions. He had been knowingly stealing for years, in pursuit of the false image of a success that never actually existed.

All of Sam’s crimes were premeditated – often, it seems, against the clear warnings of his closest advisors.

2019: Born in the Darkness

The prosecution actually omits one key moment when Sam overtly decided to commit fraud – perhaps the very most important one.

In 2019, mere months after the founding of FTX, he directed Gary Wang to implement an “allow negative” feature that would be deployed exclusively on the accounts of Alameda Trading. The feature was implemented on July 31 of 2019, and quickly allowed Alameda to run up $100 million in debt on FTX. As Wang testified, this was “money belonging to other customers of FTX.”

That very same day, July 31, Sam lied about what was going on. In a Tweet, he explicitly claimed that Alameda’s “account is just like everyone else’s.”

He wasn’t just lying and stealing before market conditions got bad: he was lying and stealing before FTX grew to anything like the size it would later.

Stealing from homeless veterans. Stealing the life savings of service workers.

Mid-2021: The Binance Buyback

In mid-2021, as his rivalry with Changpeng Zhao and Binance was heating up, Bankman-Fried decided he wanted to buy back a tranche of FTX equity from them.

The prosecution writes that “Bankman-Fried repeatedly told [Caroline] Ellison that buying back the stock was “really important” to him, largely because Binance was a major competitor and the defendant viewed Binance’s leader as a rival. (Tr. 668).” That is, Sam saw CZ as a personal rival for stature within the crypto industry. In other words, This was at least partially an ego-driven decision.

Again, the prosecution: “At the time, Binance’s equity in FTX was worth approximately $2 billion, and FTX’s revenue was only half that amount … Ellison told Bankman-Fried, ‘We don’t really have the money for this, we’ll have to borrow from FTX to do it.’ (Tr. 668). Bankman-Fried responded, ‘That’s okay. I think this is really important, we have to get it done.’ Bankman-Fried then repurchased the FTX shares owned by Binance using a mix of FTX funds and customer deposits.”

Customer deposits belonging to homeless veterans. Customer deposits belonging to waiters.

Customer deposits belonging to Ukrainian refugees.

Fall of 2021: YOLO the Deposits

Sam Bankman-Fried again consciously chose to steal from his customers in Fall of 2021, when he asked Caroline Ellison, the prosecution writes, “to determine what would happen if Alameda spent $3 billion more on venture investments. (Tr. 707-10).”

“Ellison prepared an analysis, which she shared with Bankman-Fried ... Ellison told BankmanFried that Alameda had more loans than assets, and that without certain FTX-related cryptocurrencies such as FTT, Solana, and Serum, Alameda’s net asset value was negative $2.7 billion. (Tr. 710). Her analysis also showed that in the event of a market downturn and the recall of Alameda’s loans, the only way to repay third-party loans would be to borrow billions of dollars of FTX customer funds. (GX-36). Ellison told Bankman-Fried that she thought that new venture investments were a bad idea and too risky.”

Sam, of course, overrode Ellison’s concerns and “directed billions of dollars in spending, which used FTX customers’ money. Those expenditures included investments of hundreds of millions of dollars each into Genesis Digital Assets (a crypto mining firm), K5 (an investment firm, which the defendant used to connect with politicians and celebrities) … purchase of stock in the company Robinhood, over $100 million in real estate purchases in the Bahamas (including a $30 million penthouse apartment for Bankman-Fried and his friends), and political donations.”

Again, this was a decision made under no duress, at nearly the height of FTX’s prominence – a moment when Sam could have chosen simply to run a very successful, hugely profitable crypto trading platform that served its customers honestly.

Instead, he knowingly chose to gamble with the deposits of homeless veterans. The deposits of Ukrainian refugees. The deposits of parents scraping by in third-world countries.

June of 2022: Repay the Borrows

After the collapse of Terra/Luna in May of 2022, many of the lenders who had funded Alameda’s trading activities demanded their money back. Firms including Celsius, Voyager, and Three Arrows demanded the immediate return of $6 billion dollars from Alameda. But Alameda didn’t have it.

This was the downturn Caroline Ellison had warned Sam about in the Fall of 2021. The emergency that could ensue if they used customer deposits as leverage for venture investments.

Bankman-Fried asked for a status report from his circle of corrupted insiders. Ellison, Gary Wang, and Nishad Singh made a spreadsheet showing “that Alameda had a negative $11 billion balance on FTX, and was borrowing $13 billion in customer funds.” Sam then told Ellison “to ‘go ahead and return the borrows’ … and ‘to use FTX customer funds to repay loans.’ Alameda proceeded to repay the third-party lenders using FTX customer funds. (GX-1017A to GX-1017K). Of the $6.5 billion that was repaid to Alameda’s lenders, almost 70 percent was customer money. (GX-1018).”

Money belonging to homeless veterans. Money belonging to Ukrainian refugees. Money belonging to waiters. To third-world families.

To Argentinians trying to protect their money from inflation so they can care for their autistic children.

September 2022: Extend and Pretend

In September of 2022, the prosecution again finds a point where Sam Bankman-Fried could have come clean … but instead decided to double down.

“As of September 1, 2022,” the DOJ writes, “Alameda was borrowing approximately $13.7 billion in customer money from FTX. (GX-19) … Bankman-Fried acknowledged that they were ‘a little short on deliverable,’ meaning short on the money that was owed to FTX customers. (Tr. 1407).”

Not only did Sam know exactly what was going on – another of his closest lieutenants again tried to warn him. “Singh asked BankmanFried to refrain from additional spending that might exacerbate the problem and increase the size of FTX’s deficit. However, notwithstanding the significant deficit, Bankman-Fried continued to spend money that necessarily was coming from customer funds.”

Those included:

A $45 million payment to Skybridge for an investment on September 7,2022.

A $10 million transfer to an account in Bankman-Fried’s own name on September 16, 2022. Though the number initially caught my eye, this does not seem to be the origin of the $10 million gift Sam gave to his parents Joe and Barbara – at least according to the FTX estate suit, that gift went through in January or February of 2022.

A $4 million transfer to an account in his name on September 22, 2022.

A $250 million transfer to Modulo Capital for an investment on September 26, 2022.

A $6 million transfer to an account in Bankman-Fried’s name on October 3, 2022, used to make a political donation.

All of these transfers “necessarily” constituted money owed to depositors. Depositors who had been reassured, in legal documents and public statements, that their funds were sacrosanct.

Homeless veterans. Ukrainian refugees. Families in the developing world.

November 2022: Lies, Damn Lies, and Tweets

The prosecution writes that Sam’s final “decision point” came in November, after my CoinDesk colleague Ian Allison unearthed a balance sheet showing that Alameda was heavily reliant on the value of FTT and other “Samcoins.” Ironically, as we learned at trial, this balance sheet was actually fraudulent – the real situation was in fact much worse. But even the fake was bad enough to trigger mass withdrawals from FTX.

Again, though, instead of admitting to his years-long fraud, Sam continued lying. He lied again and again and again. As the prosecution writes:

“Bankman-Fried sent a series of false and misleading Tweets to induce FTX customers to leave their money on the FTX platform and deter them from seeking to withdraw their money. Specifically, on November 7, 2022, Bankman-Fried tweeted: “A competitor is trying to go after us with false rumors. FTX is fine. Assets are fine.” (GX-866). He added in a second Tweet, in part, “FTX has enough to cover all client holdings. We don’t invest client assets (even in treasuries). We have been processing all withdrawals, and will continue to be.” (Id.).

“In a third Tweet, Bankman-Fried wrote, “It’s heavily regulated, even when that slows us down. We have GAAP audits, with > $1B excess cash. We have a long history of safeguarding client assets, and that remains true today.”

Many people listened to these lies, and chose not to withdraw funds from FTX.

If this is anything less than stomach-turning to you – if you are not revolted by this utterly debased worm of a man – you’ve abdicated your humanity, just as thoroughly as he has.

The Last Boomer: Doing Well By Doing Wrong

I started this book project because the story of Sam Bankman-Fried is so entirely improbable. Sam was a math whiz from Palo Alto, the figurehead of a wide-eyed social movement called Effective Altruism, the son of two law professors who specialized in corporate ethics, and (we now know) the man-crush of premier finance chronicler Michael Lewis. And despite all of this, instead of merely enjoying his advantages and running a successful business, he ran the largest financial fraud in a decade.

There are two things about this that deserve to be unpacked at length. First, and most important, it appears these superficially good inputs actually helped Bankman-Fried rationalize his crimes – most of all, his mother Barbara’s utilitarian moral philosophy, and his involvement with Will MacAskill’s Effective Altruism.

But second, Sam Bankman-Fried didn’t just manage to appear seductively, almost theatrically good while committing major crimes around the back – we’ve seen other cases like that. He also managed to enthrall people so thoroughly that they continued to defend him after his crimes were clear – most notably and inexcusably, Michael Lewis. Even if they didn’t actually believe what they were saying, Yale law professors felt safe standing up and obfuscating Sam’s incredibly clear malfeasance.

This bizarre loyalty that Sam inspired is in one respect old-fashioned elite corruption – the friends of Sam’s parents have been particularly quick to defend their kid. But there really was something about Sam, something that made him a vessel for the hopes and dreams of a certain kind of technocratic, vaguely progressive, ultimately brainless Californian Ideologist.

This is why this book (in the sense you’re reading a draft of it right now) is tentatively titled “The Boy Who Wasn’t There.” Because what Sam was most of all was a screen onto which people – mostly older people – could project their own understanding of themselves, and of what their own lives meant. Sam internalized this, or understood it from the beginning, consciously crafting his image as a scruffy techno-saint.

More specifically, it’s tempting to describe Sam as The Last Baby Boomer – the final form of the post-hippie delusion that one could become rich while improving the world.

While even, as Sam seemed to believe of himself, saving the world.

Can Evil be New?

I debated the order of the words in my title – debated whether Sam was merely the new face of Evil, or whether he might be “the face of a new Evil.” Obviously I went with the former, because human evil never really changes – it mostly amounts to an indifference to hurting others, which clearly describes Sam.

But I wouldn’t be working on this book if the other thing wasn’t also at least a little true: Sam is such a chameleon, so evasive to moral judgment, because he really is the embodiment of some novel swerve in man’s recurring malice towards man.

One aspect of this, I think, is inherent to the growing abstraction of finance. Sam knew, in some vague sense, that he was risking the money of his customers. But it all seemed like a game to him, like even the worst-case consequences weren’t that severe, because he was far, far away from those customers. He handled only their money – he knew nothing of what it meant for their lives.

In fact, he didn’t even have the imagination to conceive how their money might impact their lives. That’s because of another novel element of Sam’s story. As a member of the California elite (if far from its highest ranks), he had little real exposure to how average Americans, much less others around the world, lived. His privilege alienated him from reality so thoroughly he thought it was all a game – almost literally.

But for now, let’s draw these rambling thoughts to a close. There will be many more months to expand on the exact contours of Sam Bankman-Fried’s depravity; to consider how he tricked so many into thinking he was a good person; how he seems to have succeeded even in tricking himself.

For now, only one message matters: This is not just a flawed man. Not just a misguided, naive boy. This is a bad man.

Sam Bankman-Fried is a walking, talking embodiment of man’s inhumanity, cruelty, and indifference to his fellow man. When he goes to meet his maker, his eternal judgment will be harsh.

In the here and now, we may have to settle for a half-century in prison.

It’ll do.